Shiba Inu Slides—But Whale Activity and HODLing Pattern Say Recovery Is Near

Despite a 13% dip, whale accumulation and stronger HODLing from retail investors suggest SHIB could soon rebound toward key resistance.

Leading meme coin Shiba Inu has recorded a 13% drop in value over the past seven days, amid a broader environment of profit-taking and bearish market sentiment.

However, while many traders appear to be exiting their positions, some investors view the dip as a strategic buying opportunity that could help trigger the meme coin’s next leg up. But how?

SHIB Whales and Retail Traders Bet on a Bounce

Readings from the SHIB/USD one-day chart show that the meme coin has steadily declined since it broke below its ascending parallel pattern on July 28. This breakdown signals a loss of bullish strength and suggests that selling pressure has overwhelmed the market.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

SHIB Ascending Parallel Channel. Source:

SHIB Ascending Parallel Channel. Source:

SHIB Ascending Parallel Channel. Source:

SHIB Ascending Parallel Channel. Source:

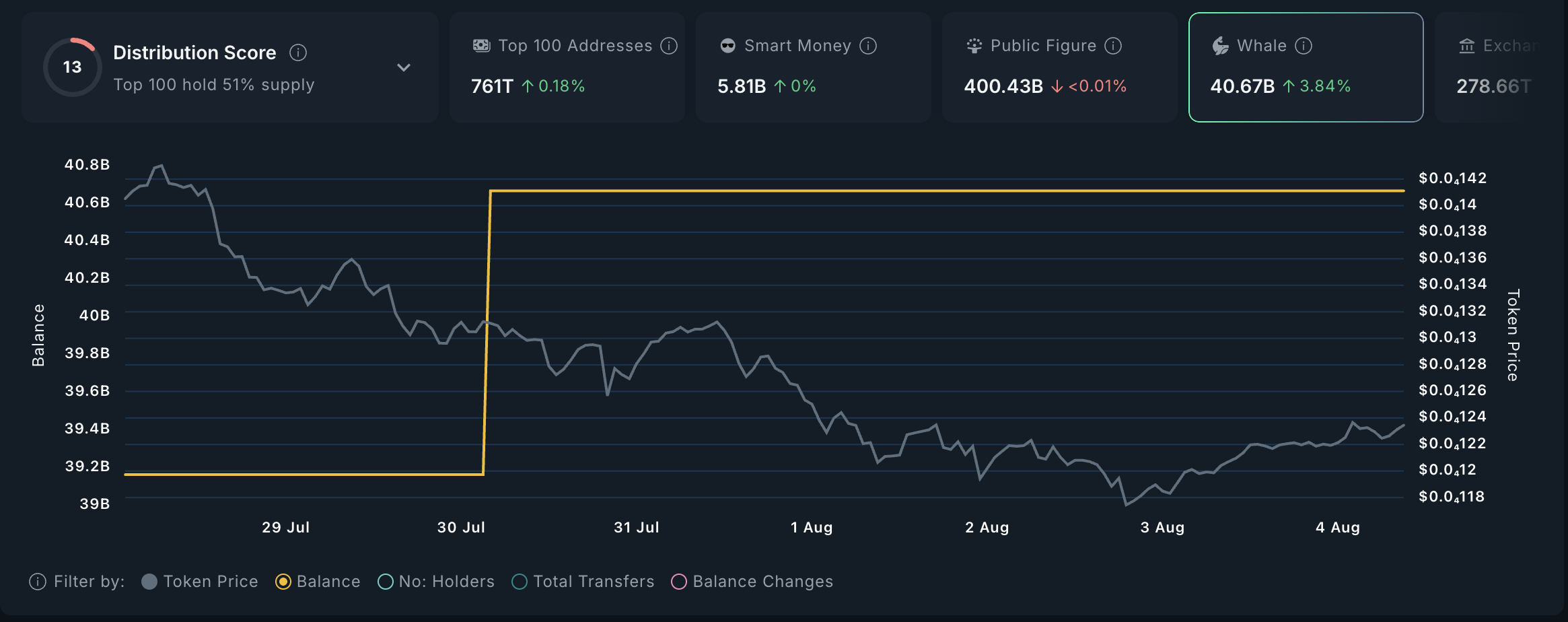

However, some traders see this decline as a buying opportunity. On-chain data from Nansen shows that whale addresses holding over $1 million worth of SHIB have been quietly accumulating during the downturn. Per the data provider, this cohort of large investors has increased their holdings by 4% in the past seven days.

SHIB Whale Holding. Source:

SHIB Whale Holding. Source:

SHIB Whale Holding. Source:

SHIB Whale Holding. Source:

The increase in whale accumulation suggests growing confidence in SHIB’s long-term value, even as its price struggles amid market volatility.

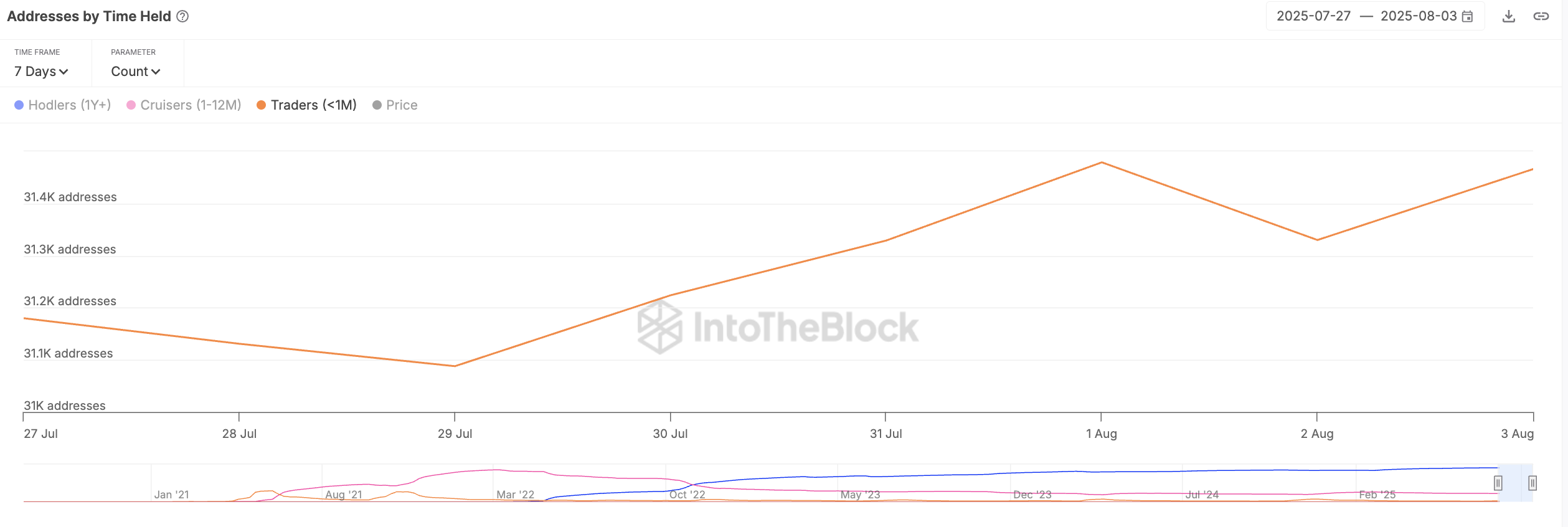

Moreover, an increase in whale activity usually spurs retail traders to follow suit, which is exactly what is happening. According to data from IntoTheBlock, the count of short-term holders extending their holding time has climbed by a modest 1% in the past seven days.

SHIB Addresses by Time Held. Source:

SHIB Addresses by Time Held. Source:

SHIB Addresses by Time Held. Source:

SHIB Addresses by Time Held. Source:

This signals increasing bullish conviction among investors who have held their coins for less than 30 days. It also improves SHIB’s short-term outlook because these holders are more reactive to price changes.

So, if this group is now choosing to hold rather than sell, it bodes well for SHIB’s price stability and near-term recovery.

Shiba Inu Bulls Aim for Breakout, But Bears Are Lurking

At press time, SHIB trades at $0.00001235. If whale accumulation continues and retail holders maintain their conviction, the meme coin could rebound toward the $0.00001362 resistance level in the short term.

SHIB Price Analysis. Source:

SHIB Price Analysis. Source:

SHIB Price Analysis. Source:

SHIB Price Analysis. Source:

Conversely, if bearish sentiment intensifies and profit-taking picks up again, SHIB risks extending its decline, potentially dropping toward $0.00001160.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Is the moat of public blockchains only 3 points? Alliance DAO founder's remarks spark heated debate in the crypto community

Instead of worrying about "moats," perhaps we should focus more on how cryptocurrencies can meet the real needs of more market users faster, at lower cost, and with greater convenience.

Digital Finance Game: Unveiling the US Cryptocurrency Strategy

Glassnode: Bitcoin weakly fluctuates, is major volatility coming?

If signs of seller exhaustion begin to appear, it is still possible in the short term for bitcoin to move towards the $95,000 level and the short-term holder cost basis.

Axe Compute (NASDAQ: AGPU) completes corporate restructuring (formerly POAI), enterprise-level decentralized GPU computing power Aethir officially enters the mainstream market

Predictive Oncology officially announced today that it has changed its name to Axe Compute and will trade on Nasdaq under the ticker symbol AGPU. This rebranding marks Axe Compute's transition into an enterprise-level operator, officially commercializing Aethir's decentralized GPU network to provide robust, enterprise-grade computing power services for AI companies worldwide.