-

Bitcoin’s latest surge signals Wall Street’s tightening grip on the market.

-

As Bitcoin [BTC] grinds into fresh highs, the conversation shifts from momentum to magnitude, raising questions about potential liquidity ceilings.

-

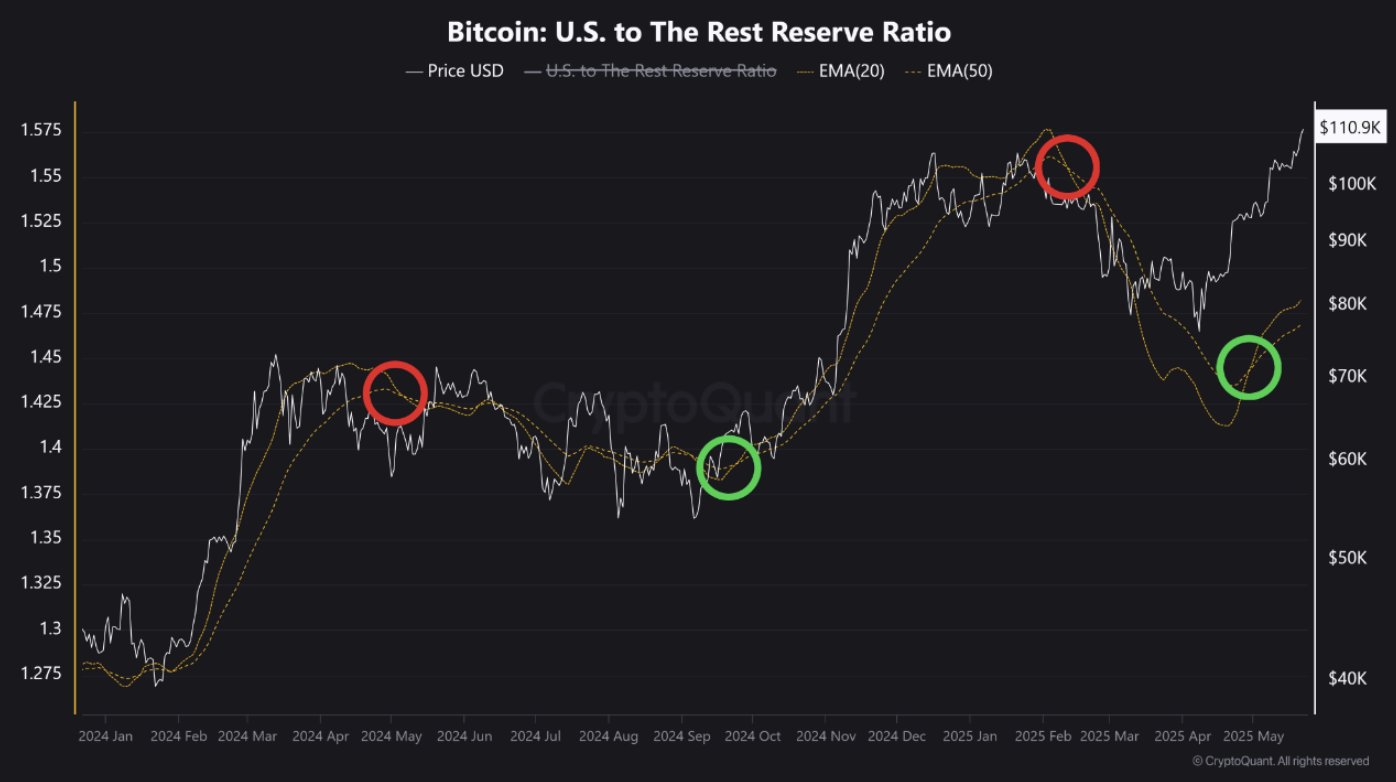

According to CryptoQuant, the BTC U.S. to Rest Reserve Ratio spike indicates heavy accumulation by U.S. players, often preceding significant bull runs.

Bitcoin surges as Wall Street influences the crypto landscape, sparking discussions about future price peaks and market volatility.

Inside the U.S. Bitcoin Vault

CryptoQuant data reveals a crucial signal: a spike in the BTC U.S. to Rest Reserve Ratio often marks considerable accumulation by American investors, historically setting up for bull runs. Currently, this familiar pattern is re-emerging, suggesting a potential 75% rally reminiscent of late 2024.

Source: CryptoQuant

Driving this momentum, recent inflows into U.S. Bitcoin spot ETFs have reached an impressive milestone, with $935 million recorded in a single day, including BlackRock’s IBIT ETF bringing in a substantial $877 million. This coincided with BTC’s daily close of $111,917, setting a promising tone for future price movements. Coupled with a bullish trend in the Coinbase Premium Index (CPI), these developments could indicate a price discovery zone pushing toward $192.5k.

Will Wall Street’s Appetite Turn Momentum into Mania?

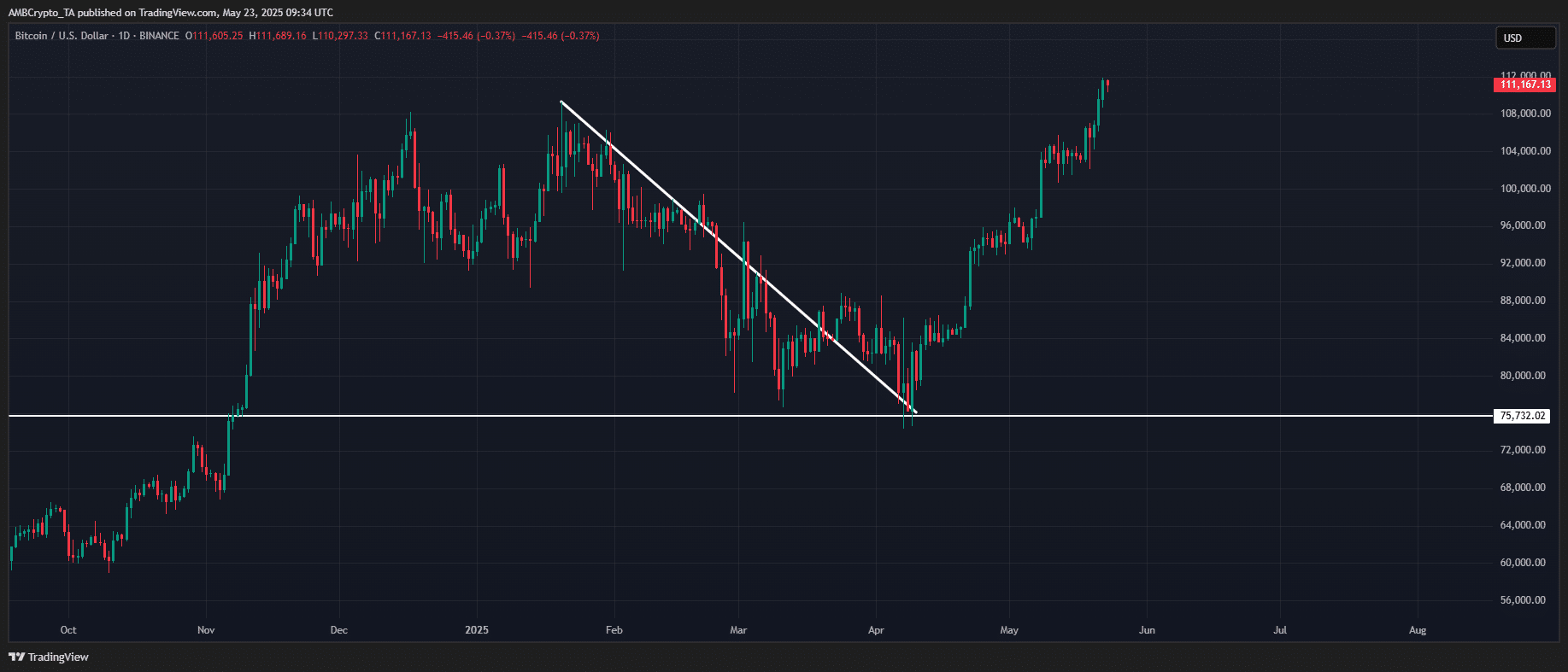

The memory of the post-2016 election volatility still lingers in the market. Bitcoin’s explosive rise followed by steep corrections serves as a cautionary tale. Marking the 20th of January as pivotal, market sentiments shifted as external socio-political factors affected risk markets.

U.S. investors began pulling back, indicated by the BTC to U.S. Rest Reserve Ratio flipping bearish. This pullback saw significant outflows from U.S. exchanges, aligning perfectly with Bitcoin’s drop to $76k in a matter of months.

Source: TradingView (BTC/USDT)

Looking ahead, easing tariffs and cooling inflation could foster an influx of capital into Bitcoin, revitalizing interest and momentum. However, macroeconomic uncertainties remain a concern. While the current golden cross is a bullish indicator, hoping for another massive rally akin to November’s is perhaps overly ambitious at this juncture.

Conclusion

The interplay of Wall Street and Bitcoin’s market dynamics showcases a complex landscape, where geopolitical risks and financial flows significantly influence price trajectories. As we navigate this evolving scenario, investors should remain alert to the shifts in sentiment while recognizing the potential for both opportunity and volatility.