Analyst: US Employment Data May Be Key to Bitcoin's June Trend, Fluctuation Range Could Reach $95,000 - $125,000

Analysts point out that the U.S. employment data to be released this Friday will be a key factor influencing Bitcoin's short-term trend. If the data is weak, it may strengthen market expectations for an early rate cut by the Federal Reserve, pushing Bitcoin to test the $125,000 high in June; conversely, if the data is strong, the price may fall back to around $95,000.

According to market observations, factors such as the recent slowdown in cryptocurrency ETF inflows and increased IPO activity may suggest that the short-term market is facing adjustment pressure.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitunix Analyst: Whale Sell-Off Accelerates, Not Panic Yet but Liquidity Gap Poses Risk

Public Chain Activity Ranking for the Past 7 Days: Solana Remains Firmly at the Top

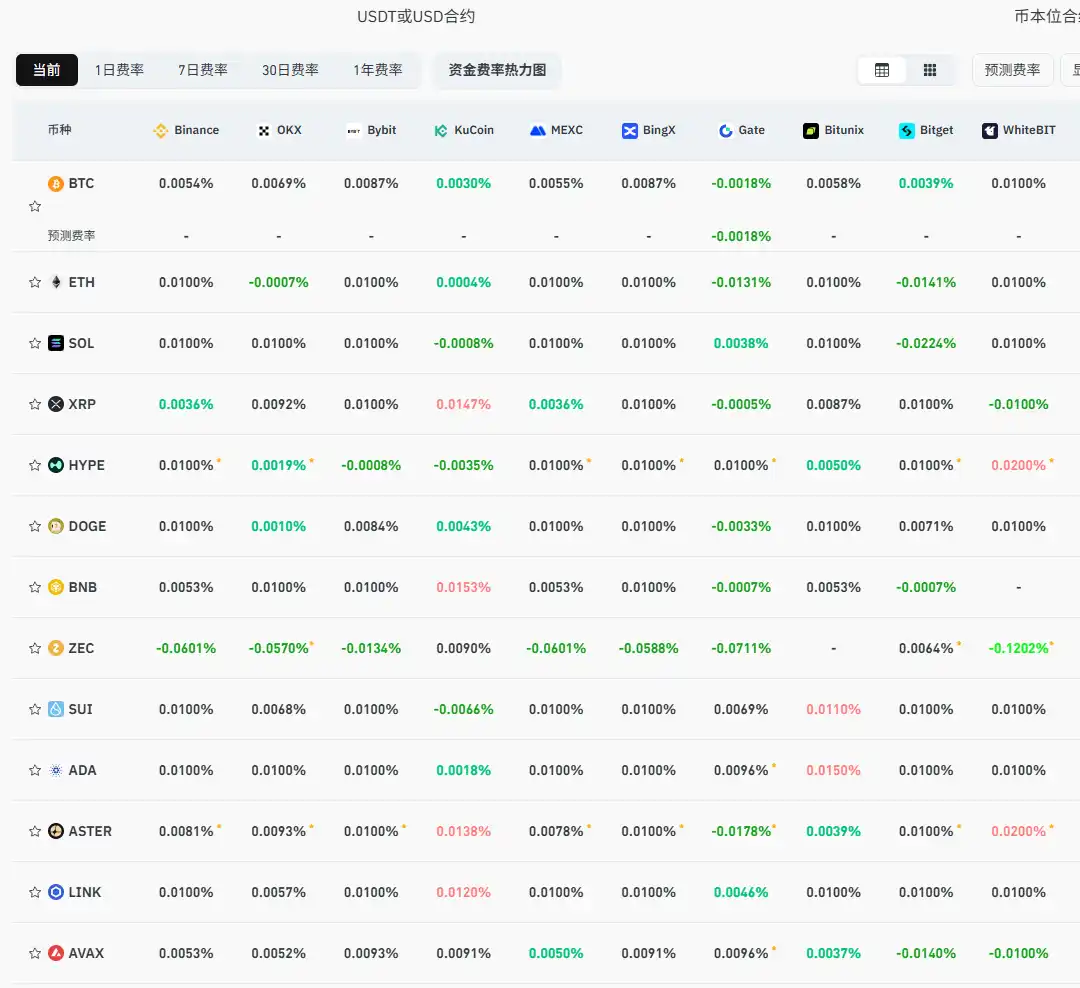

Current mainstream CEX and DEX funding rates indicate that bearish sentiment in the market has weakened.

CoinMarketCap: Launched the decentralized finance index token CMC20