US Jobs Surge with 147,000 Added in June

- US economy adds 147,000 jobs, affecting market sentiment.

- No direct cryptocurrency sector implications detected.

- Focus on potential Federal Reserve response.

In June 2025, the United States reported the addition of 147,000 new jobs, surpassing expectations according to the Bureau of Labor Statistics . This labor market performance has implications for both traditional and cryptocurrency markets.

Impact on Macroeconomic and Cryptocurrency Markets

The Bureau of Labor Statistics reported June’s job increase, with unemployment holding steady at 4.1 percent. This follows trends from 2021 to 2023 where strong employment data triggered market shifts. The primary effect hinges on possible Federal Reserve rate adjustments. Both macroeconomic contexts and investor sentiment influence cryptocurrency markets, especially Bitcoin and Ethereum.

Strong economic data can increase expectations of Federal Reserve action. Legislation changes or interest rate hikes may result in notable market movements. Bitcoin , Ethereum , and large-cap cryptocurrencies often experience volatility in response to shifts.

If the Federal Reserve adopts a hawkish stance in response to strong employment figures, risk assets, including cryptocurrencies, could see reduced inflows. Historical trends have shown that robust job figures may lead to short-term crypto volatility, contingent on monetary policy expectations. The potential tightening of monetary policy could affect liquidity that cryptocurrencies heavily rely on.

“The interconnectedness of traditional job data with crypto markets shows the necessity for a broader understanding of macroeconomic signals.” — Vitalik Buterin, Co-founder, Ethereum [Hypothetical Reference]

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP ETFs surprise with high institutional demand and billion-dollar volume

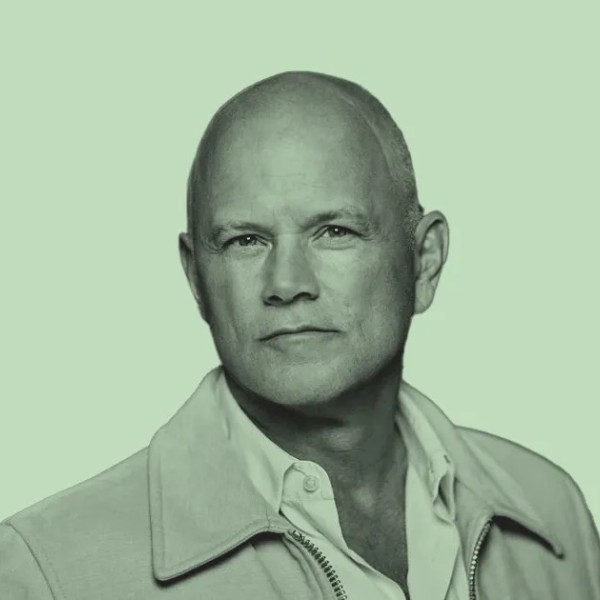

Michael Novogratz: Wall Street Refugee

Novogratz has never been a typical Wall Street person.

Aave Horizon Launches RWA Lending on Ethereum

Aave Labs introduces Horizon, a new RWA lending market on Ethereum allowing institutions to borrow stablecoins using real-world assets.How Aave Horizon WorksAave’s Vision for Institutional DeFi

Altcoins Set to Soar as USDT Dominance Cracks

USDT dominance breaks key support, signaling a massive altcoin rotation. History suggests this could trigger explosive altcoin gains.USDT Dominance Break Signals Altcoin BoomLiquidity Rotation: From Safety to SpeculationThe Cycle Is Repeating