Ricardo Salinas Invests 80% Portfolio in Bitcoin

2025/07/05 20:40

2025/07/05 20:40- Ricardo Salinas reallocates major investment portfolio to Bitcoin and crypto assets.

- 80% of Salinas’ portfolio is now in Bitcoin.

- Move accentuates Bitcoin’s role as a store of value.

Lede

Ricardo Salinas, Mexican billionaire and Grupo Salinas chairman, shifts 80% of his portfolio to Bitcoin, fueling discussions on digital asset investment in Mexico and globally.

Nut Graph

Salinas’ major portfolio shift emphasizes the increasing appeal of Bitcoin as a store of value and influences both institutional and retail investment sentiments.

Body

Ricardo Salinas Pliego, known for his expansive business presence, has allocated a substantial portion of his portfolio to Bitcoin. This decision aligns with his recent statements promoting Bitcoin over traditional real estate investments.

Salinas’ choice to invest heavily in Bitcoin includes holdings in related firms like MicroStrategy. His shift reduces reliance on real estate, highlighting his concern over currency devaluation impacts. As Salinas himself stated, “My shift from real estate to Bitcoin is based on concerns over currency devaluation.”

The reallocation by Salinas affects market perceptions, reinforcing Bitcoin’s position as a mainstream asset. The move signals a significant endorsement of crypto, influencing investor confidence globally and within Latin America.

Salinas’ actions underline the ongoing debate surrounding fiat currencies’ stability. His advocacy for Bitcoin challenges traditional financial structures and suggests potential implications for real estate markets.

Financial circles are closely watching the potential ripple effects Salinas’ investment may create. His influential status could shift asset preferences towards cryptocurrencies, impacting institutional investors’ strategies .

Salinas’ decision may initiate further institutional participation in digital assets, as other financial leaders evaluate Bitcoin’s viability. Historical precedents show similar endorsements have spurred short-term Bitcoin price upswings and increased market attention.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Essence of Bitcoin and AI

Liberalism gives vitality to Bitcoin; democratization gives it scale. The network effect is the invisible bridge connecting the two, and also proves that freedom grows through participation.

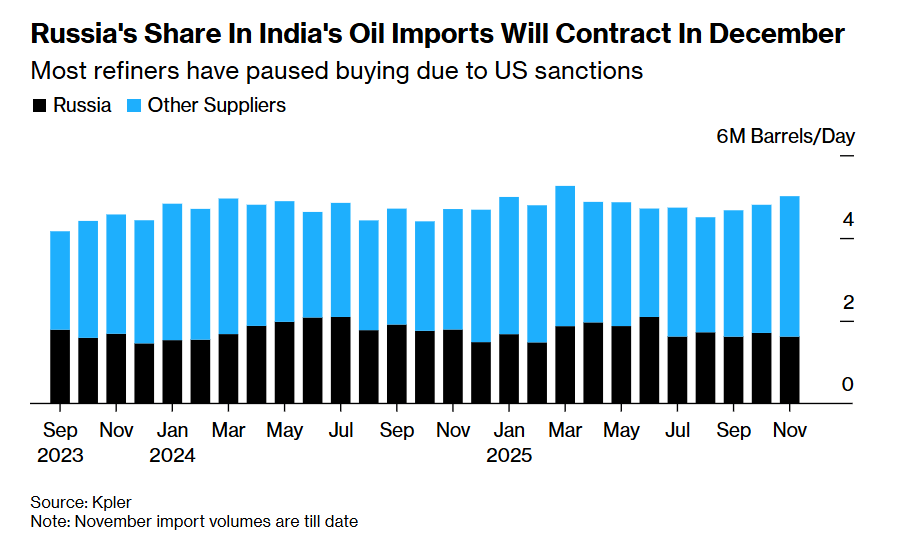

Trump's pressure works! India's five major refineries suspend orders for Russian oil

Due to Western sanctions and US-India trade negotiations, India significantly reduced its purchases of Russian crude oil in December, with its five major core refineries placing no orders.

Masayoshi Son takes action! SoftBank sells all its Nvidia shares, cashing out $5.8 billions to shift towards other AI investments

SoftBank Group has completely sold its Nvidia holdings, cashing out $5.8 billions. Founder Masayoshi Son is shifting the strategic focus, allocating more resources to the artificial intelligence and chip-related sectors.

Research Report|In-Depth Analysis and Market Cap of Allora Network (ALLO)