Matrixport: Little Possibility for Overall Altcoin Surge

On April 18, the latest Matrix on Target weekly report pointed out that since the US launched the Ethereum spot ETF, Ethereum's dominance has decreased by nearly 50%. The report states that over the past year, various altcoin narratives have emerged rapidly and disappeared just as quickly, all displaying a "sharp rise followed by a crash" pyramid price structure.

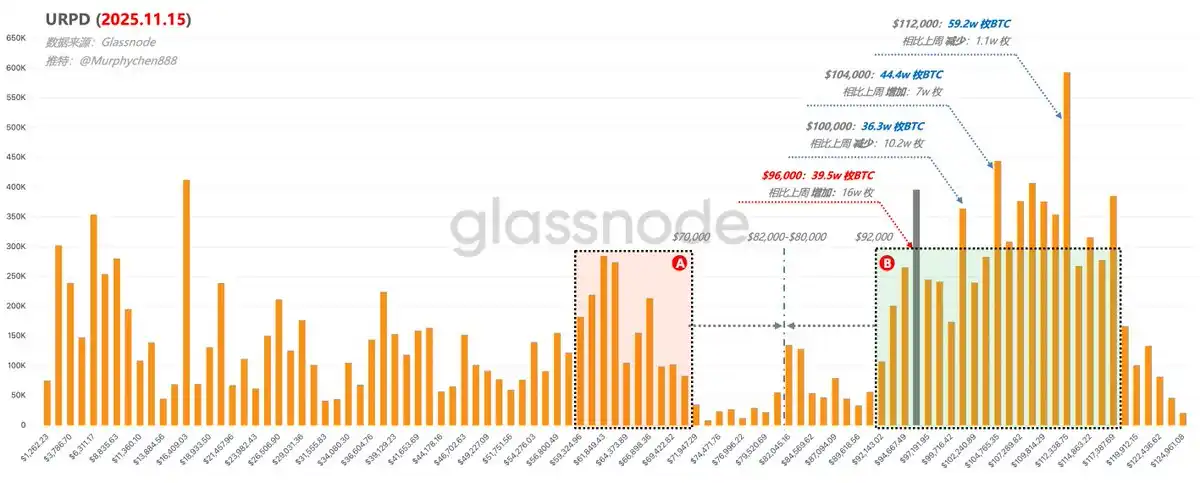

The analysis suggests that Bitcoin may remain in the $80,000 to $90,000 range in the short term, while the probability of a large-scale altcoin surge is low unless three liquidity catalysts occur: dovish signals from the Federal Reserve, growth in stablecoins, or an increase in macro liquidity. The report also points out that, unlike past bear markets, the regulatory risk for Bitcoin has significantly decreased, explaining why its performance during the current adjustment period is better than in previous ones.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

SOL treasury companies and ETF total holdings exceed 24.2 million SOL, equivalent to approximately $3.44 billions

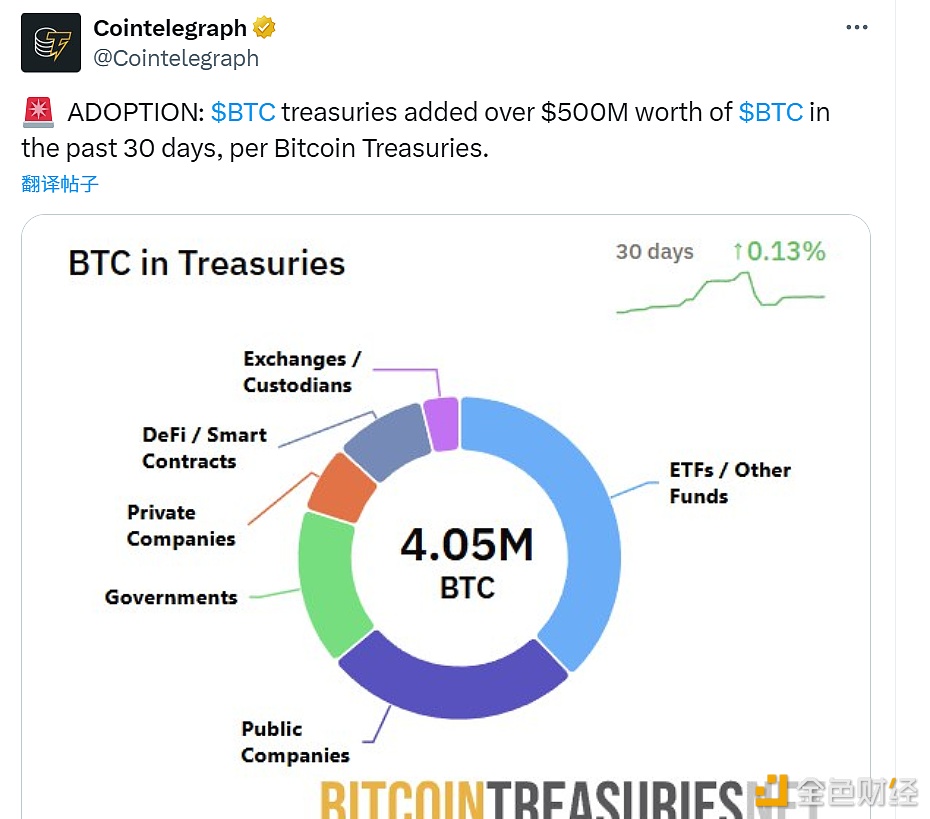

Institutions increased their BTC holdings by over $500 million in the past 30 days

Adam Back: Strategy's leverage ratio is very low, previously only transferred BTC to another custodian and did not sell