Solana Shakes Off 12-Month Lows, Gaining Momentum for a $130 Rally

After hitting a 12-month low, Solana (SOL) is making a strong recovery, climbing 17% to $124.81. With solid support and increasing buying interest, SOL could reach $138.

Solana plunged to a 12-month low of $95.23 on April 7, marking a sharp decline amid broader market turbulence.

However, as the market embarked on a recovery this week, SOL has witnessed a rebound, with its price climbing as demand surges.

SOL Rebounds 17%, Eyes Further Gains

Since SOL began its current rally, its value has soared by 17%. At press time, the altcoin trades at $124.58, resting atop an ascending trend line.

SOL Ascending Trend Line. Source: TradingView

SOL Ascending Trend Line. Source: TradingView

This pattern emerges when the price of an asset consistently makes higher lows over a period of time. It represents an uptrend, indicating that SOL demand is gradually increasing, driving its prices higher. It suggests that the coin buyers are willing to pay more, and it serves as a support level during price corrections.

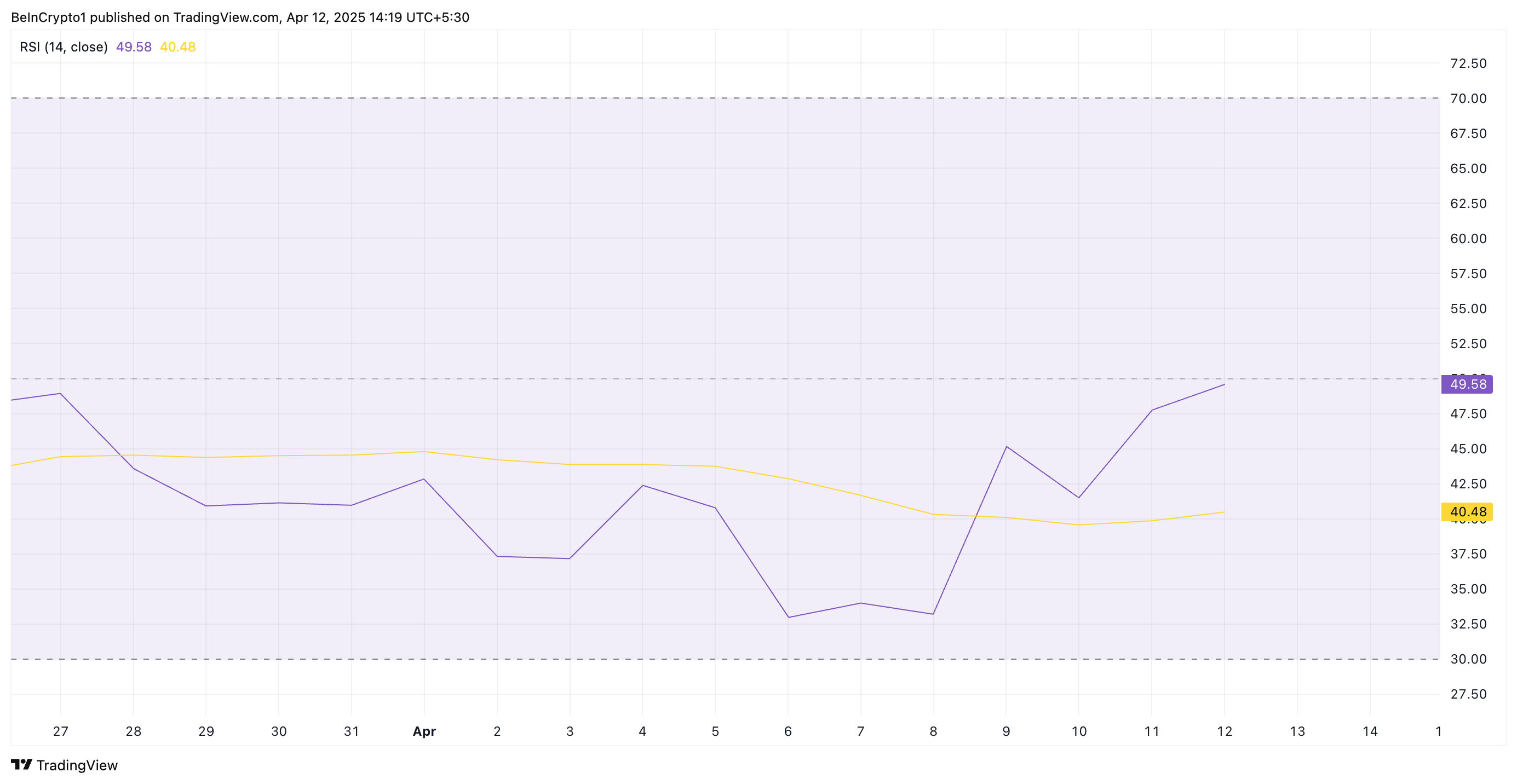

SOL’s recovery is further supported by its rising Relative Strength Index (RSI), indicating increasing buying interest. This momentum indicator is at 49.58 at press time, poised to break above the 50-neutral line.

SOL RSI. Source: TradingView

SOL RSI. Source: TradingView

The RSI indicator measures an asset’s overbought and oversold market conditions. It ranges between 0 and 100. Values above 70 suggest that the asset is overbought and due for a price decline, while values under 30 indicate that the asset is oversold and may witness a rebound.

At 49.50 and climbing, SOL’s RSI signals a steady shift in momentum from bearish to bullish. A rise above 50 would confirm increasing buying pressure and a potential for a sustained upward price movement.

Solana Bulls Eye $138

SOL’s ascending trend line forms a solid support floor below its price at $120.74. If demand soars and the bullish presence with the SOL spot markets strengthens, the coin could continue its rally and climb to $138.41.

SOL Price Analysis. Source: TradingView

SOL Price Analysis. Source: TradingView

However, if profit-taking commences, the support at $120.74 would be breached, and the SOL’s price could revisit $95.23.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Decoding VitaDAO: A Paradigm Revolution in Decentralized Science

Mars Morning News | ETH returns to $3,000, extreme fear sentiment has passed

The Federal Reserve's Beige Book shows little change in U.S. economic activity, with increasing divergence in the consumer market. JPMorgan predicts a Fed rate cut in December. Nasdaq has applied to increase the position limit for BlackRock's Bitcoin ETF options. ETH has returned to $3,000, signaling a recovery in market sentiment. Hyperliquid has sparked controversy due to a token symbol change. Binance faces a $1 billion terrorism-related lawsuit. Securitize has received EU approval to operate a tokenization trading system. The Tether CEO responded to S&P's credit rating downgrade. Large Bitcoin holders are increasing deposits to exchanges. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved by the Mars AI model.

The central bank sets a major tone on stablecoins for the first time—where will the market go next?

The People's Bank of China held a meeting to crack down on virtual currency trading and speculation, clearly defining stablecoins as a form of virtual currency with risks of illegal financial activities, and emphasized the continued prohibition of all virtual currency-related businesses.