ETH vs SOL Showdown: Node War and Infrastructure Moat Behind $587 Billion Staked

However, despite the funding bet having come to the same level, in terms of security, ETH still holds a slight edge.

Original Author: 0xTodd, Partner at Nothing Research

A few days ago, I saw a post saying, "Now that Solana's staking amount has exceeded ETH's staking amount, does this mean that Solana's chain security has surpassed ETH's?" This statement is too misleading, to the point that many people actually believe it.

But that's not the case. Let's look at some data:

The staking data for ETH is 34M ETH, worth around $610 billion; Sol's staking data is 388M SOL, worth around $587 billion.

SOL has indeed reached the same level as ETH, if not slightly below SOL, especially before the recent ETH rebound. (Data source: Beaconcha Solana Beach). Considering that both have a PoS mechanism attack threshold of around 33%, the theoretical attack difficulty seems to be the same.

33% can prevent block production, 51% can create a new longest chain, 67% can execute double spends. But in terms of practical difficulty, attacking ETH is significantly harder than Solana.

P.S.: Of course, assuming the success rate of attacking SOL is 0.001%, the difficulty of attacking ETH might be 0.0001%. Although the difference is significant, it is important to note that both are still highly unlikely events. The reasons for this are (1) node centralization and (2) Staking infrastructure maturity.

I. Node Centralization

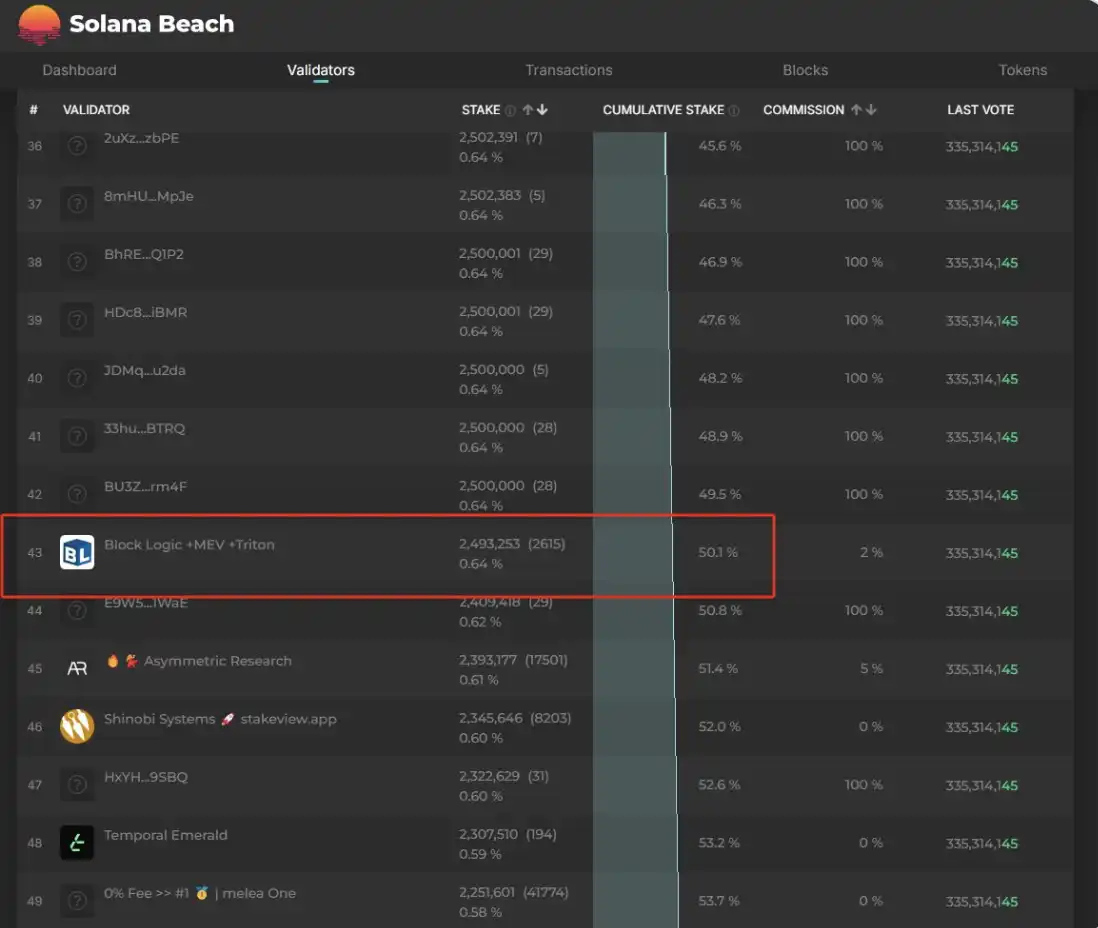

Let's first consider a scenario: imagine a magical hacker who exploits a 0-day vulnerability and successfully compromises Amazon and major cloud service providers' data centers. Then, controlling Solana> 50% requires obtaining the nodes ranked in the top 43 simultaneously. It's challenging but not impossible.

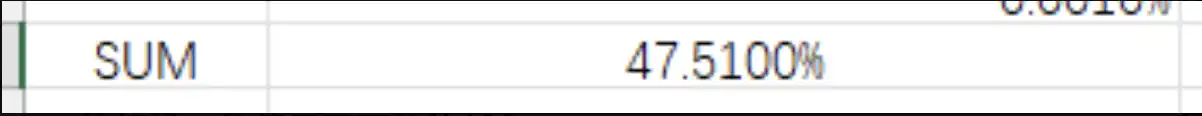

On the other hand, for ETH, with each node staking a maximum of 32 ETH, one would need to acquire 1,187,000 nodes, which sounds like an insurmountable task. Of course, this calculation might seem unfair to Solana because fundamentally, ETH is also operated by numerous node operators. An entity may own tens of thousands of nodes. Yet, based on the current list of node operators on Rated... you will find that all registered ETH node operators combined represent only 47.5%, not even close to reaching the 50% threshold. It remains an impossible task.

The reason is that ETH, as an ancient public chain, has truly experienced an ancient PoS attack and has indeed made a lot of preparations to prevent this potential danger, such as encouraging retail participation in staking. Ethereum's 32 ETH threshold is not high, while Solana has high server requirements, with monthly costs being 5-10 times that of ETH, and this is just the entry level. So, if retail investors want to break even, they need to stake at least 10K SOL or more, and the yield is even lower than Jito's.

II. Infrastructure Maturity

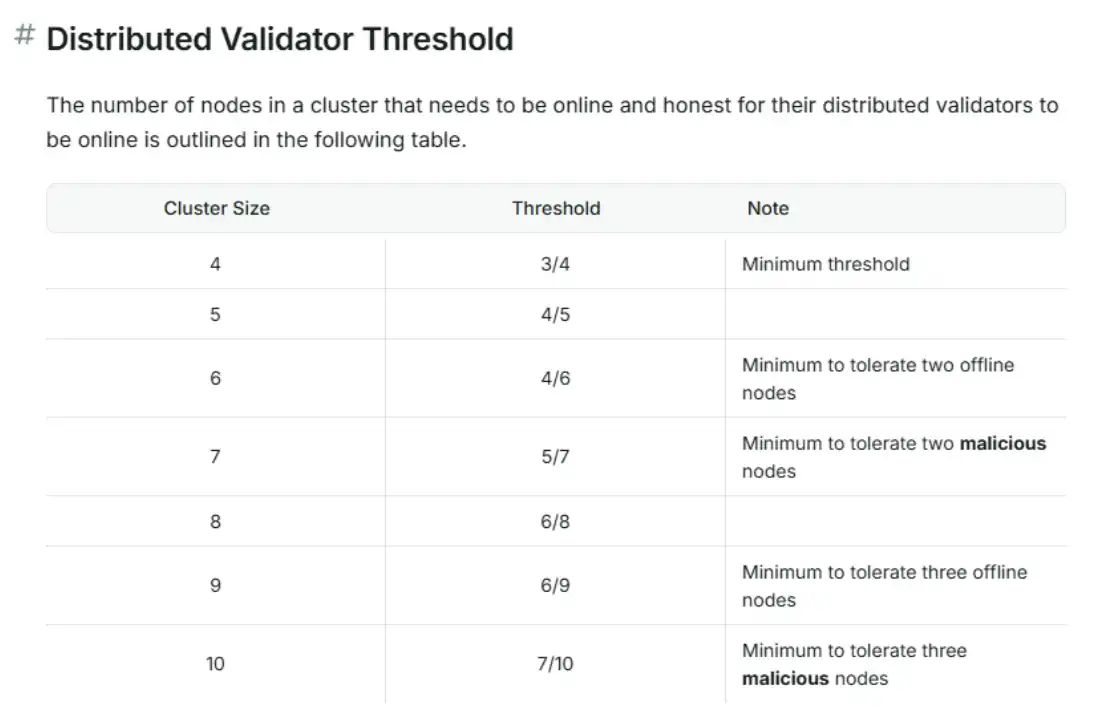

Many ETH staking infrastructures, including @LidoFinance and @Obol_Collective, have also done a lot of homework. For example, Lido requires nodes to use fewer Amazon data centers and more niche data centers. They use fewer mainstream clients and support more niche clients. In addition, Lido specifically allocates 4% of the ETH to support Delegated Proof-of-Stake (DVT) infrastructure such as Obol and SSV. As for Obol, it is DVT technology. You can think of it as your node being collectively managed by a cluster rather than a single entity. For example, if four people manage a node, you can set it as 3/4, so that if one node goes offline, the other nodes can immediately take over. If you set it as 10, then you can set it as 7/10, tolerating a maximum of three nodes offline.

Note: On ETH and most PoS chains, node downtime is also considered a form of malicious behavior. If 33% of nodes go offline, the chain will become paralyzed. Moreover, Obol's uniqueness lies in the fact that it achieves the cluster through a client, so your private key (fragment) will not be uploaded to the chain, making it more secure. This is achieved through DKG (I can share more about DKG later when I have time). Recently, Obol just launched on the mainnet, and those interested can go check it out at @ebunker_eth.

Therefore, infrastructure designed for ETH staking like Obol currently does not exist for Solana. Of course, this is not to praise one and criticize the other; both chains are very secure. However, even though the stakes have reached the same level, in terms of security, due to node concentration and infrastructure maturity, ETH still has a slight edge.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates Today: Bitcoin Faces Challenges Amid Stablecoin Uncertainty and Changing Regulations

- Bitcoin's structural resilience persists amid monthly volatility, driven by evolving regulations, institutional adoption, and shifting market sentiment. - SEC's 2025 regulatory framework aims to streamline crypto oversight, potentially reducing uncertainty and aligning with global standardization efforts. - Tether's USDT stability downgrade raises concerns over Bitcoin's role in reserves, while Arthur Hayes predicts $80k-$250k price swings tied to liquidity and Fed policy. - Infrastructure projects like

Bitcoin News Update: Cryptocurrency Markets Confront Threefold Challenges: Increased Regulatory Oversight, Shifting Corporate Strategies, and Technical Hurdles Hamper BTC Rebound

- Asian markets and crypto assets fell as Japan's BOJ policy shifts drove capital out of equities and digital currencies, with Bitcoin dropping below $82,000. - Tether defended its USDt stablecoin amid S&P's "weak" rating, citing $215B in Q3 2025 assets, but ongoing stability concerns persist in the crypto sector. - Binance faces legal challenges including a Hamas attack-related lawsuit, compounding regulatory risks for crypto exchanges amid compliance scrutiny. - Grayscale's Zcash ETF filing highlights ni

Ethereum News Update: Apeing’s 10x Presale Advantage Depends on Prompt Community Participation

- Apeing ($APEING) presale offers 10x potential gains via early whitelist access, contrasting its $0.0001 presale price with a projected $0.001 listing. - Community-driven projects like FARTCOIN and PEPE demonstrate how cultural relevance and engagement drive meme coin growth, mirroring Apeing's strategy. - Ethereum's gas improvements and XRP's institutional adoption create a favorable market backdrop, supporting speculative meme coin opportunities. - Investors are urged to assess risks despite projected 1

Deciphering the ZKsync Boom: The Impact of Vitalik's Support on Layer 2 Adoption

- Vitalik Buterin's endorsement boosted ZKsync's $ZK token by 143%, signaling growing institutional and retail confidence in ZK rollups. - The Atlas upgrade achieved 43,000 TPS with 70% lower gas fees, attracting Deutsche Bank and UBS for asset tokenization and compliance solutions. - ZKsync trails Arbitrum ($16.63B TVL) but aims to close gaps via privacy-centric design and the upcoming Fusaka upgrade targeting 30,000 TPS. - Institutional partnerships and Ethereum's ZK roadmap position ZKsync as a key play