Date: Thu, April 10, 2025 | 04:58 AM GMT

The crypto market is back in rally mode following U.S. President Trump’s surprise announcement of a 90-day pause on tariffs, which sent waves of optimism through global markets. Bitcoin (BTC) jumped 7% and Ethereum (ETH) surged 12% in just a few hours

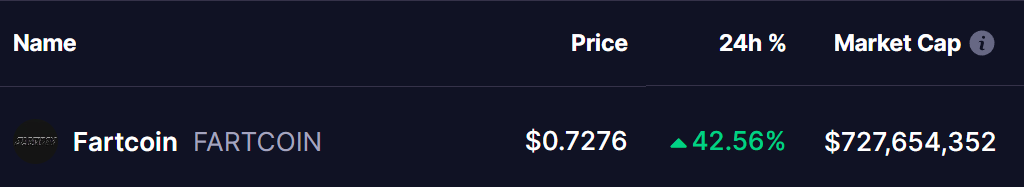

But among the sea of green, FARTCOIN is making the loudest noise—up 42% in a single day and currently topping the gainers list.

Source: Coinmarketcap

Source: Coinmarketcap

Cup and Handle Breakout

On the daily chart, FARTCOIN has successfully broken out of a textbook Cup and Handle formation—a bullish continuation pattern often followed by explosive upside moves. After initially rejecting the neckline resistance at $0.64 back on March 26, the token pulled back into a healthy consolidation phase, forming the “handle” portion of the pattern.

FARTCOIN Daily Chart/Coinsprobe (Source: Tradingview)

FARTCOIN Daily Chart/Coinsprobe (Source: Tradingview)

The key support at $0.35, backed by the 50-day moving average (red line), held strong and provided the launchpad for today’s move.

With the breakout now confirmed above $0.64, FARTCOIN has also broken past the 100-day MA, and is currently trading around $0.72—a significant milestone that signals a shift in momentum.

What’s Next for FARTCOIN?

From here, there are two possible scenarios:

- Retest Scenario – FARTCOIN may revisit the breakout level (~$0.64) to test it as new support before resuming upward movement.

- Momentum Push – If bullish sentiment continues without a pullback, the price may aim for the next resistance zones at $0.90 and $1.15, which represents a potential 78% upside from current levels.

The breakout aligns with increasing volume and a broader memecoin resurgence, suggesting the rally might still have legs—especially with favorable macro triggers like the Trump tariff pause adding fuel.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making any investment decisions in cryptocurrencies.