BitMine Overtakes Rivals with $2 Billion Ether Buying Spree

BitMine Immersion Technologies has reclaimed its position as the world’s largest corporate Ether holder after a staggering buying spree saw it purchase over $2 billion worth of ETH in just over two weeks.

BitMine Immersion Technologies has reclaimed its position as the world’s largest corporate Ether holder after a staggering buying spree saw it purchase over $2 billion worth of ETH in just over two weeks.

The Bitcoin mining firm revealed on Thursday that it acquired 566,776 ETH—valued at more than $2.03 billion—within the last 16 days. This aggressive accumulation pushes BitMine ahead of competitors in the newly emerging Ether treasury sector.

Tom Lee, managing partner at FundStrat and chairman of BitMine, stated the company is “well on our way to achieving our goal of acquiring and staking 5% of the overall ETH supply,” highlighting the firm’s ambition to become a dominant force in Ethereum staking and treasury management.

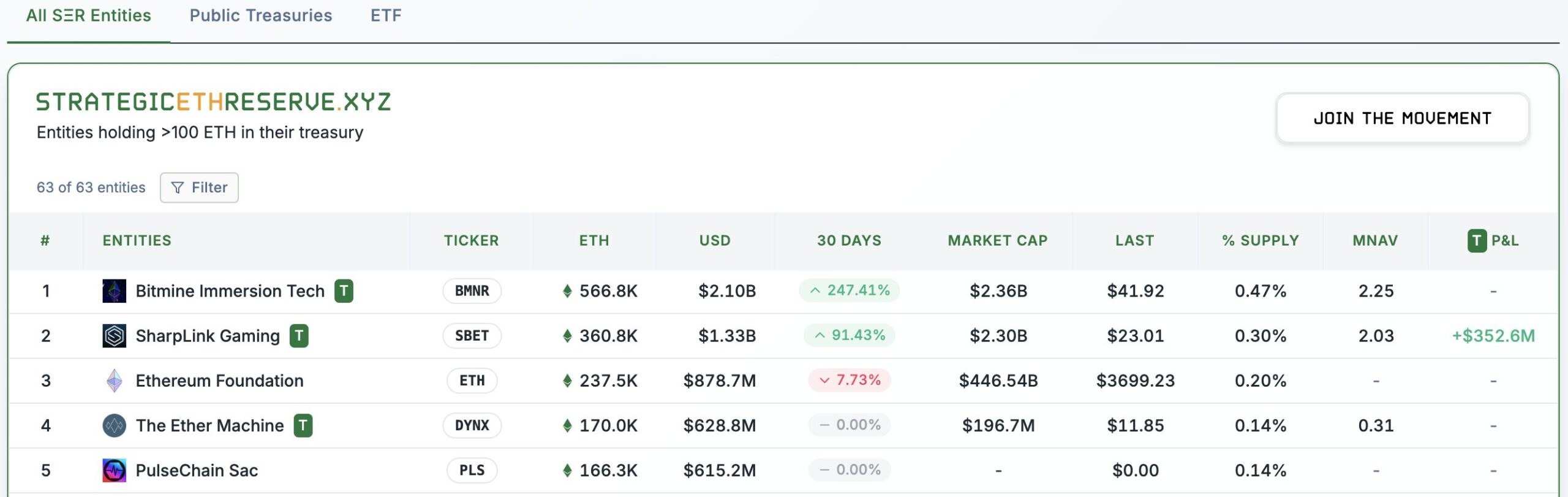

According to Strategic Ether Reserves data , BitMine now tops the leaderboard of Ether treasury firms, surpassing SharpLink Gaming, which recently bought 79,949 ETH to increase its holdings to around 360,800 ETH, worth roughly $1.3 billion. The Ethereum Foundation ranks third with approximately 237,500 ETH.

Source

: Strategic Ether Reserves

Source

: Strategic Ether Reserves

Ether’s supply is dynamic, fluctuating based on issuance and burn rates. Should BitMine achieve its 5% target, its market share of Ethereum would exceed Michael Saylor’s Strategy’s Bitcoin holdings, which currently stand at 607,770 BTC, representing 2.9% of Bitcoin’s capped 21 million supply.

The market has responded sharply to these corporate Ether moves. BitMine’s shares (BMNR) skyrocketed by more than 3,000% to hit an all-time high of $135 on July 3 following its Ether accumulation strategy announcement . Similarly, SharpLink Gaming’s (SBET) stock jumped 171% to trade at $79.21 after its Ether pivot in late May.

Overall, Strategic Ether Reserves shows that 61 corporate entities currently hold 2.31 million ETH, representing 1.91% of Ethereum’s total circulating supply and valued at $8.46 billion. In contrast, Bitbo data indicates that over 206 firms collectively hold upwards of 3.4 million Bitcoin, representing 16.5% of the total BTC supply and worth over $408 billion.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto: The Fear Index Drops to 10, But Analysts See a Reversal

Uniswap Labs Faces Pushback as Aave Founder Highlights DAO Centralization Concerns

Ethereum Interop Roadmap: How to Unlock the “Last Mile” for Mass Adoption

From cross-chain to "interoperability," many of Ethereum's fundamental infrastructures are accelerating towards system integration for large-scale adoption.

A $170 million buyback and AI features still fail to hide the decline; Pump.fun is trapped in the Meme cycle

Facing a complex market environment and internal challenges, can this Meme flagship really make a comeback?