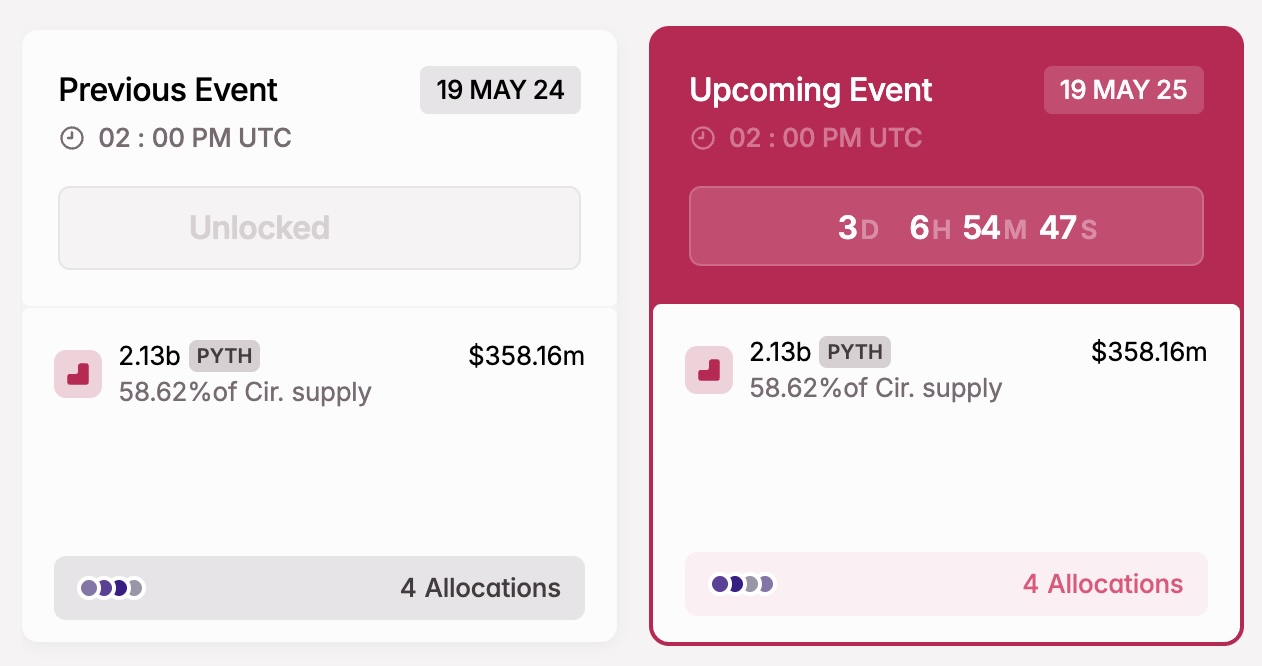

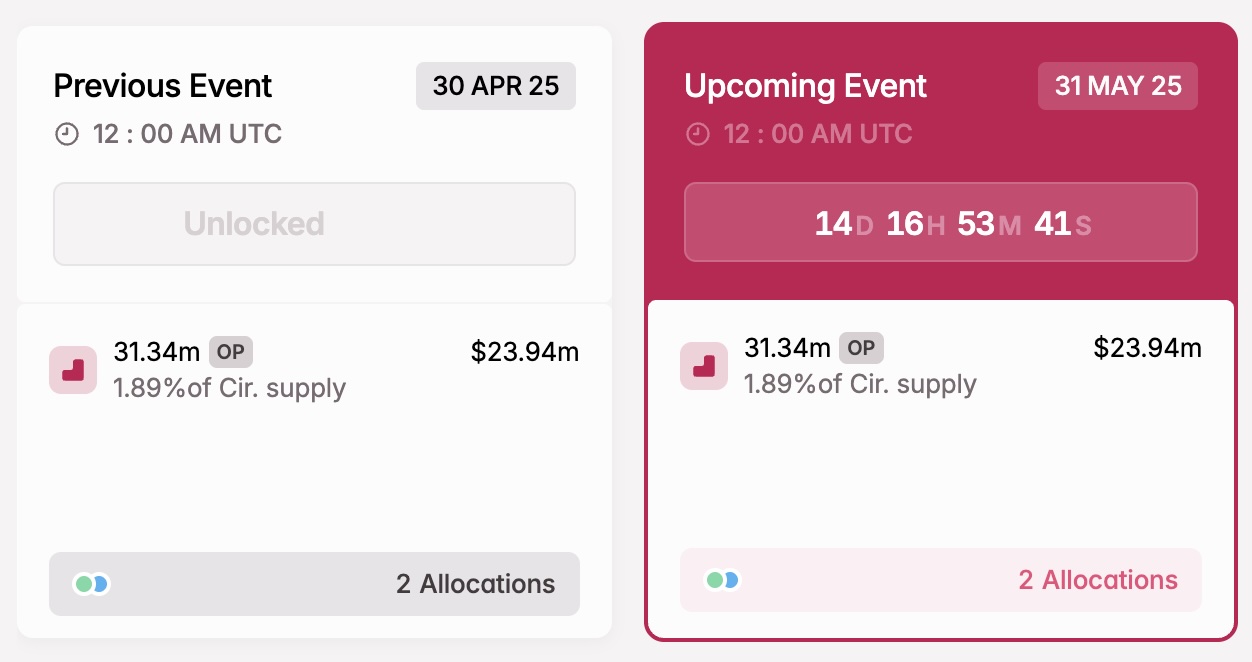

On May 19, Pyth Network (PYTH) will unlock 2.13 billion coins, and on May 31, Optimism (OP) will unlock 31.34 million coins. These unlocks have the potential to significantly increase the circulating supply of both altcoins , potentially causing a major supply shock in the market. According to experts, these unlock events, worth $358 million for PYTH and $23.94 million for OP, are putting trading volumes and derivative positions under pressure. Open interest for PYTH has fallen by 50%, while short positions for OP are rapidly increasing. Technically, PYTH struggles to hold the $0.12 support level, and closing above $0.215 may instill confidence. Meanwhile, OP faces the risk of breaking below $0.50 if it fails to maintain its position within the $0.545–$0.60 range. Overall, without an increase in volume and breakthroughs of key resistances, both altcoins face downward pressure.

Growing Selling Pressure on PYTH Coin

Since peaking at $0.55 in December 2024, PYTH coin has sharply dropped, currently trading around $0.139. The On-Balance Volume indicator remains below previous peak levels, signaling weak buying appetite. However, the Chaikin Money Flow shows a slight positive trend, indicating limited capital inflow. The $0.12 level is a critical support, while $0.215 represents the first threshold that could change the market direction, as it corresponds to the 23.6% Fibonacci retracement level. Overcoming this resistance might squeeze short positions and trigger an upward reaction. Conversely, a move below $0.10 might be considered.

PYTH Coin Opening

PYTH Coin Opening

Caution prevails in the derivatives market. According to Coinglass, total open interest, which approached $80 million in December 2024, has now declined to $40–$50 million. As investors reduce leverage, temporary drops in volatility have been seen, but a volume spike is anticipated with the coin unlock. Historical data suggests that if strong sellers seize the opportunity provided by this new supply, forced liquidations could suppress prices yet again.

Bells Toll for Optimism Altcoin

Optimism has descended from its peak of $2.773 in December 2024 to the current level of $0.632, still trading below all key exponential moving averages. The daily RSI indicator has dropped to 36, nearing the oversold boundary, while the Chaikin Money Flow, at -0.04, indicates ongoing capital outflow. Technically, the $0.545–$0.60 range serves as the final bastion. If lost, the psychological threshold of $0.50 could be tested. A sustained move above $1.071 (the 23.6% Fibonacci level) and reclaiming the $1.4 area would be the initial signs of upward strength.

OP Coin

OP Coin

The picture on the derivatives side for OP is more aggressive. While open interest has decreased from $350 million to $150–$180 million, there has been a noticeable increase in short positions recently. Although the concentration of long liquidations confirms the seller’s control, this accumulation also heightens the possibility of a squeeze if positive news triggers sentiment.

Experts advise investors to manage risks by limiting position sizes and leverage rates in both PYTH and OP coins until the unlock events.