Solana’s (SOL) 7% Rally Could Unwind as Traders Bet Against Uptrend

Solana’s recent rally lacks strong demand, with bearish indicators suggesting a potential decline. Traders' sentiment remains predominantly short, signaling a risk of price drops, especially if support levels fail.

Solana has posted a 7% increase in the past 24 hours, aligning with the broader market’s recovery. While this surge may appear promising, technical and on-chain data suggest that the coin could face significant resistance.

Despite the recent rally, SOL risks shedding these gains and could fall below the $100 mark if bearish pressures dominate.

Solana’s Price Surge Lacks Momentum

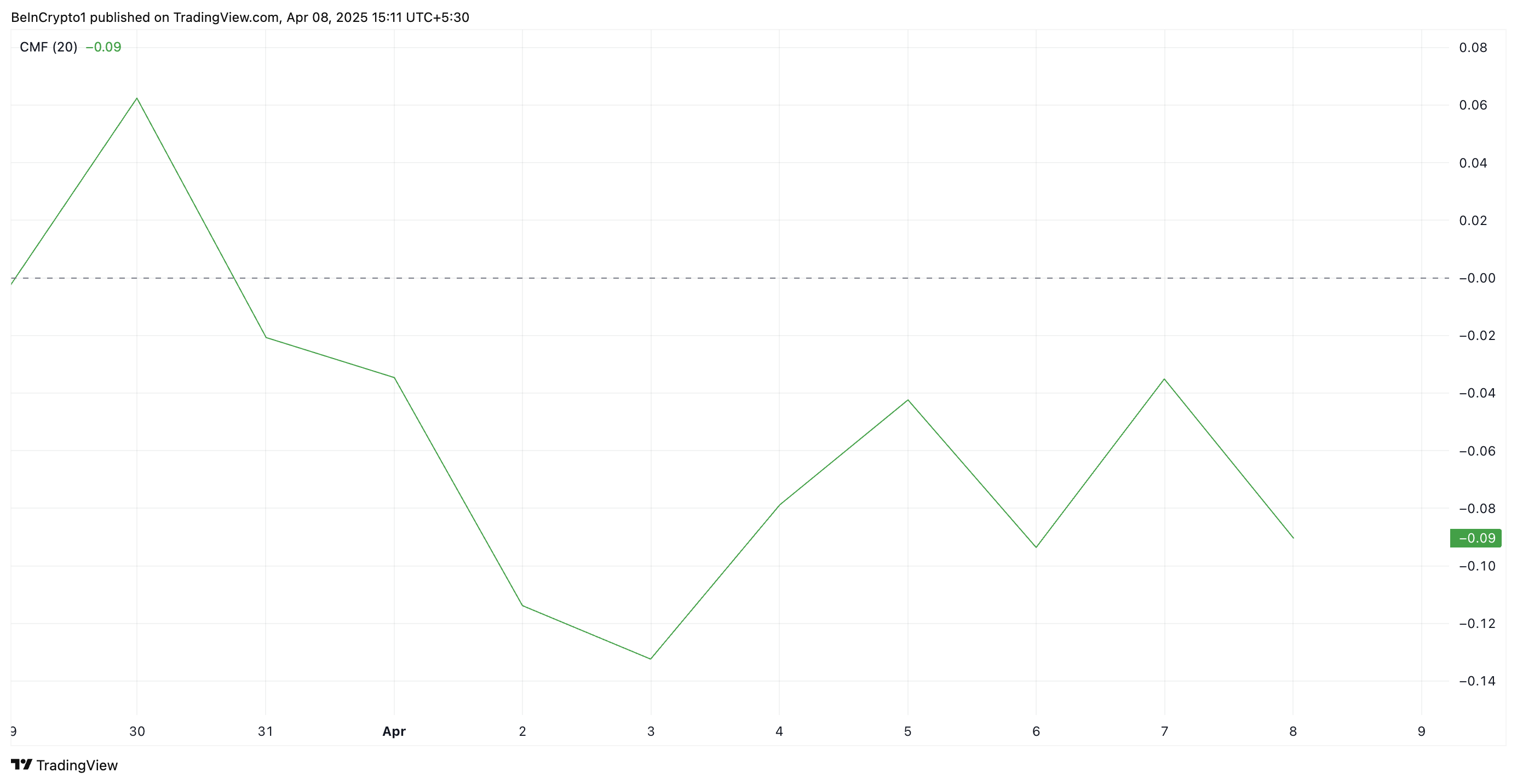

While impressive, SOL’s current rally largely reflects the broader market trend rather than demand for the altcoin. The bearish divergence formed by its Chaikin Money Flow (CMF) shows this.

At press time, SOL’s CMF is below the zero line at -0.09, indicating a lack of buying momentum among SOL market participants.

SOL CMF. Source:

TradingView

SOL CMF. Source:

TradingView

The CMF indicator measures money flow into and out of an asset. A bearish divergence emerges when the CMF is negative while the price is climbing. The divergence signals that despite the upward movement, there is more selling pressure than buying interest, suggesting weak bullish momentum.

This indicates that SOL’s current price rally may lack sustainability and could be at risk of reversing or stalling as new demand remains scarce.

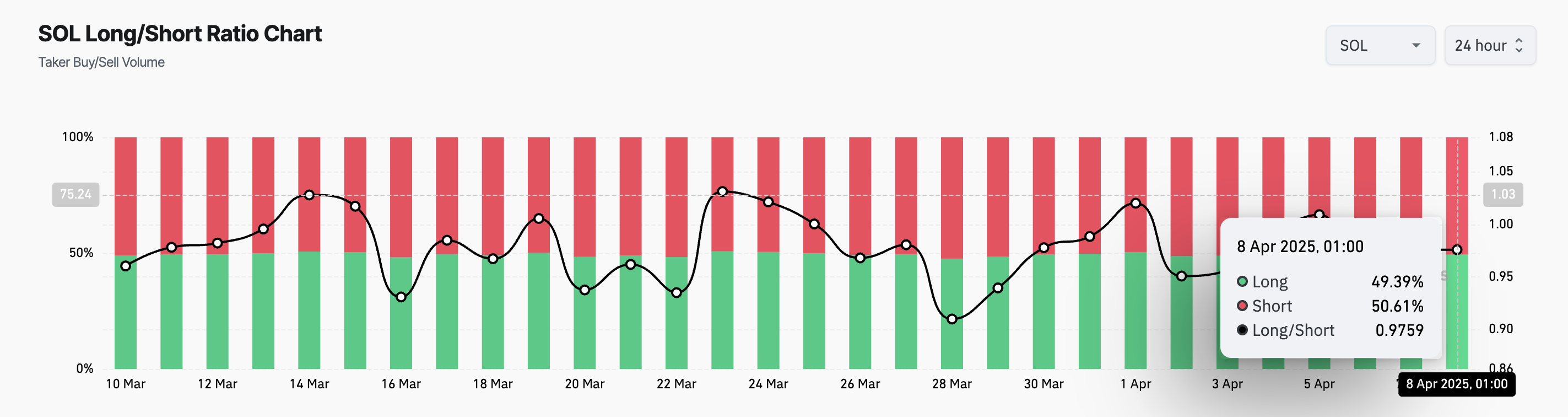

Further, the coin’s long/short ratio highlights that its market participants lean more heavily toward the short side. At press time, this stands at 0.97.

SOL Long/Short Ratio. Source:

Coinglass

SOL Long/Short Ratio. Source:

Coinglass

The long/short ratio measures the balance between long positions (betting on price increases) and short positions (betting on price decreases) in the market. When the ratio is below zero like this, it indicates that there are more short positions than long positions.

This suggests that bearish sentiment remains dominant in the SOL market, and its futures traders are anticipating a decline in the asset’s price.

Solana in Crucial Zone: Will $95 Hold or Lead to a Steeper Decline?

During Monday’s intraday trading session, SOL plummeted to a 12-month low of $95.26. Although it has since rebounded to trade at $108.77 at press time, the lingering bearish bias leaves the coin at risk of shedding these gains.

If SOL witnesses a pullback, it could break below the support at $107.88. If it falls back below $100, the coin’s price could fall toward $79.

SOL Price Analysis. Source:

TradingView

SOL Price Analysis. Source:

TradingView

On the other hand, if the uptrend continues, backed by a surge in new demand, SOL’s price could breach the resistance at $111.06 and climb toward $130.82.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Every country is heavily in debt, so who are the creditors?

As national debts rise, the lenders are not external forces, but rather ordinary people who participate through savings, pensions, and the banking system.

If Bitmain is sanctioned, which American mining company will fall first?

The U.S. government is conducting a stress test on Bitmain, with the first casualties likely to be domestic mining farms in the United States.

Aethir unveils strategic roadmap for the next 12 months, accelerating the construction of global AI enterprise computing infrastructure

Aethir's core vision has always been to drive the realization of universal, decentralized cloud computing capabilities for users worldwide.

Elon Musk Calls Bitcoin a "Fundamental" and "Physics-Based" Currency

Elon Musk stated, "In a future where anyone can have anything, I believe you will no longer need currency as a database for the allocation of labor."