-

Bitcoin is at a critical juncture as macroeconomic conditions challenge its recent upward momentum, creating uncertainty for traders.

-

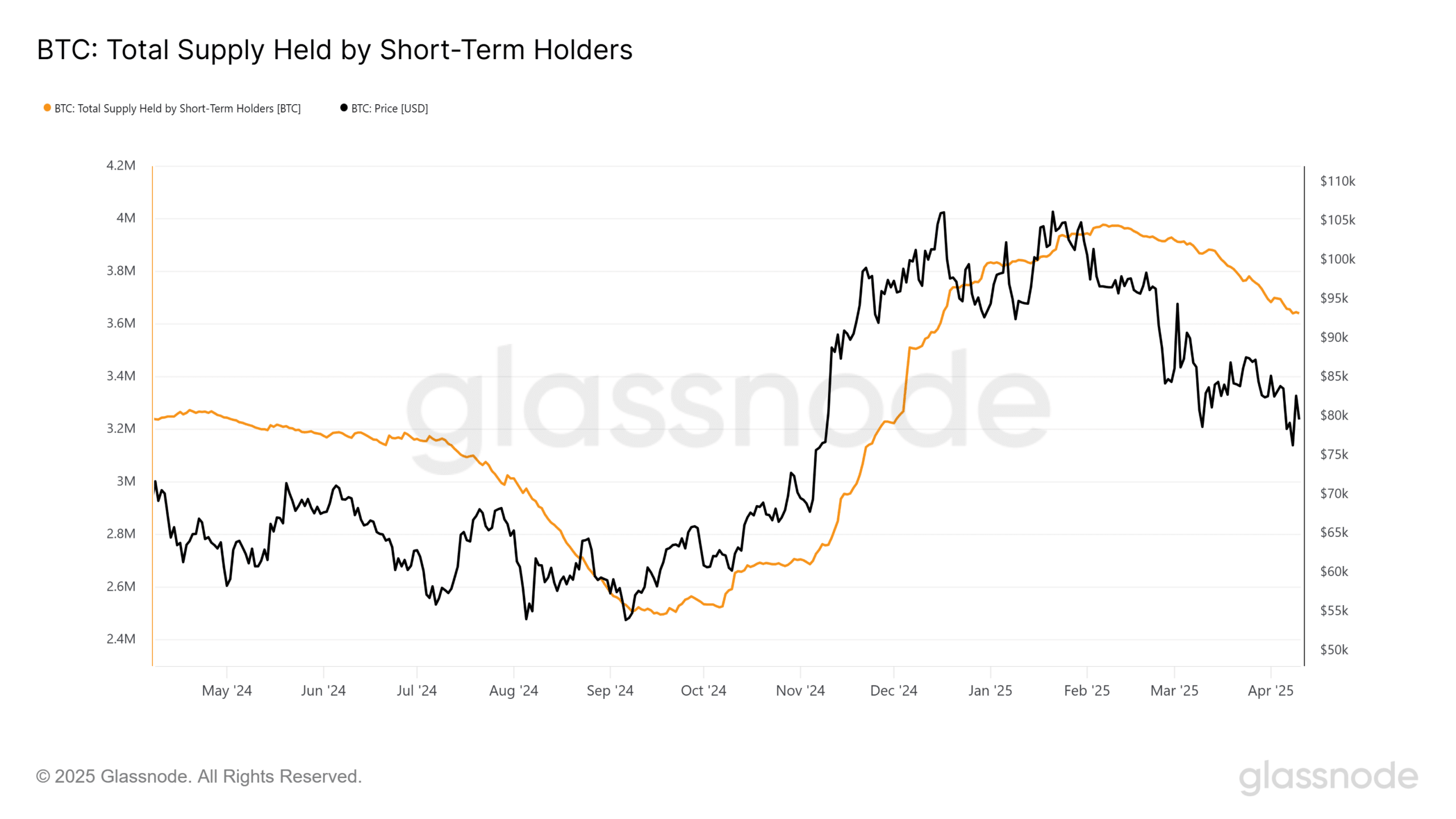

The cryptocurrency’s short-term holders (STHs) are under pressure, with STH supply indicating potential capitulation risks if prices dip further.

-

According to Glassnode, the average realized price for STHs stands significantly higher than the current trading levels, amplifying the risk of forced sales.

Bitcoin faces increasing volatility as macro factors impact market sentiment, with short-term holders at risk of capitulation if price levels falter.

Bitcoin’s STH supply signals capitulation risk

Bitcoin’s short-term holder (STH) supply is nearing a significant turning point. Recently, STH-held Bitcoin reached a four-year high of 400,000 BTC, only to decline to 360,000 BTC, indicating a pattern of net distribution.

This decline coincides with Bitcoin breaching several key support levels, which reflects ongoing sell-side pressure from STHs. As these holders are increasingly concerned, the market dynamics appear precarious.

On-chain data from Glassnode reveals that much of these holdings were amassed at around $93,000. With Bitcoin trading below this realized price, approximately 360,000 BTC sits in an unrealized loss state, raising the likelihood of capitulation.

Critically, the STH realized price rests at $131,000 for upper liquidity and $72,000 for the lower band. A decline to $72,000 would place STHs’ profit margins under significant strain, risking forced liquidations as witnessed historically.

Should Bitcoin linger below $72,000, we may see cascading sell pressure that amplifies drawdowns. Conversely, a recovery above $93,000 could restore confidence among STHs, alleviating supply-side risks and reigniting bullish momentum.

Macro volatility shaking short-term confidence

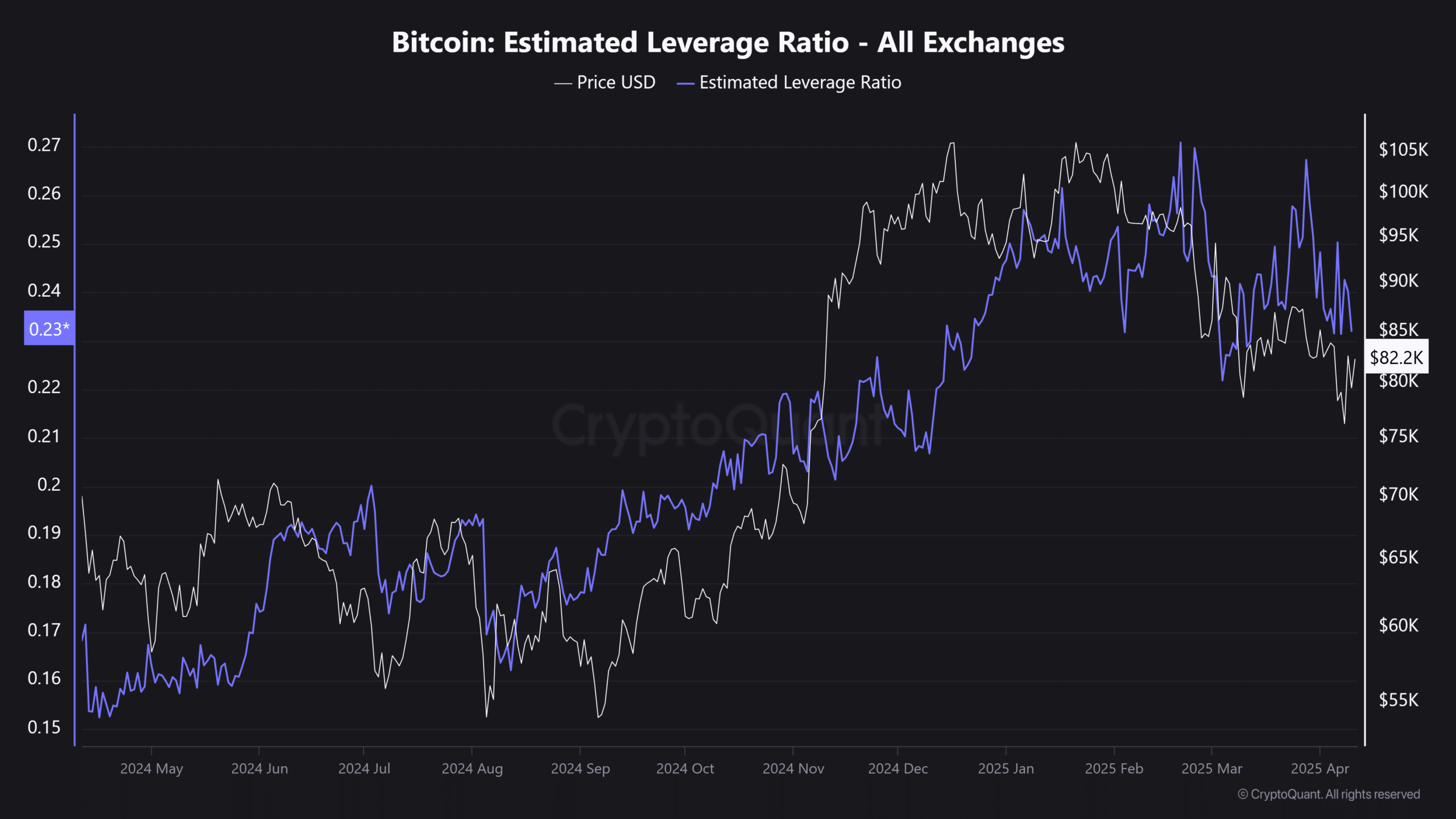

Analyzing Bitcoin from a macro-structural perspective, the cryptocurrency is consolidating below the critical $85,000 resistance level. The pattern of repeated rejections highlights a liquidity zone that, if surpassed, could instigate a wave of short liquidations.

Additionally, Bitcoin’s Estimated Leverage Ratio (ELR) has declined below its early March baseline, indicating a phase of sustained deleveraging among traders. A reduction in high-leverage positions signals that futures traders remain cautious.

Despite these challenges, Bitcoin exhibits resilience. Following the recent macro disturbances associated with tariff announcements, its market cap experienced only a $90 billion contraction—a relatively small flush-out relative to other risk assets.

However, with the Fed unlikely to implement interest rate cuts in the immediate future, macroeconomic uncertainty may compel STHs to exit positions, particularly those who purchased around $93,000. If prices fail to rebound soon, these holders could sell to avoid deeper losses.

With prevailing high levels of fear, minimal speculative demand, and significant resistance levels overhead, a drop to $72,000 appears increasingly plausible before Bitcoin attempts a stable breakout.

Conclusion

In summary, Bitcoin’s recent developments present a mixed outlook as macro pressures and STH responses shape market dynamics. Traders and holders should monitor critical price levels closely, as movements below $72,000 may catalyze selling pressure, while a recovery above $93,000 could restore optimism in the market.