XRP Price at Risk of Falling Below $3 After $840 Million Sell-Off

XRP's price faces downward pressure after significant sell-offs, with $3 support at risk. A recovery could occur if it breaks above $3.41, but further declines are possible if selling continues.

XRP has recently faced a sharp drop from its all-time high (ATH), with the price stabilizing within a sideways trend.

The altcoin is currently holding above the crucial $3 support, which has acted as a psychological level for investors. However, with increasing sell-offs, XRP could struggle to maintain this support in the coming days.

XRP Investors Are Selling

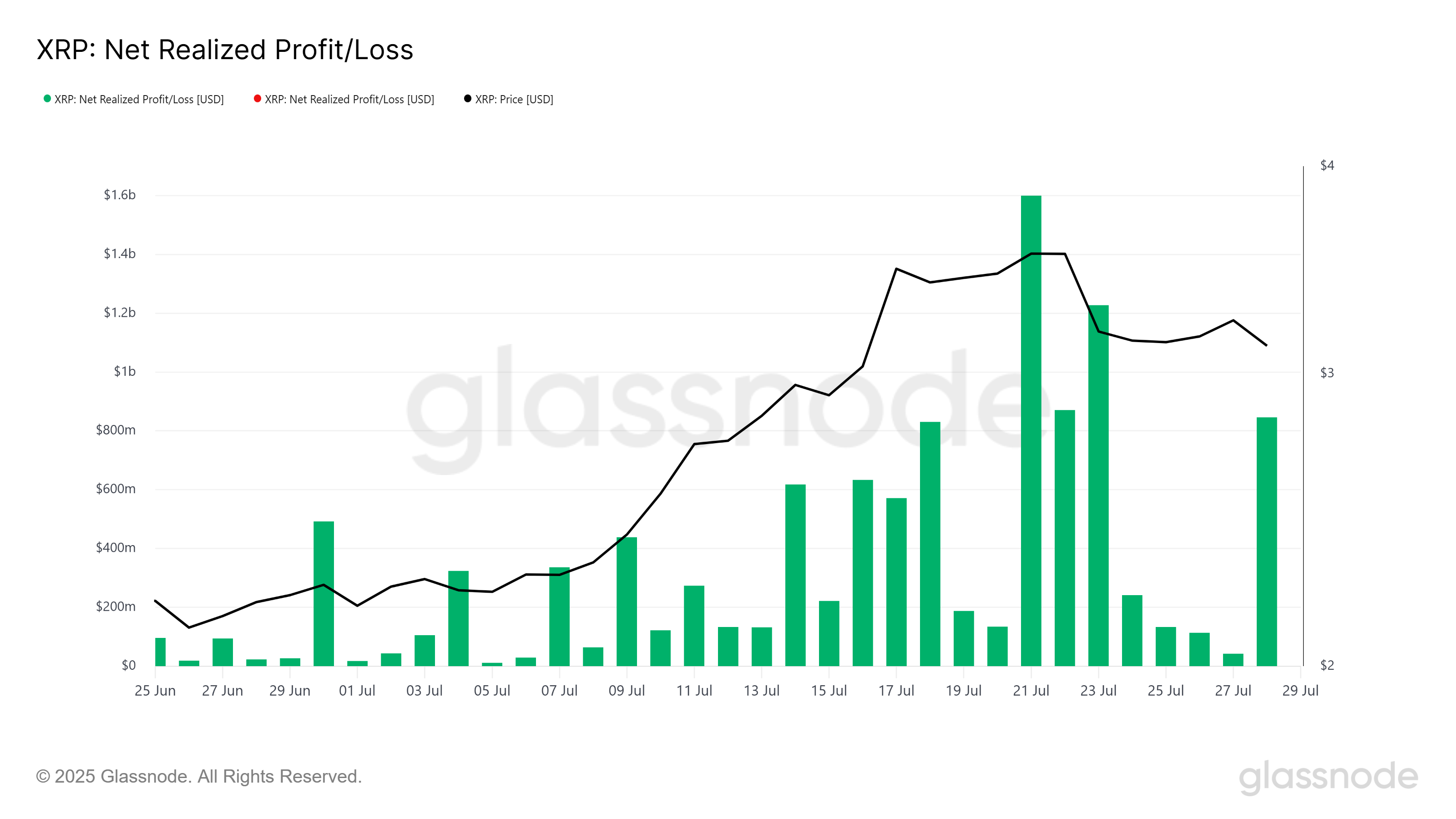

The Net Realized Profit/Loss indicator shows a significant $845 million worth of sell-offs in the last 24 hours, marking one of the highest single-day sell-offs this month. This high selling volume suggests that many XRP investors are still uncertain about the coin’s stability.

XRP’s price fluctuations reflect broader investor concerns about the coin’s short-term trajectory. The uncertainty is prompting many to secure their profits, especially as the altcoin struggles to push back toward its ATH of $3.66.

XRP Net Realized Profit/Loss. Source:

Glassnode

XRP Net Realized Profit/Loss. Source:

Glassnode

XRP’s macro momentum is being heavily influenced by the recent uptick in Liveliness, which tracks the movement of long-term holders (LTHs). Currently, Liveliness is at a four-month high, signaling that many long-term holders are selling their XRP. This shift from accumulation to distribution can have a negative impact on the price, as LTHs typically have a significant influence on XRP’s value.

When Liveliness increases, it suggests that XRP holders are capitalizing on the recent gains, which could lead to further selling pressure. If this trend continues, XRP could face downward pressure, with the risk of breaching the psychological support level of $3.00.

XRP Liveliness. Source:

Glassnode

XRP Liveliness. Source:

Glassnode

XRP Price Needs To Hold On

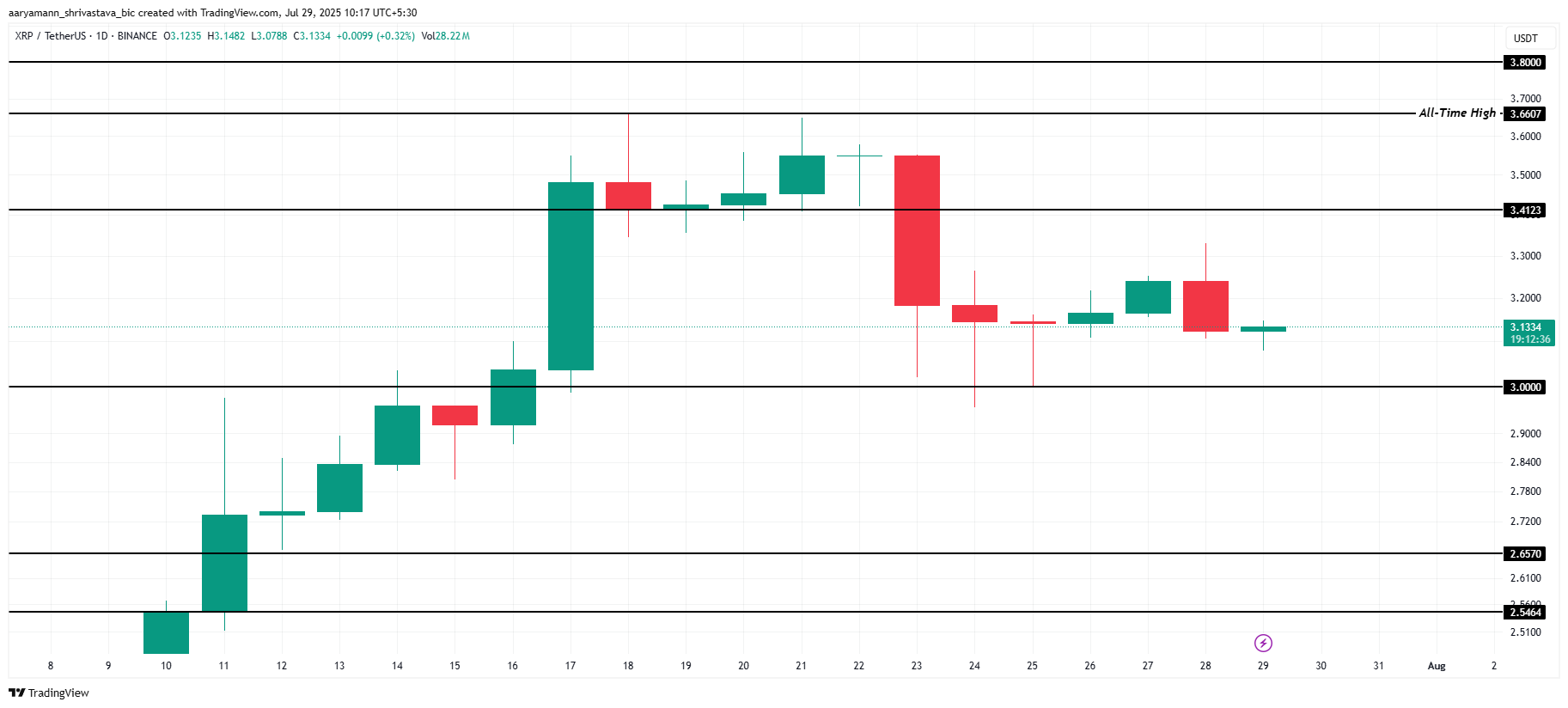

XRP is currently trading at $3.13, holding just above the support level of $3.00. Although this support has not been frequently tested, it remains a crucial level for the altcoin. Should XRP fail to maintain this level, further downside pressure could push it below $3.00, potentially targeting $2.65.

Given the current market dynamics and the sell-off pressure from investors, XRP’s price is likely to face further downward momentum. If the support at $3.00 is lost, it could create further selling pressure.

XRP Price Analysis. Source:

TradingView

XRP Price Analysis. Source:

TradingView

However, if the broader market exhibits bullish signals and investor sentiment shifts, XRP could reclaim its bullish trend. A break above the $3.41 resistance level would signal a potential return to upward momentum, bringing the coin closer to its ATH of $3.66.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

"Whales" Accelerate Bitcoin Sell-Off, But Is It Really a Panic Signal?

Some "whale" wallets are showing regular selling patterns, which may be related to profit-taking rather than panic signals, but the market's ability to absorb these sales has weakened.

Will bitcoin be cracked by quantum computers by 2030?

Quantum computers may break bitcoin within five years. How will the crypto world respond to this existential crisis?

Raking in crypto dividends: How did the family of Trump's Secretary of Commerce earn 2.5 billions dollars a year?

After Howard Lutnick became the Secretary of Commerce in the Trump administration, his family's investment bank, Cantor, is heading toward its most profitable year ever.

BTC price bull market lost? 5 things to know in Bitcoin this week