The U.S. Consumer Price Index (CPI) report for the month of March has been officially released on Thursday, and the inflation rate has decreased to 2.4% compared to the expected 2.6%.

The inflation rate was released by the Bureau of Labour Statistics (BLS) today. While the monthly meeting updates or adjusts the Federal Reserve’s monetary rates, these rates have an immediate impact on the U.S. markets, including the crypto-verse.

As an immediate impact of the announcement, Bitcoin remains stable with sentiments bullish even as market experts predict a surge in altcoins. Fartcoin saw a 34.22% price surge in the past 24 hours.

The US CPI data plays a crucial role in boosting the economic backbone of the nation. Let us now understand the impact of this month’s CPI data on the US market and cryptocurrencies.

Inflation Rate cools down below expectations

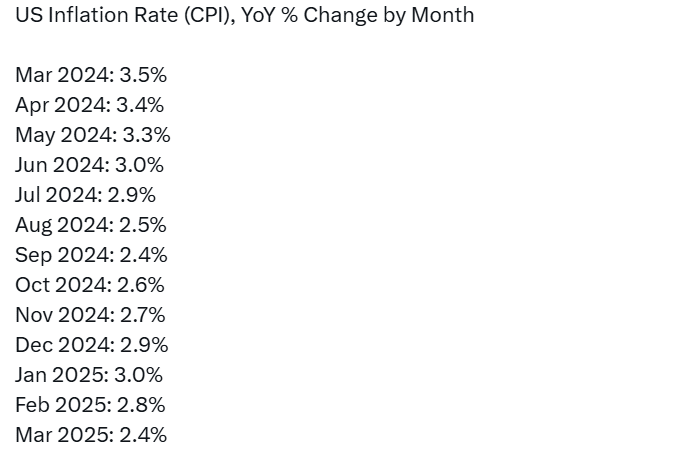

As per the latest reports from Bureau of Labor Statistics , inflation in the United States of America has decreased to 2.4% year-on-year (YoY) in March from 2.8% in February. Reportedly, it has come out as below the expectation of 2.5% by market experts, indicating increased volatility in the market. Following this, the monthly CPI has dropped by 0.4% after recording a decline of 0.2% during February.

Bitcoin & Altcoin Market Reaction!

Following the release U.S. CPI data, the cryptocurrency market has displayed a positive response. Reportedly, the Bitcoin price has stabilized with bullish sentiments and is trading back above the $80,000 level. Following in the footsteps of Bitcoin, the altcoin segment witnessed a similar price action by adding a notable value to their respective portfolios.

Among the top gainers are:

- Fartcoin: 40.62% in 24 hours and is currently trading at $0.7382.

- Flare: 26.94% in 24 hours and is currently listed at $0.01431.

- Among other top gainers are Bittensor, Sonic, Walrus, and Render.

Conclusion

If the bullish sentiments sustain, the price of top crypto tokens could regain momentum and potentially retest their important resistance levels this week. However, considering other political and economic factors, the market is highly volatile at this point. Make sure to do your own research (DYOR) before investing in any digital asset.