Ethereum Eyes $4,000 as Whales and ETFs Pour Billions into Market

With ETH trading at a six-month high and ETF inflows topping $2.2 billion in five days, analysts suggest a potential breakout past $4,000, with projections as high as $10,000 by year-end.

Ethereum is drawing heightened attention from institutional investors and crypto whales, pushing its price toward the $4,000 mark for the first time since late 2024.

On July 20, blockchain analytics firm Lookonchain reported that two newly created wallets purchased 58,268 ETH, worth approximately $212 million. The wallets, suspected to belong to institutional investors or whales, acquired the assets from Galaxy Digital and FalconX.

Ethereum Gains $450 Billion Market Cap as Institutional Bets Intensify

On-chain analyst EmberCN added to the narrative by highlighting another significant Ethereum purchase involving another whale. The transaction involved 13,462 ETH—worth approximately $50 million—acquired from Binance at an average price of $3,714.

Ethereum Whales ETH Purchase. Source:

Ethereum Whales ETH Purchase. Source:

Meanwhile, the buying pressure isn’t coming from anonymous whales alone. The corporate sector is also contributing to this accumulation trend by pulling their weight in the market.

SharpLink, currently the largest corporate holder of Ethereum, has continued its aggressive ETH accumulation this month.

Over the past day, the firm added 4,904 ETH, worth approximately $17.45 million. This pushed its monthly total to 157,140 ETH, valued at nearly $493 million at an average acquisition price of $3,136.

Beyond direct purchases, Ethereum is also seeing record inflows into spot exchange-traded funds (ETFs).

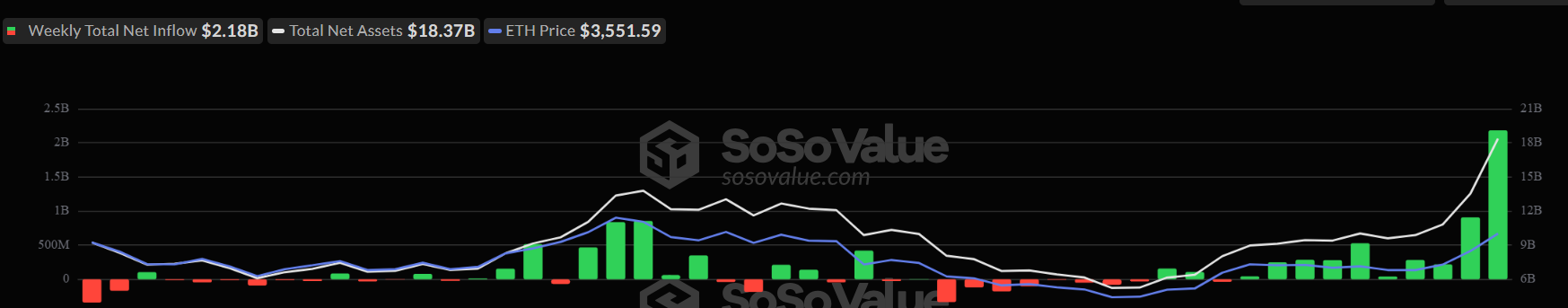

In the last five trading sessions, ETH spot ETFs attracted $2.2 billion, which is more than double the $1 billion added the week before.

Spot Ethereum ETFs Weekly Flows. Source:

Spot Ethereum ETFs Weekly Flows. Source:

“Back-to-back record weeks. 4 of top 5 inflow days since launch over past two weeks,” Nate Geraci, an ETF expert, pointed out.

This momentum suggests increasing conviction among investors that Ethereum is well-positioned for future growth.

Notably, the network’s role in powering stablecoins, decentralized finance (DeFi), and tokenized assets continues to draw attention from traditional financial institutions, including BlackRock.

Considering this bullish momentum, Arthur Hayes, CIO of Maelstrom, suggested that Ethereum could soon breach the $4,000 threshold. His outlook supports broader market forecasts projecting a potential run toward $10,000 before year-end.

As of press time, the digital asset is trading at a six-month high of $3,710, the highest level since December 2024. Meanwhile, the price rally has elevated ETH’s market capitalization to over $450 billion, making it the 25th most valuable asset globally.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Ali Qianwen app's initial launch faces a surge in traffic; the official response is "operating well, feel free to ask."

The public beta of the Qianwen app has been launched, with Alibaba introducing its personal AI assistant to the consumer market. The first day’s traffic exceeded expectations, and some users experienced service congestion. “Alibaba Qianwen crashed” quickly trended on social media, but the official response stated that the system is operating normally.

Another giant exits! The "Godfather of Silicon Valley Venture Capital" sells all Nvidia shares and buys Apple and Microsoft

Billionaire investor Peter Thiel has revealed that he has fully exited Nvidia, coinciding with rare simultaneous retreats by SoftBank and "Big Short" investor Michael Burry, further intensifying market concerns about an AI bubble.

How to evaluate whether an airdrop is worth participating in from six key dimensions?

Airdrop evaluation is both an "art and a science": it requires understanding human incentives and crypto narratives (art), as well as analyzing data and tokenomics (science).

Raking in crypto dividends: How did the family of Trump's Commerce Secretary earn $2.5 billion a year?

After Howard Lutnick became the Secretary of Commerce in the Trump administration, his family's investment bank, Cantor, is heading for its most profitable year ever.