Bitcoin Price Watch: Bulls Defend Key Support as Momentum Cools

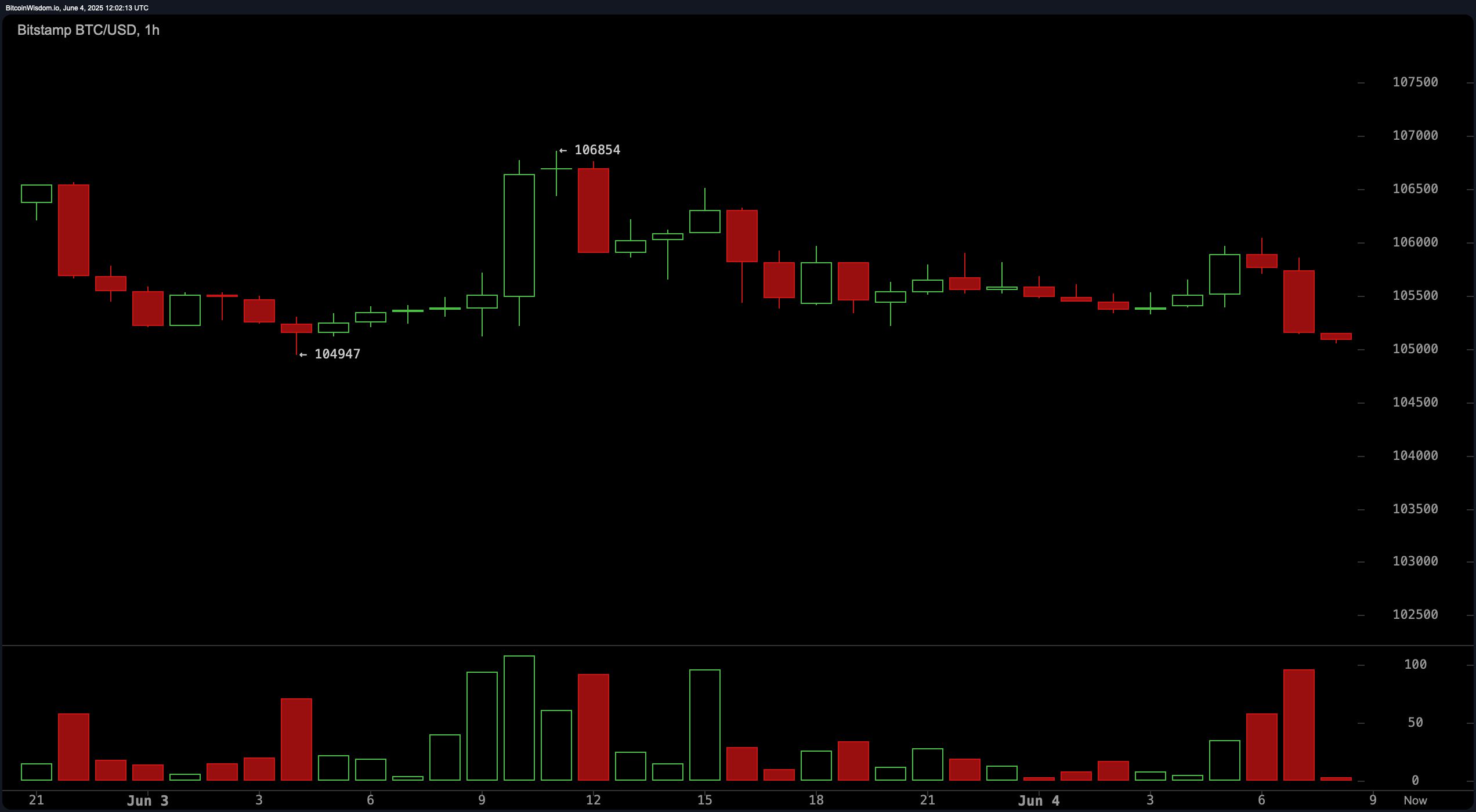

Bitcoin traded at $105,289 on June 4, 2025, with a total market capitalization of $2.09 trillion. The cryptocurrency’s 24-hour trade volume stood at $24.92 billion, within a daily price range of $105,293 to $106,854.

Bitcoin

On the 1-hour chart, bitcoin exhibited a micro downtrend leading into June 4, characterized by a consistent pattern of lower highs. The most recent rejection occurred at $106,854, confirming this as a short-term resistance. Although a bounce attempt was observed at $104,947, the price failed to clear the $106,000 level with strength. Trading volume patterns reinforced bearish sentiment, with increasing sell-side volume on red candles. As such, a cautious intraday-long position may be considered near $104,500 to $104,900 if volume weakens on further declines.

The BTC/USD 4-hour chart reflects a consolidation phase following a recovery from the $103,100 low. Price action shows signs of indecision, marked by long wicks and a lack of strong directional movement. Key levels to monitor include support at approximately $103,100 and resistance at around $106,800. Despite a few bullish impulses, weak follow-through has stalled momentum. Scalpers and swing traders may observe the $103,000–$103,500 range as a potential accumulation zone, though the upper range near $106,800 remains a formidable barrier.

From a broader perspective, the daily chart indicates that bitcoin remains in a mid-term uptrend despite a recent pullback from the $112,000 high. Support has held firm near the $104,000 level, suggesting a consolidation pattern rather than a full reversal. Resistance is clustered in the $110,000 to $112,000 range, which remains significant after the May rally. The recent spike in trading volume during the price decline indicates possible profit-taking or distribution. Traders may view $104,000–$105,000 as a strategic re-entry zone should selling pressure subside.

Oscillators convey a largely neutral outlook. The relative strength index (RSI) stands at 52, indicating equilibrium between buying and selling momentum. The Stochastic oscillator reads 27, and the commodity channel index (CCI) is at −42, both also suggesting non-directional momentum. The average directional index (ADX) at 20 reflects a lack of a strong prevailing trend. Notably, the momentum indicator at −3,957 and the moving average convergence divergence (MACD) at 1,404 both signal a short-term negative bias.

Moving averages (MAs) paint a divided picture. Short-term indicators such as the exponential moving average (EMA) and simple moving average (SMA) for 10, 20, and 30 periods all suggest a selling environment. In contrast, the 50, 100, and 200-period EMAs and SMAs are still firmly bullish, supporting a longer-term upward trend. This divergence reinforces the current narrative of short-term caution within an otherwise intact macro uptrend. Investors and traders alike may consider adopting a range-bound strategy until a decisive breakout or breakdown occurs.

Bull Verdict:

Despite short-term weakness, bitcoin continues to hold key mid-range support near $104,000, with longer-term moving averages firmly bullish. If current consolidation persists and the price reclaims $106,800 with volume, a return toward the $110,000–$112,000 resistance zone appears likely, sustaining the broader uptrend.

Bear Verdict:

Momentum and MACD indicators suggest weakening market strength, and failure to break above $106,000 signals vulnerability. A drop below $103,000 could trigger a broader correction, shifting sentiment bearish in the short term and potentially invalidating the mid-term uptrend structure.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

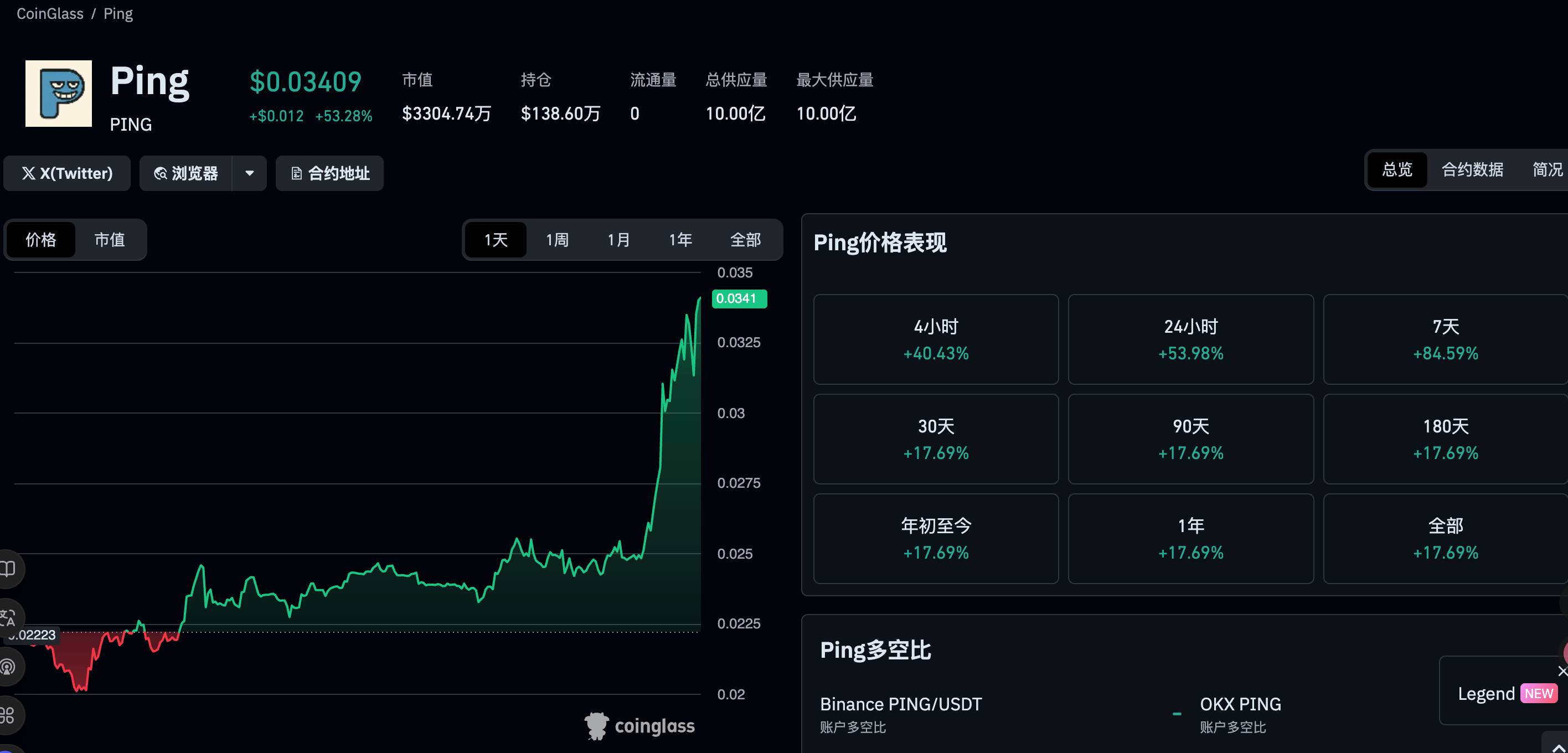

$PING rebounds 50%, a quick look at the $PING-based launchpad project c402.market

c402.market's mechanism design is more inclined to incentivize token creators, rather than just benefiting minters and traders.

Crypto Capitalism, Crypto in the AI Era

A one-person media company, ushering in the era of everyone as a Founder.

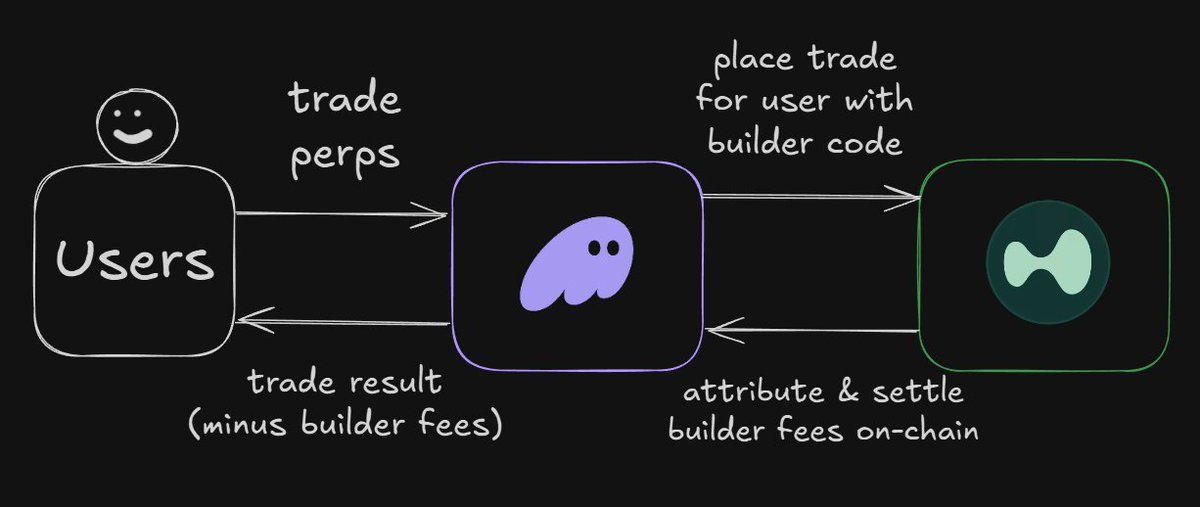

Interpretation of the ERC-8021 Proposal: Will Ethereum Replicate Hyperliquid’s Developer Wealth Creation Myth?

The platform serves as a foundation, enabling thousands of applications to be built and profit.

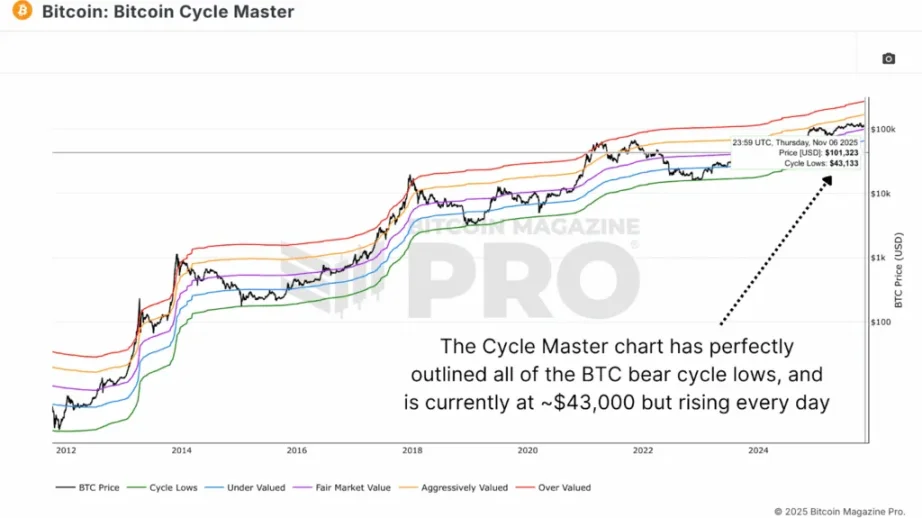

Data shows that the bear market bottom will form in the $55,000–$70,000 range.

If the price falls back to the $55,000-$70,000 range, it would be a normal cyclical movement rather than a signal of systemic collapse.