JPMorgan CEO: Tariff Impact Could Still Lead to Recession

On May 15, JPMorgan Chase CEO Jamie Dimon stated that with the ongoing impact of tariffs affecting the global economy, a recession is still possible. In an interview that day, Dimon expressed hope to avoid such a situation, but he would not rule out the possibility at present. If a recession does occur, it is uncertain how severe it would be or how long it would last. Reports indicate that the Trump administration's tariff policies have already shaken the market for over a month. Dimon noted that due to excessive market volatility, some clients are postponing investments.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitunix Analyst: Whale Sell-Off Accelerates, Not Panic Yet but Liquidity Gap Poses Risk

Public Chain Activity Ranking for the Past 7 Days: Solana Remains Firmly at the Top

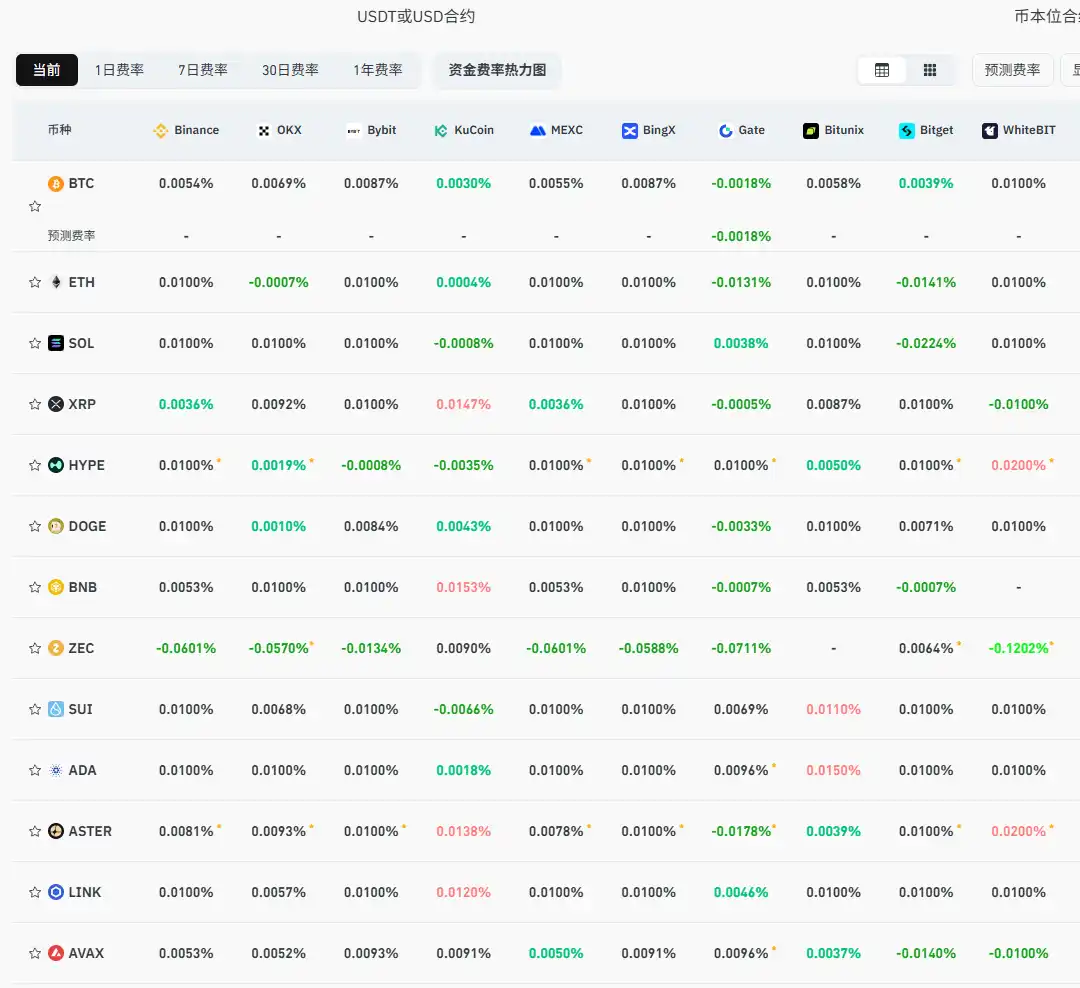

Current mainstream CEX and DEX funding rates indicate that bearish sentiment in the market has weakened.

CoinMarketCap: Launched the decentralized finance index token CMC20