Date: Fri, Aug 01, 2025 | 09:20 AM GMT

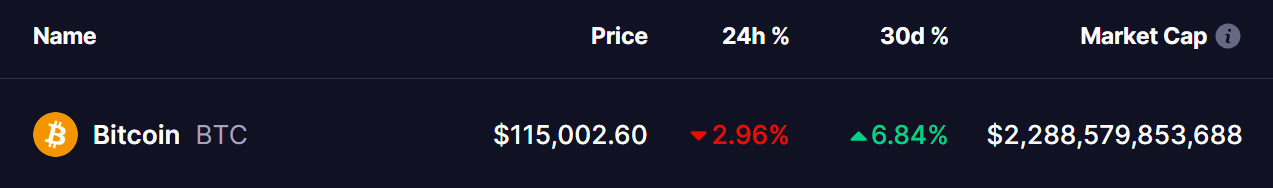

The broader cryptocurrency market is seeing a wave of red, with Bitcoin (BTC) leading the downturn. After climbing to a high of $123,000 in mid July, BTC has pulled back sharply, now trading around $115K— with a near 3% drop in the last 24 hours. Altcoins are following suit, with Ethereum (ETH) shedding over 6% during the same period.

However, all eyes are now on a potential reversal signal emerging in Bitcoin’s price chart.

Source: Coinmarketcap

Source: Coinmarketcap

Falling Wedge in Play?

A closer look at the 4-hour chart reveals that BTC has been forming a falling wedge pattern since mid-July — a bullish reversal structure often seen before upward price movements.

The recent price drop has taken BTC from the upper trendline near $118,700 (where it also lost support from the 100-moving average) down to the critical lower support of the wedge at around $114,340, where the 200-moving average is currently sitting.

Bitcoin (BTC) 4H Chart/Coinsprobe (Source: Tradingview)

Bitcoin (BTC) 4H Chart/Coinsprobe (Source: Tradingview)

This convergence of technical support — the wedge’s bottom boundary and the 200 MA — could serve as a strong base for a potential bounce.

What’s Next for BTC?

Bitcoin now sits at a make-or-break level for the lower timeframe. If bulls can defend this support zone, a rebound toward the wedge’s upper trendline around $117,000–$118,000 is possible. A successful breakout above that could trigger a stronger rally — potentially flipping short-term market sentiment.

However, if the price breaks below this wedge support and the 200 MA, the bearish momentum could accelerate further, likely dragging BTC closer to the $112,000–$110,000 region.

As the market awaits confirmation, this pattern could play a pivotal role in shaping Bitcoin’s next move