This IOTA Price Rally Could Shock Everyone

After months of sluggish sideways movement, IOTA is finally showing signs of life. In the last 48 hours, momentum has exploded on the charts, with bulls taking full control and pushing prices into levels not seen since early February. With daily and hourly indicators flashing bullish, the question now is whether this IOTA Price move is just the beginning — or if it’s already overheating.

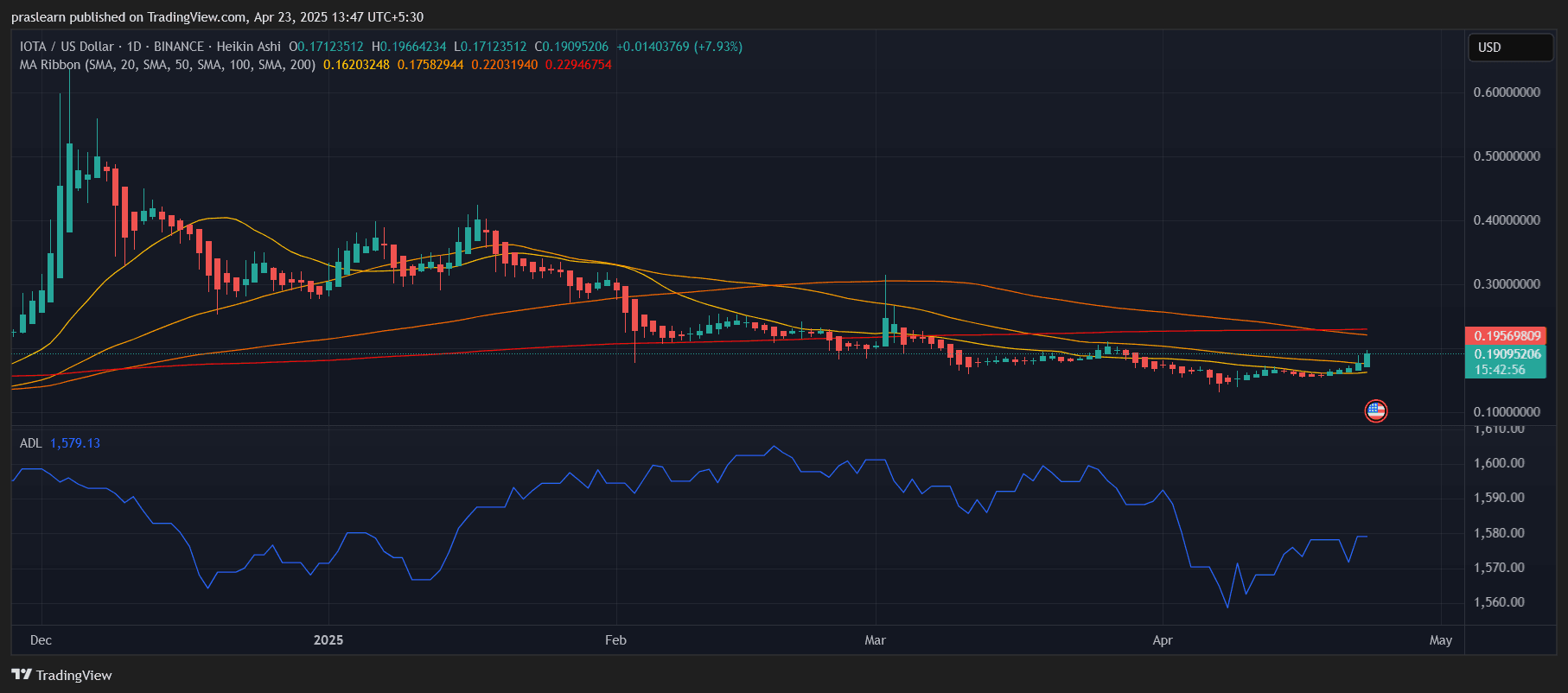

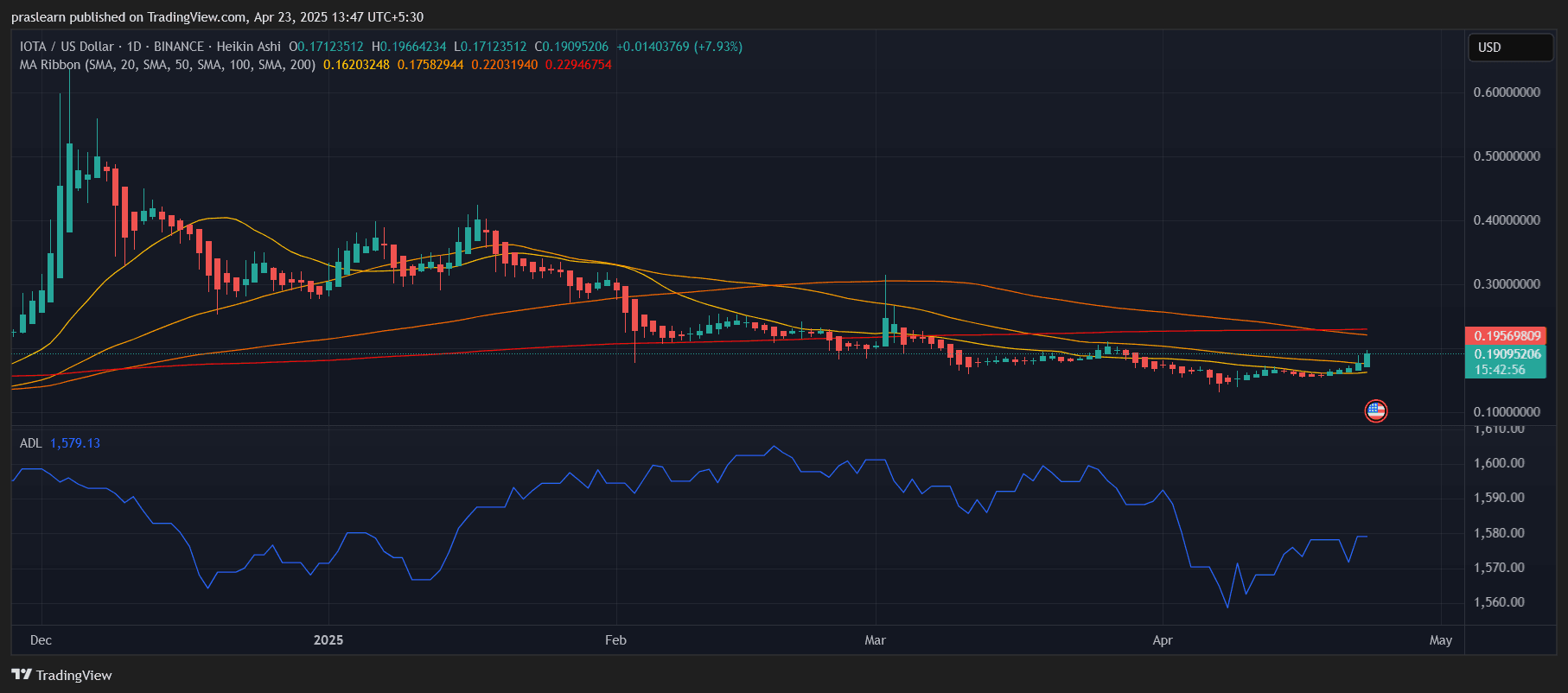

IOTA Price Prediction: Daily Chart Signals the End of a Long Downtrend

IOTA/USD Daily Chart- TradingView

IOTA/USD Daily Chart- TradingView

Looking at the daily chart, IOTA has managed to break above its 50-day and 100-day moving averages, which were long acting as a ceiling during its multi-month downtrend. Price is now trading around $0.19, with a 7.9% gain on the latest daily candle. The key breakout came after the price crossed above the $0.17–$0.18 range, triggering a wave of buying pressure. Volume picked up along with the rising ADL (Accumulation/Distribution Line), now at 1,579.13, confirming demand is coming from strong hands.

With the 200-day MA still overhead at $0.22, a close above $0.20 in the coming sessions could open the door to test that long-term level. If bulls can break and hold above $0.22, IOTA could quickly revisit the psychological zone near $0.25.

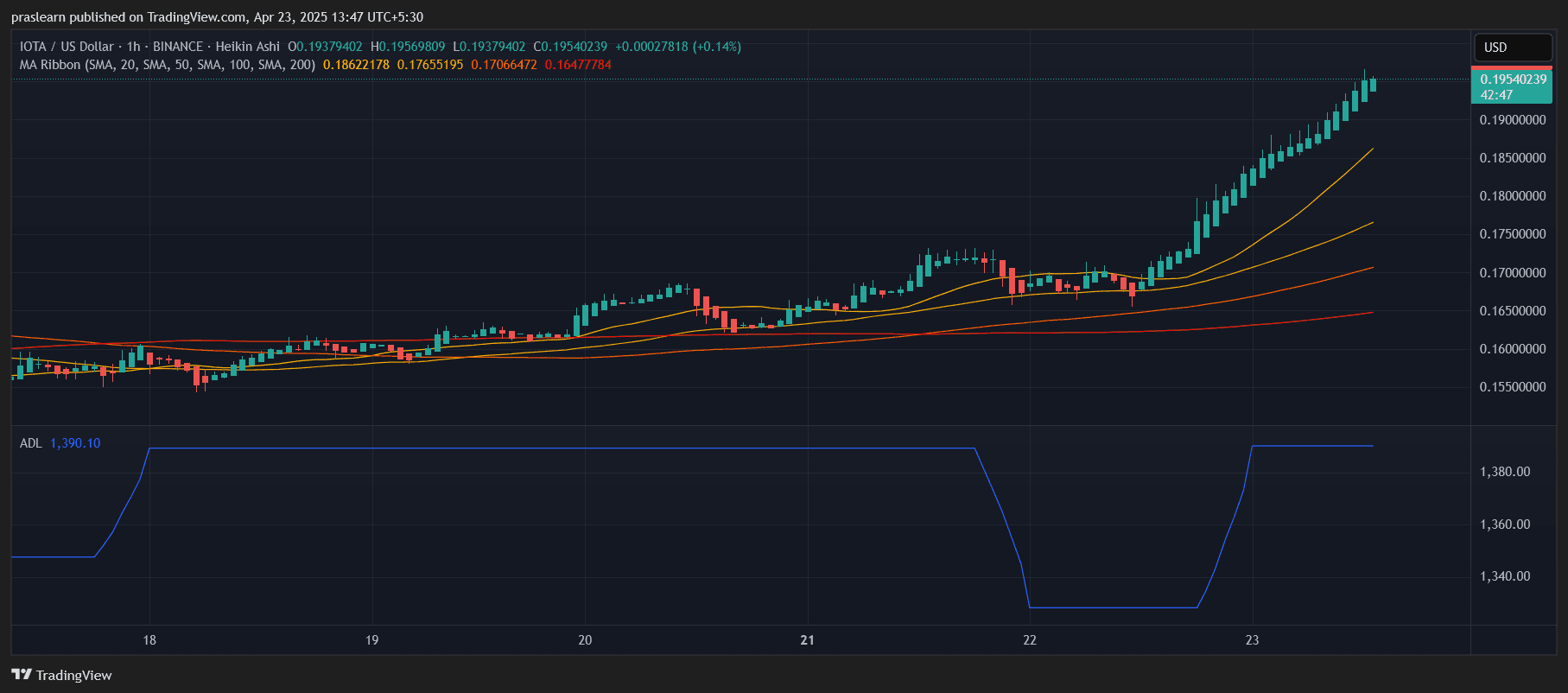

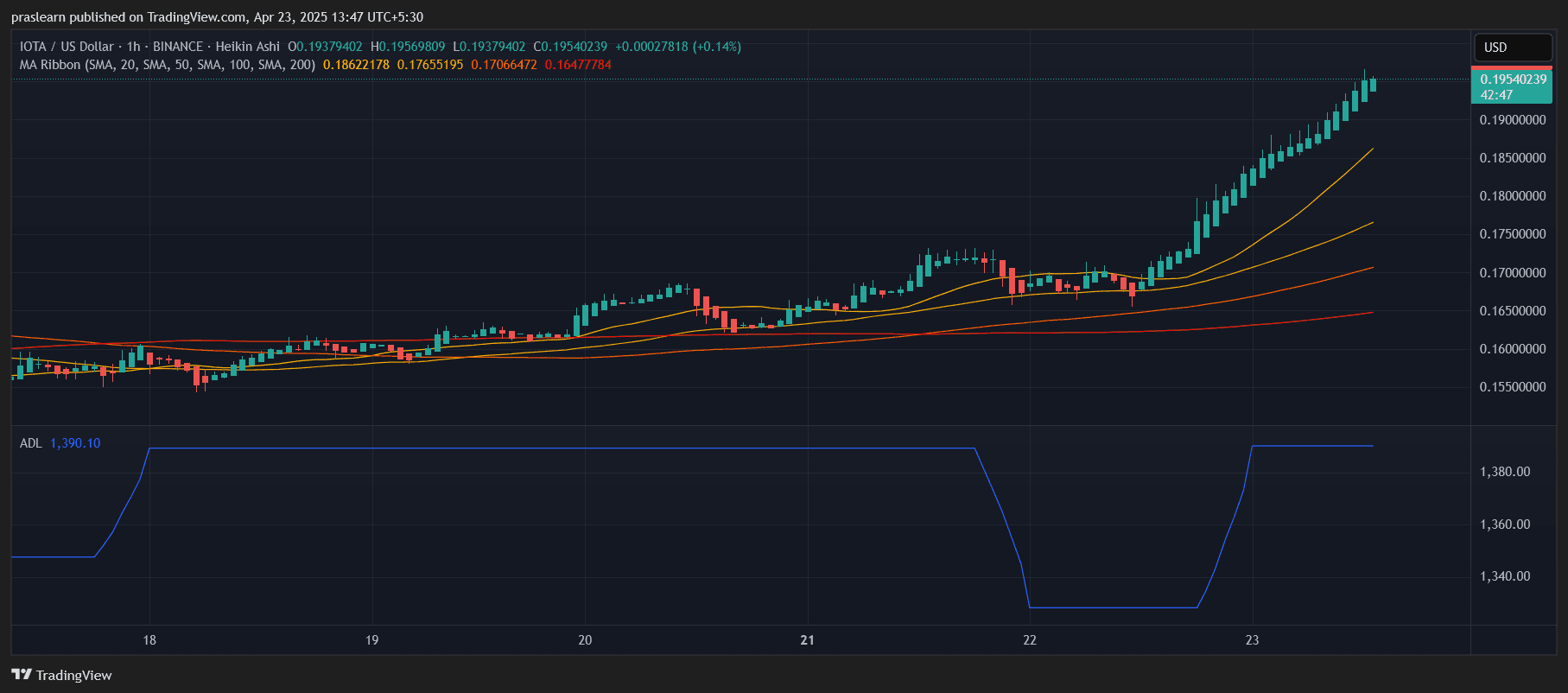

Hourly Chart Shows Parabolic Momentum

IOTA/USD 1 Hr Chart- TradingView

IOTA/USD 1 Hr Chart- TradingView

Zooming into the hourly chart, the rally looks even more aggressive. IOTA price is in a steep upward channel , now trading around $0.195 after a fast-paced climb from $0.17 earlier this week. All key short-term moving averages — 20, 50, 100, and 200 — are sloping upward and stacked in a bullish alignment. This confirms strong upward momentum across short timeframes.

The ADL on the hourly chart jumped to 1,390.10, and the last few candles show tight consolidation, which often precedes another push higher. If this continues, $0.20 becomes the next immediate target. A minor pullback to the $0.185–$0.187 range would be healthy and could offer a second entry for traders eyeing continuation.

Is IOTA Building a New Base for 2025?

What makes this breakout interesting is its timing. Many altcoins are still struggling to regain investor trust, but IOTA appears to be building quiet strength. With enterprise adoption and real-world utility still part of its long-term pitch — particularly in the IoT and data economy sectors — a technical reversal here could catch many off guard.

Assuming broader market stability and Bitcoin doesn’t shock the system, IOTA’s path back to $0.25 seems realistic in the near term. Looking further out, a reclaim of $0.30 would signal a deeper structural trend reversal, especially if paired with rising trading volume and positive sentiment.

IOTA Price Prediction: What Happens Next?

In the short term, IOTA looks poised to test $0.20 . If it breaks above that with volume, the $0.22–$0.25 range becomes the next destination. On the flip side, failure to hold above $0.185 could lead to a retest of the 100-day moving average at $0.17. Still, both momentum and structure favor the bulls for now.

Looking ahead to Q2 and Q3 of 2025, if IOTA continues this trajectory and reclaims the $0.30 zone, it could set up for a high-reward year-end rally — particularly if altcoin sentiment improves across the market.

After months of sluggish sideways movement, IOTA is finally showing signs of life. In the last 48 hours, momentum has exploded on the charts, with bulls taking full control and pushing prices into levels not seen since early February. With daily and hourly indicators flashing bullish, the question now is whether this IOTA Price move is just the beginning — or if it’s already overheating.

IOTA Price Prediction: Daily Chart Signals the End of a Long Downtrend

IOTA/USD Daily Chart- TradingView

IOTA/USD Daily Chart- TradingView

Looking at the daily chart, IOTA has managed to break above its 50-day and 100-day moving averages, which were long acting as a ceiling during its multi-month downtrend. Price is now trading around $0.19, with a 7.9% gain on the latest daily candle. The key breakout came after the price crossed above the $0.17–$0.18 range, triggering a wave of buying pressure. Volume picked up along with the rising ADL (Accumulation/Distribution Line), now at 1,579.13, confirming demand is coming from strong hands.

With the 200-day MA still overhead at $0.22, a close above $0.20 in the coming sessions could open the door to test that long-term level. If bulls can break and hold above $0.22, IOTA could quickly revisit the psychological zone near $0.25.

Hourly Chart Shows Parabolic Momentum

IOTA/USD 1 Hr Chart- TradingView

IOTA/USD 1 Hr Chart- TradingView

Zooming into the hourly chart, the rally looks even more aggressive. IOTA price is in a steep upward channel , now trading around $0.195 after a fast-paced climb from $0.17 earlier this week. All key short-term moving averages — 20, 50, 100, and 200 — are sloping upward and stacked in a bullish alignment. This confirms strong upward momentum across short timeframes.

The ADL on the hourly chart jumped to 1,390.10, and the last few candles show tight consolidation, which often precedes another push higher. If this continues, $0.20 becomes the next immediate target. A minor pullback to the $0.185–$0.187 range would be healthy and could offer a second entry for traders eyeing continuation.

Is IOTA Building a New Base for 2025?

What makes this breakout interesting is its timing. Many altcoins are still struggling to regain investor trust, but IOTA appears to be building quiet strength. With enterprise adoption and real-world utility still part of its long-term pitch — particularly in the IoT and data economy sectors — a technical reversal here could catch many off guard.

Assuming broader market stability and Bitcoin doesn’t shock the system, IOTA’s path back to $0.25 seems realistic in the near term. Looking further out, a reclaim of $0.30 would signal a deeper structural trend reversal, especially if paired with rising trading volume and positive sentiment.

IOTA Price Prediction: What Happens Next?

In the short term, IOTA looks poised to test $0.20 . If it breaks above that with volume, the $0.22–$0.25 range becomes the next destination. On the flip side, failure to hold above $0.185 could lead to a retest of the 100-day moving average at $0.17. Still, both momentum and structure favor the bulls for now.

Looking ahead to Q2 and Q3 of 2025, if IOTA continues this trajectory and reclaims the $0.30 zone, it could set up for a high-reward year-end rally — particularly if altcoin sentiment improves across the market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Aster announces a $10 million trading competition, combined with Stage 4 airdrop and Rocket Launch incentives, driving multi-layered growth in platform depth and liquidity.

After achieving strong performance in Stage 3, Stage 4 (Harvest) airdrop plan was launched, and the “Double Harvest” trading competition with a total reward of 10 million USD will be introduced on November 17.

Mars Morning News | Federal Reserve officials send strong hawkish signals again, December rate cut in doubt

The crypto market has generally declined, with bitcoin and ethereum prices falling and altcoins experiencing significant drops. Hawkish signals from the Federal Reserve have affected market sentiment, and multiple project tokens are about to be unlocked. Early ethereum investors have made substantial profits, and expectations for a continued gold bull market persist. Summary generated by Mars AI. The accuracy and completeness of this summary, generated by the Mars AI model, are still being iteratively improved.

IOTA collaborates on the ADAPT project: Building the future of digital trade in Africa together

IOTA is collaborating with the World Economic Forum and the Tony Blair Institute for Global Change on the ADAPT project. ADAPT is a pan-African digital trade initiative led by the African Continental Free Trade Area. Through digital public infrastructure, ADAPT connects identity, data, and finance to enable trusted, efficient, and inclusive trade across Africa.