Bitcoin Dominance Records Sharp Decline — Is Altseason Finally Here?

Bitcoin’s market share decline hints at a brewing Altseason, but analysts warn the 60–61% dominance zone may delay the full shift.

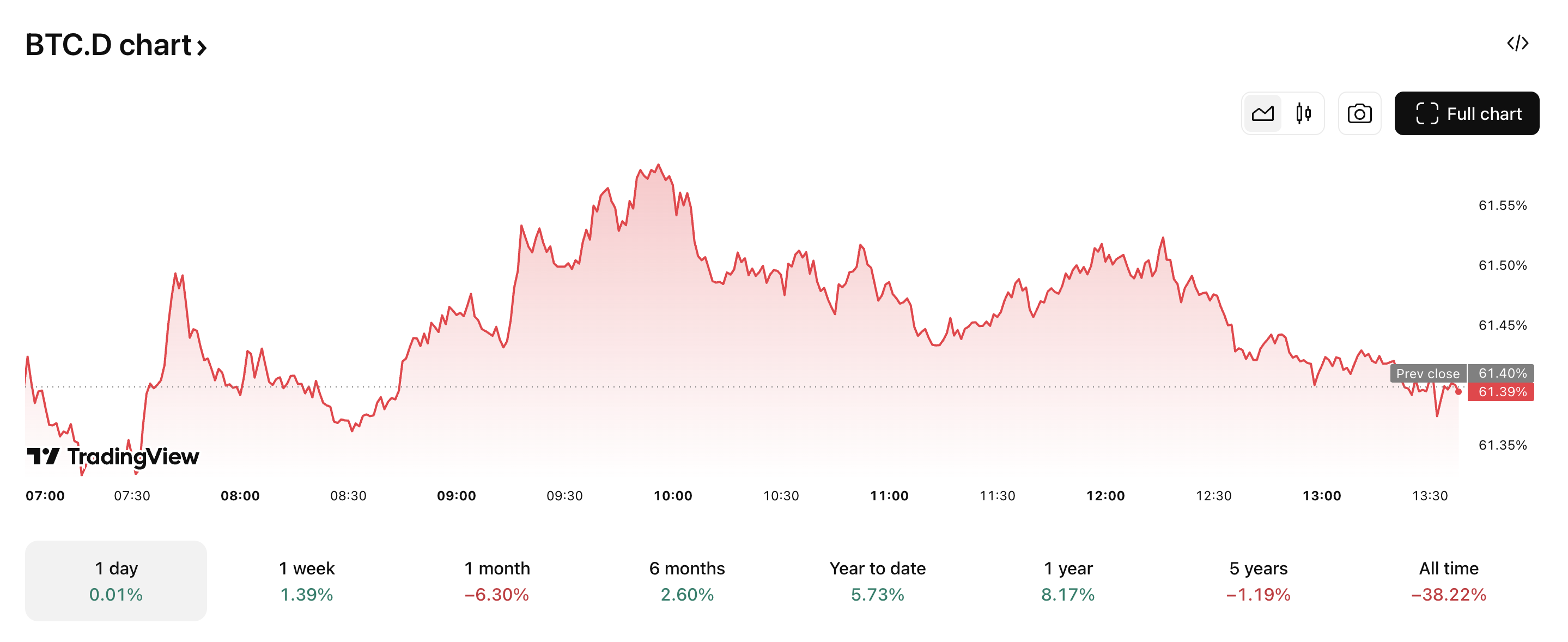

In recent weeks, the Bitcoin Dominance Index (BTC.D), which measures Bitcoin’s market share relative to the entire cryptocurrency market, has recorded a sharp decline of 6.30%.

According to technical analysts, this could be an early signal of an upcoming “Altseason” expected to unfold within 3–6 months.

Bitcoin Dominance Gives Way, Altseason Nearing?

According to observations from several well-known market analysts, BTC.D is undergoing critical structural changes.

Notably, Bitcoin Dominance has formed a “bearish cross” on the 3-week timeframe. It is often considered a key technical indicator signaling a potential trend reversal.

BTC.D has fallen more than 6.30% in 1 month. Source:

BTC.D has fallen more than 6.30% in 1 month. Source:

In addition, BTC.D has officially broken its three-year uptrend line. This is widely viewed as one of the strongest signals that Bitcoin’s market strength is being eroded.

“Bitcoin dominance has lost its 3-year uptrend. This is the biggest sign of an Altseason and upcoming parabolic pump” Ash Crypto stated.

Merlijn, a veteran trader, pointed out that the current market setup is playing out just like the 2021 “playbook,” during which a major altcoin season occurred. According to him, Bitcoin Dominance has entered “Phase 4” – the clear breakdown stage – paving the way for capital rotation into altcoins.

Once this pivot fully happens, a powerful capital rotation cycle from Bitcoin to other altcoins will likely emerge.

One of the other key indicators highlighted is the ETH/BTC pair. In the context of BTC.D’s decline, many experts believe Ethereum will lead the next wave of altcoin market growth.

In recent weeks, ETH has gained strength relative to BTC, suggesting that capital is gradually shifting away from Bitcoin. Investors are likely seeking greater returns among lower-cap assets.

ETH/BTC is going up only. Source:

ETH/BTC is going up only. Source:

Moreover, crypto investor Ted asserted that in the next 3–6 months, Ethereum and many altcoins could experience significant growth. While short-term pullbacks may be designed to “shake out” weak hands, the structural trend suggests that the altcoin market is setting up for a cyclical rally.

Short-Term Barrier For Altcoin Season

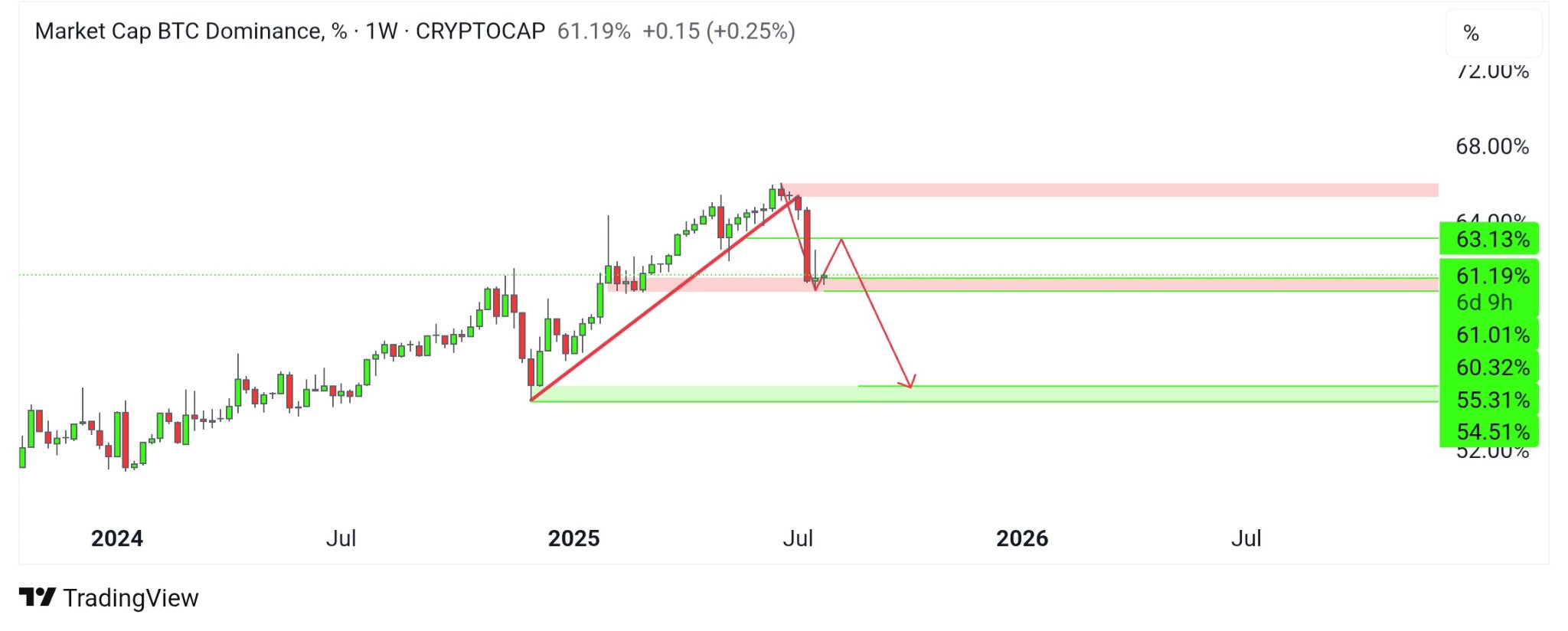

However, not everyone agrees that Altseason will kick off immediately. Some analysts argue that BTC.D is still hovering within the 60–61% demand zone, which could act as a strong support level that helps Bitcoin maintain its market share in the short term.

Bitcoin Dominance Chart. Source:

Bitcoin Dominance Chart. Source:

Analyst Crypto Candy emphasized that unless BTC.D convincingly breaks below this zone, altcoins may continue to struggle and show sluggish growth.

“As long as the 60-61% zone holds, we may not see proper momentum in alts. Also, in the meantime, we may see slow movement and retracement on alts, ” the analyst stated.

Therefore, investors are advised to remain patient and closely monitor price actions and capital flows in the short term. Altcoin growth may not happen overnight; instead, it could gradually shift as the market slowly pivots from Bitcoin dominance to a more diversified asset rotation cycle.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

"Whales" Accelerate Bitcoin Sell-Off, But Is It Really a Panic Signal?

Some "whale" wallets are showing regular selling patterns, which may be related to profit-taking rather than panic signals, but the market's ability to absorb these sales has weakened.

Will bitcoin be cracked by quantum computers by 2030?

Quantum computers may break bitcoin within five years. How will the crypto world respond to this existential crisis?

Raking in crypto dividends: How did the family of Trump's Secretary of Commerce earn 2.5 billions dollars a year?

After Howard Lutnick became the Secretary of Commerce in the Trump administration, his family's investment bank, Cantor, is heading toward its most profitable year ever.

BTC price bull market lost? 5 things to know in Bitcoin this week