Bitcoin (BTC) has declined by 2.13% in the last 24 hours, currently trading near the critical $114,518 support level, signaling potential volatility ahead for BTC/USD.

-

Bitcoin price dropped 2.13% in 24 hours, testing key support at $114,518.

-

Hourly charts show BTC closer to resistance, indicating limited sharp moves expected soon.

-

COINOTAG experts note a false breakout below support, suggesting a possible rebound to $116,000.

Bitcoin price falls 2.13%, testing key support levels. Track BTC/USD trends with COINOTAG for timely crypto market insights.

-

Most cryptocurrencies are experiencing declines today, reflecting broader market pressure.

-

Bitcoin’s hourly and daily charts indicate consolidation near resistance and support zones.

-

COINOTAG analysis highlights a false breakout below $114,518, with potential for a bounce back.

Bitcoin price dips amid market volatility, testing critical support. Stay informed with COINOTAG’s expert crypto analysis.

What Is Causing Bitcoin’s 2.13% Price Decline?

Bitcoin’s 2.13% decline over the past 24 hours is primarily due to market-wide selling pressure and technical resistance near key levels. The BTC/USD pair is currently testing the $114,518 support, which has seen a false breakout. This indicates uncertainty among traders and potential for either a rebound or further drop depending on closing prices.

How Does Bitcoin’s Hourly Chart Reflect Current Market Sentiment?

The hourly chart shows Bitcoin trading closer to the resistance level than support, suggesting limited room for sharp downward moves in the short term. With most of the daily Average True Range (ATR) already expended, volatility is expected to remain subdued until new market catalysts emerge. COINOTAG’s technical analysis points to consolidation as traders await clearer signals.

What Are the Midterm Outlook and Key Support Levels for BTC/USD?

From a midterm perspective, Bitcoin is critically testing the $114,518 support level. If BTC closes below this mark decisively, accumulated selling pressure could push prices toward the $112,000 zone. Conversely, a strong close above this support may trigger a bounce back to the $116,000 resistance. COINOTAG experts emphasize monitoring candle closes for confirmation of trend direction.

What Is the Current Trading Price of Bitcoin?

At press time, Bitcoin is trading at approximately $115,145, reflecting the ongoing market uncertainty and technical battles between buyers and sellers at key levels.

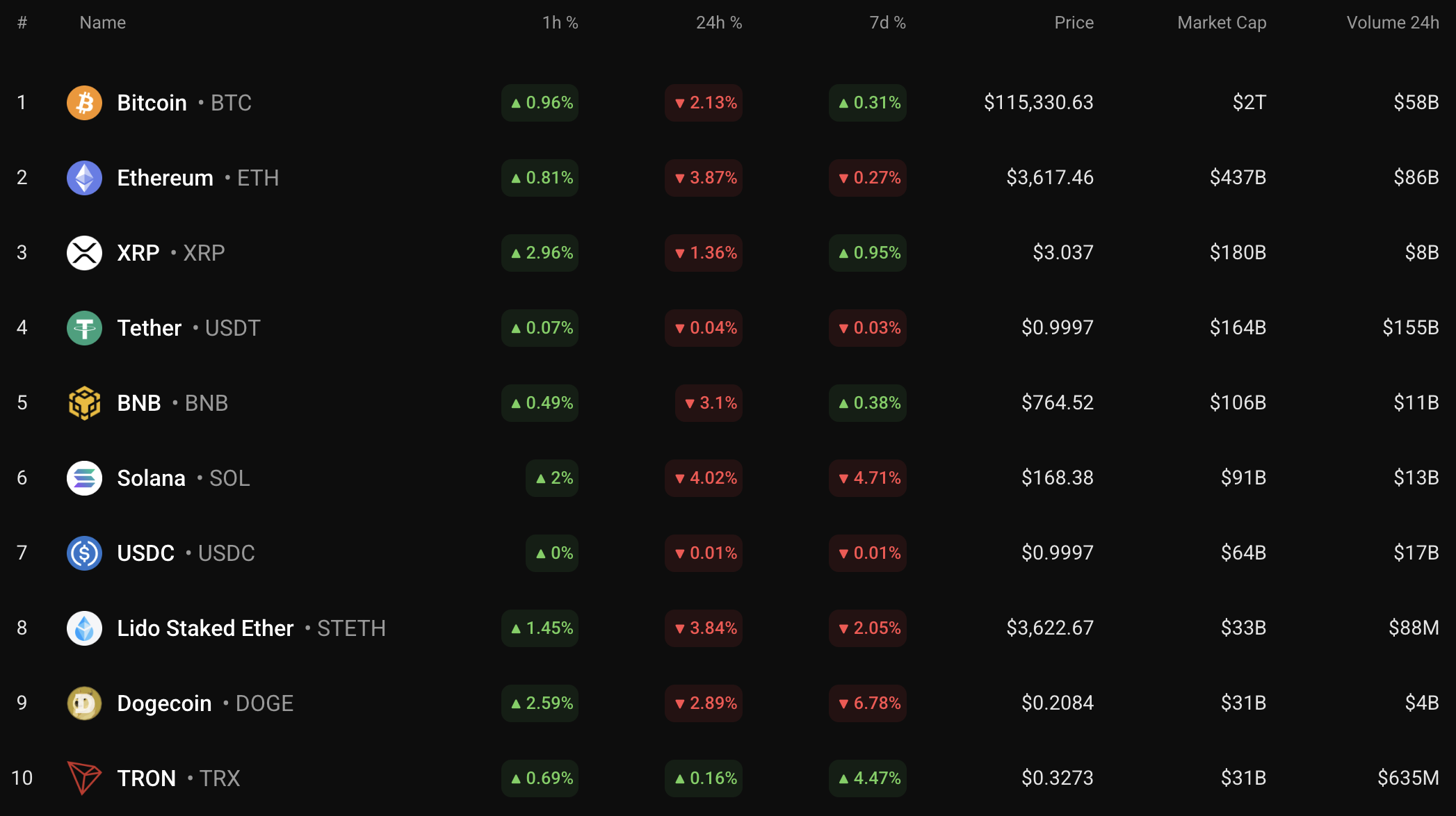

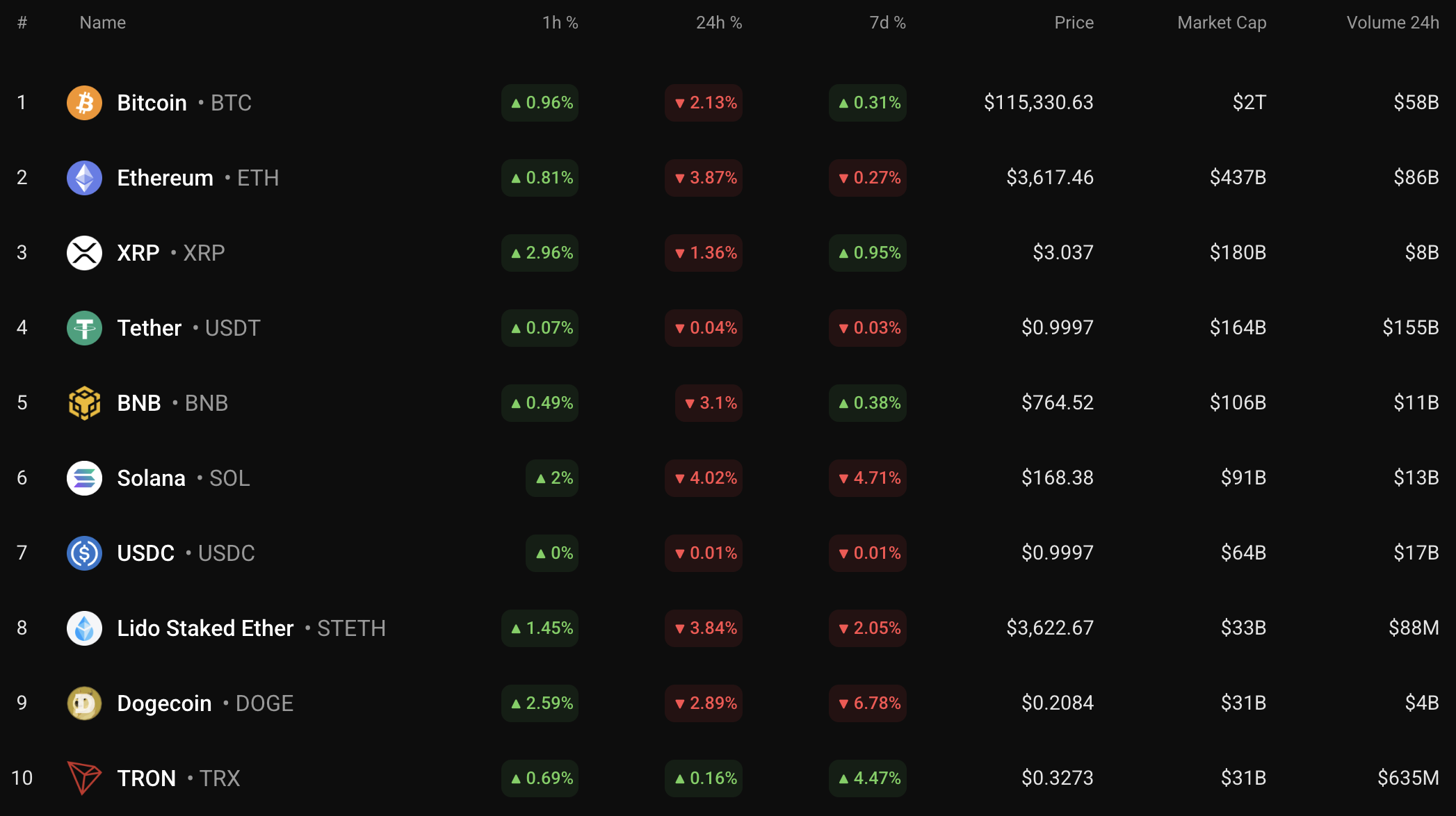

Top coins by CoinStats

How Are Other Cryptocurrencies Performing Today?

According to CoinStats data, most major cryptocurrencies are experiencing declines, mirroring Bitcoin’s downward pressure. This broad market weakness suggests cautious sentiment among investors, likely influenced by macroeconomic factors and recent regulatory developments. COINOTAG continues to monitor these trends to provide timely updates.

Image by TradingView

What Does the Longer-Term Bitcoin Price Chart Indicate?

Longer timeframes reveal a false breakout below the $114,518 support, which often signals a potential reversal rather than sustained decline. This technical pattern suggests that while short-term volatility is present, Bitcoin may stabilize or recover if buyers regain control. COINOTAG advises traders to watch for confirmation in upcoming sessions.

Image by TradingView

What Are the Key Technical Levels to Watch for Bitcoin?

| Support | $114,518 | Critical support, false breakout observed |

| Resistance | $116,000 | Potential bounce target |

| Lower Support Zone | $112,000 | Possible drop if support breaks |

What Are the Implications of Bitcoin’s Price Movements?

Bitcoin’s current price action reflects a market in flux, with traders balancing between support and resistance. The false breakout below $114,518 suggests indecision, making it crucial to monitor closing prices for trend confirmation. COINOTAG’s analysis underscores the importance of these levels for short- and midterm trading strategies.

Frequently Asked Questions

Why is Bitcoin price falling today?

Bitcoin’s price is falling due to increased selling pressure across the crypto market and technical resistance near the $114,518 support level, causing short-term price volatility.

What is the key support level for Bitcoin currently?

The critical support level for Bitcoin is $114,518, which recently showed a false breakout, signaling potential for either a rebound or further decline depending on market momentum.

What price is Bitcoin trading at now?

Bitcoin is trading near $115,145, indicating a cautious market environment as traders watch key technical levels closely.

Key Takeaways

- Bitcoin price declined 2.13%: Testing critical support at $114,518 amid market volatility.

- False breakout observed: Indicates potential for price rebound or further drop depending on candle close.

- Market consolidation expected: Limited sharp moves likely as daily ATR nears completion.

Conclusion

Bitcoin’s recent price drop to $115,145 highlights the importance of the $114,518 support level in determining short- and midterm trends. With a false breakout signaling market indecision, traders should watch for confirmation in upcoming sessions. COINOTAG remains committed to providing expert, data-driven crypto insights to navigate this volatile period.

The rates of most of the coins are falling today, according to CoinStats.

Top coins by CoinStats

BTC/USD

The price of Bitcoin (BTC) has fallen by 2.13% over the last 24 hours.

Image by TradingView

On the hourly chart, the rate of BTC is closer to the resistance than to the support level. As most of the daily ATR has been passed, there are low chances of seeing sharp moves by tomorrow.

Image by TradingView

On the longer time frame, the price of the main crypto has made a false breakout of the support of $114,518.

If the candle closes far from that mark, one can expect a bounce back to the $116,000 mark.

Image by TradingView

From the midterm point of view, the rate is testing the $114,518 level. If it breaks out, the accumulated energy might be enough for an ongoing drop to the $112,000 zone.

Bitcoin is trading at $115,145 at press time.