Crypto Market Sees $197.48 Million Liquidations in 24 Hours

Points Cover In This Article:

Toggle- Crypto market sees $197.48M liquidations.

- Significant market volatility continues.

- High leverage positions notably affected.

Major cryptocurrency exchanges reported $197.48 million in liquidations within the past 24 hours, highlighting substantial market turbulence typically seen on platforms like Binance and ByBit.

Cryptocurrency market’s liquidation spree underscores ongoing volatility, revealing the fragility in leveraged trading positions. Immediate reactions among traders highlight potential reevaluations of strategies.

Magnitude of Liquidations

The single largest liquidation amounting to $93.11 million underscores the influence of leveraged positions across platforms. As major exchanges like Binance and ByBit address these shifts, questions arise about market stability in volatile times. Crypto market liquidations peak at $197.48 million amid volatility.

Impact on Holdings

The financial ripple from these liquidations impacts BTC and ETH holdings. Leveraged positions see higher scrutiny, prompting potential strategy changes, although no public institutional responses currently emerge.

Market Reactions and Infrastructure

Market reactions emphasize concerns over infrastructure’s capacity to handle such volatility. Talks between users and platforms may pivot toward enhanced risk management strategies or potential reforms in trading frameworks.

“Market infrastructure must keep pace with the speed of sentiment shifts and leverage.” — Changpeng Zhao (CZ), CEO, Binance.

Historical Context and Future Outlook

Historical analysis reveals this event parallels past market upheavals driven by global uncertainties, stressing the need for rigor in risk assessment. Observers note potential regulatory dialogues around market resilience.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

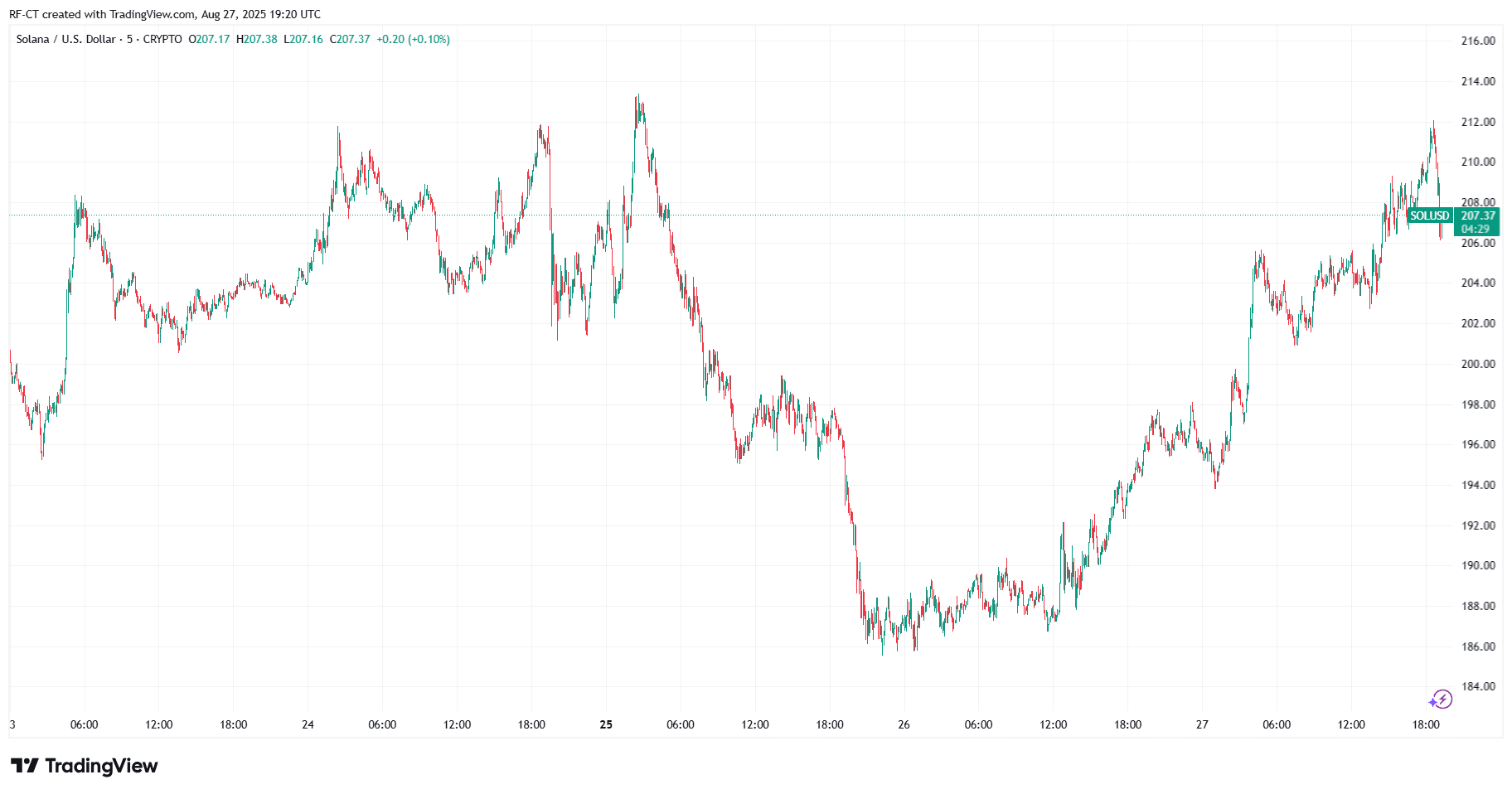

Solana Price Prediction: Can SOL Break Through $215 and Soar to $300?

Solana is struggling with key resistance around the $205 to $215 range—will increased institutional inflows push SOL above $300, or will a failure to hold support drive it lower? Here are today’s price predictions and outlook.

Bitcoin News Today: LQWD Unlocks 24% Bitcoin Yield via Lightning Network Innovation

- LQWD Technologies deployed 19.75 Bitcoin on Lightning Network, achieving 24% annualized yield in 24-day test. - The test validated LQWD's infrastructure efficiency, supporting 1.6M transactions for low-cost cross-border payments. - Lightning's enterprise adoption grows as Tando enables Bitcoin-M-PESA interoperability in Kenya's 34M-user ecosystem. - Corporate Bitcoin treasury trends expand as LQWD demonstrates yield generation through Lightning-based operations. - Despite adoption challenges, Lightning b

KYI Tech Embeds Identity in Stablecoins to Thwart $1.6B Fraud Crisis

- Circle and Paxos pilot KYI tech with Bluprynt to embed verified issuer identities in stablecoins, targeting $1.6B annual fraud losses. - The blockchain-native system enables real-time token verification via wallets and explorers, aligning with U.S. regulatory shifts under the GENIUS Act. - By attaching auditable credentials to tokens at issuance, the framework strengthens transparency and compliance for major stablecoins like USDC and PYUSD. - Regulators and industry leaders endorse the initiative as a c

The Future of Crypto in 2025: 4 High-Potential Assets Redefining the Market

- The 2025 crypto market faces a pivotal shift driven by tech innovation and institutional demand, with BlockDAG, Ethereum, Hedera, and Solana emerging as key assets. - BlockDAG's hybrid DAG-PoW architecture achieves 15,000 TPS and 70% energy efficiency, positioning it as a scalable, ESG-compliant disruptor with projected 36x ROI. - Ethereum struggles with 15-30 TPS limitations despite Shanghai++ upgrades, while Solana's 65,000 TPS and developer tools drive growth but raise decentralization concerns. - Hed