Dormant PEPE Whale Withdraws 2 Trillion From Binance

PEPE's whale activity slashed Binance’s reserves of the token by 2% and triggered a 10% daily price surge in the meme coin.

A major PEPE holder has resurfaced after a two-year silence, pulling over 2 trillion tokens from Binance in a move that has captured the attention of the crypto market.

This surprise activity has ignited a fresh wave of interest in the meme coin, driving both price gains and trading volumes.

PEPE Trading Explodes as Whale Shifts $29 Million Tokens From Binance

On May 17, blockchain analytics firm Lookonchain reported that a whale initiated a major transaction involving PEPE tokens. The investor withdrew 1.79 trillion PEPE—valued at $22.23 million—from Binance into a newly activated wallet.

A day later, the whale withdrew another 420 billion PEPE tokens, worth roughly $5.39 million, from the crypto trading platform.

PEPE Whale Transactions. Source:

X/LookonChain

PEPE Whale Transactions. Source:

X/LookonChain

As a result, the whale has now removed 2.21 trillion PEPE tokens, worth $29 million, from Binance in two separate transactions during a 24-hour period.

Market observers noted that these actions have effectively reduced Binance’s PEPE reserves by about 2%.

The withdrawals, directed into self-custody wallets, suggest a deliberate accumulation strategy and signal the whale’s confidence in the token’s long-term value. Typically, such behavior reflects a shift away from short-term speculation toward a buy-and-hold approach.

Meanwhile, the whale’s return and the rapid accumulation of tokens coincided with a PEPE price rally.

According to BeInCrypto data, the meme coin has surged over 10% in the last 24 hours and now trades at $0.00001345. This marks a staggering 87.5% gain in the past month alone.

Moreover, the rally has had ripple effects across the digital asset’s derivatives markets.

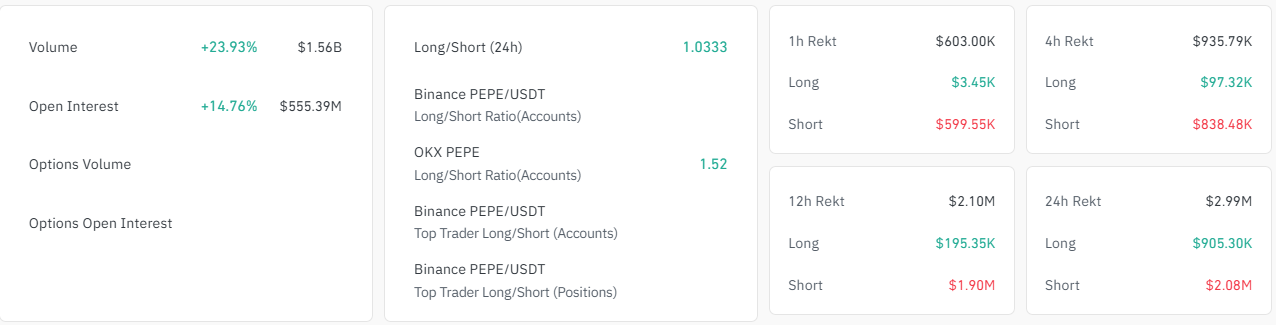

CoinGlass data shows that short positions betting against PEPE’s price surge faced roughly $2 million in liquidations over the past 24 hours. During the same period, long traders also saw losses amounting to about $907,000.

At the same time, open interest in PEPE futures jumped 15%, topping $500 million—a level last seen in January. Open interest measures the total value of active, unsettled futures contracts and is commonly used to gauge market sentiment and trading activity.

PEPE Derivates Market Data. Source:

CoinGlass

PEPE Derivates Market Data. Source:

CoinGlass

This fresh wave of activity, driven by a large investor, reinforces PEPE’s status as a leading digital asset. It also places the token among the most closely tracked meme coin in today’s volatile market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

After Pectra comes Fusaka: Ethereum takes the most crucial step towards "infinite scalability"

The Fusaka hard fork is a major Ethereum upgrade planned for 2025, focusing on scalability, security, and execution efficiency. It introduces nine core EIPs, including PeerDAS, to improve data availability and network performance. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

Decoding VitaDAO: A Paradigm Revolution in Decentralized Science

Mars Morning News | ETH returns to $3,000, extreme fear sentiment has passed

The Federal Reserve's Beige Book shows little change in U.S. economic activity, with increasing divergence in the consumer market. JPMorgan predicts a Fed rate cut in December. Nasdaq has applied to increase the position limit for BlackRock's Bitcoin ETF options. ETH has returned to $3,000, signaling a recovery in market sentiment. Hyperliquid has sparked controversy due to a token symbol change. Binance faces a $1 billion terrorism-related lawsuit. Securitize has received EU approval to operate a tokenization trading system. The Tether CEO responded to S&P's credit rating downgrade. Large Bitcoin holders are increasing deposits to exchanges. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved by the Mars AI model.