On April 23, Arthur Hayes stated that while Trump may push for tariff policies again in the future, Bitcoin would not be affected like tech stocks. Due to high debt levels and the difficulty of maintaining deflationary policies, Bitcoin will benefit. He believes the Treasury's debt buyback plan provides liquidity to the market, allowing Bitcoin to find support amidst uncertainty. It is expected that Bitcoin could climb to $200,000 after breaking $110,000, potentially triggering a shift from Bitcoin to other cryptocurrencies, kicking off a new "altcoin season."

Arthur Hayes: BTC May Decouple from Tech Stocks, Could Rise to $200,000 After Breaking $110,000

PANews2025/04/23 07:55

Show original

0

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Earn new token airdrops

Lock your assets and earn 10%+ APR

Lock now!

You may also like

The total number of institutions currently holding Bitcoin has reached 355.

金色财经•2025/11/16 18:54

SOL treasury companies and ETFs hold over 24.2 million SOL, worth approximately $3.44 billion.

BlockBeats•2025/11/16 16:25

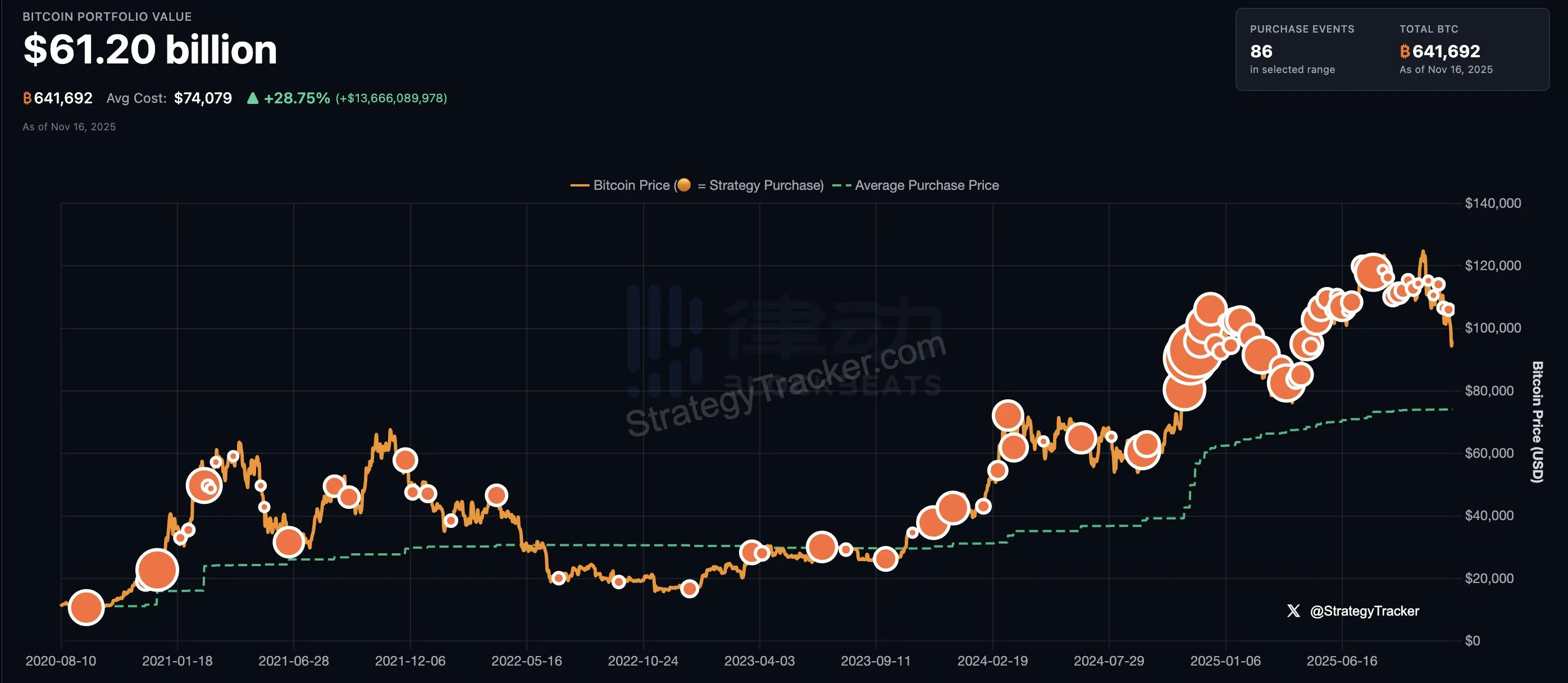

Michael Saylor releases Bitcoin Tracker information again, possibly hinting at another BTC purchase

BlockBeats•2025/11/16 16:22

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$94,300.26

-1.78%

Ethereum

ETH

$3,098.08

-3.34%

Tether USDt

USDT

$0.9995

+0.01%

XRP

XRP

$2.21

-2.34%

BNB

BNB

$921.56

-2.34%

Solana

SOL

$137.07

-3.96%

USDC

USDC

$0.9999

+0.01%

TRON

TRX

$0.2910

-0.69%

Dogecoin

DOGE

$0.1564

-4.48%

Cardano

ADA

$0.4851

-4.64%

How to buy BTC

Bitget lists BTC – Buy or sell BTC quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now