Trump’s trade war pressures crypto market as April 2 tariffs loom

Concerns over a global trade war continue to pressure traditional and cryptocurrency markets as investors brace for a potential tariff announcement from US President Donald Trump on April 2 — a move that could set the tone for Bitcoin’s price trajectory throughout the month.

Trump first announced import tariffs on Chinese goods on Jan. 20, the day of his inauguration as president .

Global tariff fears have led to heightened inflation concerns, limiting appetite for risk assets among investors. Bitcoin has fallen 18%, and the S&P 500 (SPX) index has fallen more than 7% in the two months following the initial tariff announcement, according to TradingView data, TradingView data shows.

“Going forward, April 2 is drawing increased attention as a potential flashpoint for fresh US tariff announcements,” Stella Zlatareva, dispatch editor at digital asset investment platform Nexo, told Cointelegraph.

Investor sentiment took another hit on March 29 after Trump pressed his senior advisers to take a more aggressive stance on import tariffs, which may be seen as a potential escalation of the trade war, the Washington Post reported , citing four unnamed sources familiar with the matter.

The April 2 announcement is expected to detail reciprocal trade tariffs targeting top US trading partners. The measures aim to reduce the country’s estimated $1.2 trillion goods trade deficit and boost domestic manufacturing.

Bitcoin ETFs, whales continue accumulating

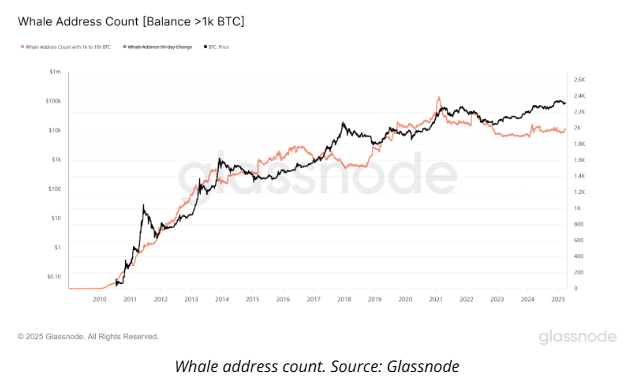

Despite mounting uncertainty, large Bitcoin holders — known as “whales,” with between 1,000 BTC and 10,000 BTC — have continued to accumulate.

Addresses in this category have remained steady since the beginning of 2025, from 1,956 addresses on Jan. 1 to over 1,990 addresses on March 27 — still below the previous cycle’s peak of 2,370 addresses recorded in February 2024, Glassnode data shows.

“Risk appetite remains muted amid tariff threats from President Trump and ongoing macro uncertainty,” according to Iliya Kalchev, dispatch analyst at Nexo, who told Cointelegraph:

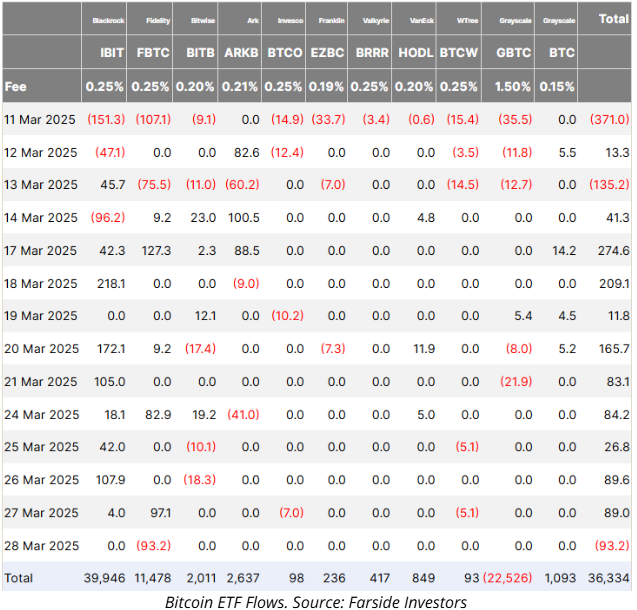

“Still, BTC accumulation by whales and a 10-day ETF inflow streak point to steady institutional demand. But hawkish surprises — from inflation or trade — may keep crypto rangebound into April.”

The US spot Bitcoin exchange-traded funds halted their 10-day accumulation streak on March 28 when Fidelity’s ETF recorded over $93 million worth of outflows, while the other ETF issuers registered no inflows or outflows, Farside Investors data shows.

Despite short-term volatility concerns, analysts remained optimistic about Bitcoin’s price trajectory for late 2025, with price predictions ranging from $160,000 to above $180,000 .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CandyBomb x THQ: Trade futures to share 133,333 THQ!

[Initial listing] Bitget to list Theoriq (THQ). Grab a share of 3,016,600 THQ

CandyBomb x VSN: Trade VSN, XRP or SOL to share 2,931,200 VSN

New users get a 100 USDT margin gift—Trade to earn up to 1088 USDT!