Dinari Secures Broker-Dealer License for Tokenized Stocks

- Dinari receives U.S. broker-dealer license for tokenized stocks.

- Gabriel Otte leads strategy and expansion efforts.

- Expected surge in investor interest and market transparency.

Dinari’s broker-dealer license allows them to offer tokenized stocks to U.S. investors. The approval marks a significant step in integrating blockchain technology into mainstream financial services.

Co-founder Gabriel Otte emphasized elevating the financial system. The company plans to activate its licensed entity in the coming quarter. This initiative sets a precedent for other blockchain and crypto firms like Coinbase and Kraken.

The license is likely to energize investor interest, potentially leading to greater market transparency and enhanced stock trading efficiency. Key networks such as Coinbase Base are poised to gain from increased activity in tokenization.

Gabriel Otte, Co-Founder and CEO, Dinari, stated, “For me, the end game is how can we elevate the entire financial system, which means not just a broker-dealer that’s on chain, but an exchange that’s on chain.”

This move might usher in a new era of blockchain-based capital markets. Dinari’s innovation could improve liquidity, broaden trading hours, and allow cross-border access, impacting the broader crypto and traditional financial ecosystems.

Industry stakeholders expect other platforms to seek similar regulatory approvals promptly. These actions may influence U.S. market operations, drawing new capital into blockchain tokenized equities.

Market participants anticipate both financial and technological advancements following Dinari’s success. The shift towards on-chain solutions might alter regulatory landscapes and technological frameworks within the financial sector.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

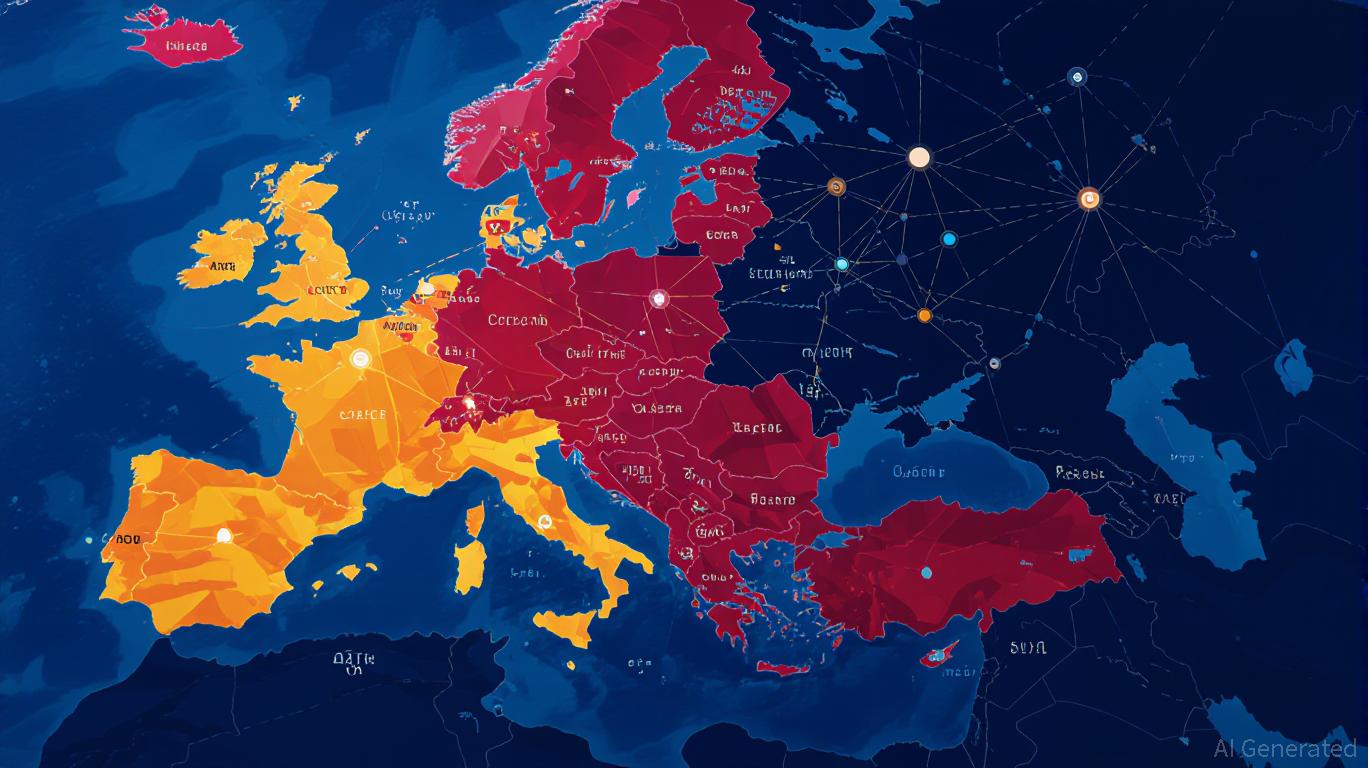

Navigating the Shifting Crypto Media Landscape in Eastern Europe: Strategic Opportunities Amid Traffic Declines

- Eastern European crypto media saw 18.3% Q2 2025 traffic decline, with 17 outlets capturing 80.71% of regional traffic amid regulatory and algorithmic shifts. - Tier-3 platforms (10,000–99,999 visits) retained 17.33% traffic through localized relevance and AI-optimized content in markets like Poland and Czech Republic. - AI-driven discovery tools and regional partnerships (e.g., Kriptoworld.hu) are reshaping distribution, with 20.6% of outlets reporting traffic from platforms like Perplexity. - Investors

Is This the Final Dip Before Altseason?

- Crypto market signals suggest altcoins may outperform Bitcoin amid waning dominance and bullish technical indicators. - Ethereum's 54% August surge and rising ETH/BTC ratio historically precede altcoin growth cycles. - Dovish Fed policy and $3B Ethereum ETF inflows create favorable conditions for altcoin capital rotation. - Institutional confidence in Bitcoin indirectly supports altcoin momentum through liquidity and risk-on appetite. - Strategic entry points for high-conviction investors include Ethereu

The EU's Ethereum-Based Digital Euro: A Strategic Catalyst for Blockchain Infrastructure and DeFi Growth

- EU selects Ethereum as foundational layer for digital euro, challenging U.S. stablecoin dominance and validating its scalability and compliance. - Ethereum's smart contracts, energy-efficient post-Merge model, and GDPR-aligned ZK-Rollups address scalability, privacy, and regulatory needs. - Infrastructure providers (Infura, zkSync) and DeFi platforms (Uniswap) stand to benefit from increased demand for CBDC operations and liquidity. - Geopolitical shift reduces reliance on U.S. payment systems, with Ethe

Metaplanet's $887M Bitcoin Play: A Catalyst for Institutional Adoption and Long-Term BTC Value

- Metaplanet allocated $887M of its ¥130.3B fundraising to Bitcoin in 2025, reflecting corporate treasury strategies shifting toward digital assets amid macroeconomic instability. - Japan's weak yen and 260% debt-to-GDP ratio drive institutional adoption of Bitcoin as a hedge against currency depreciation, with 948,904 BTC now held across public company treasuries. - Metaplanet's 1% Bitcoin supply target (210,000 BTC) and inclusion in global indices signal growing legitimacy, as regulatory reforms in Japan