Germany’s NRW.BANK Issues €100 Million Bond on Polygon

- NRW.BANK issues €100 million bond on Polygon.

- Largest public sector blockchain bond in Europe.

- Signals institutional engagement, technological integration.

Germany’s state-owned development bank, NRW.BANK, launched a groundbreaking €100 million blockchain bond utilizing the Polygon network. This marks a pivotal point in digital securities, indicating widespread institutional confidence in blockchain technology.

NRW.BANK is the primary issuer, with Deutsche Bank, DZ BANK, and DekaBank as joint lead managers. Utilizing Germany’s Electronic Securities Act, the bond is registered using Cashlink Technologies’ BaFin-approved crypto registry.

The Impact of Polygon on Digital Finance

The bond issuance highlights Polygon’s utility while potentially impacting Ethereum due to Polygon’s Layer 2 status. The event shows significant institutional trust and maturation in blockchain for public finance sectors.

“This is more than a technical milestone. It’s a signal that public financial institutions are ready to move beyond blockchain pilots and start integrating these systems at scale” – Michael Duttlinger, CEO, Cashlink

Regulatory Alignment and Future Implications

This landmark issuance aligns with Germany’s regulatory framework and underscores the maturation of digital finance. The deployment on Polygon bolsters institutional approval and could spark interest in blockchain solutions, reflecting increased blockchain adoption in Europe.

Insights and Future Trends

Insights on possible outcomes include broader acceptance of blockchain bonds, spurring trends toward digital transformation in finance. The use of existing regulatory frameworks like eWpG provides a significant precedent for future large-scale institutional blockchain finance endeavors.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

SoftBank shares drop 5%, snapping 9-day rally after $2 billion Intel deal

Share link:In this post: SoftBank shares fell over 5% after it announced a $2 billion deal to buy Intel stock at $23 per share. Asian markets dropped across the board as investors waited for the U.S. Fed’s Jackson Hole meeting. Jerome Powell is expected to signal a possible rate cut, with futures showing an 83% chance for September.

Texas judge sides with Logan Paul’s effort to dismiss CryptoZoo lawsuit

Share link:In this post: Judge Ronald Griffing said Logan Paul’s bid to remove a lawsuit over the collapse of CryptoZoo should be allowed. Griffin also urged the class-action plaintiff to update all but one of its 27 claims against Paul, the one linking him to commodity pool fraud. The judge dismissed Paul’s bid to accuse CryptoZoo co-founders of the project’s failure.

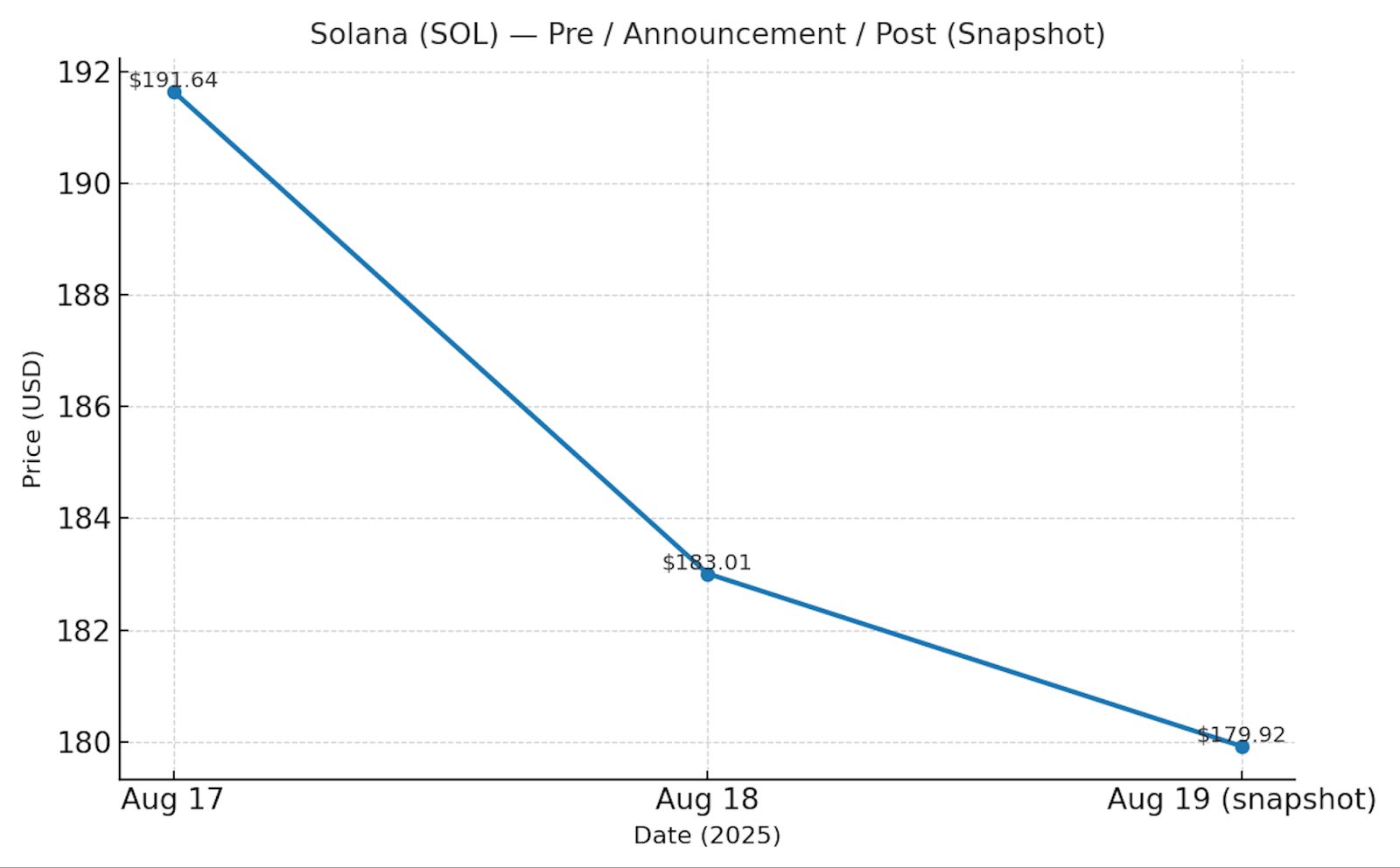

XRP & Solana ETF delays spark volatility – Stay or exit before October?

Share link:

Ethereum ETFs supply holdings to exceed BTC ETF’s holdings by September

Share link:In this post: Ethereum ETFs now hold over 6.5M ETH, with projections showing a September flip as they close in on Bitcoin ETFs’ share of the circulating supply. US spot ETH ETFs saw $59M in outflows on August 15 after record weekly inflows of 649,000 ETH pushed totals above $3.7B. Institutional investors dominate Ethereum with 19.2M ETH, while retail holdings fall sharply, highlighting shifting market influence amid price swings near $4,450.