$TRUMP Whale Takes $3.3M Loss, Total Loss Hits $15.7M

- A $TRUMP investor faces a $15.7M loss yet plans another large purchase to recover funds.

- $TRUMP token’s volatility impacts a major investor, resulting in $15.7M in losses.

- The whale sold 743,947 $TRUMP tokens at $10.66 per token, resulting in a loss of $3.3M.

A major $TRUMP cryptocurrency investor suffered another substantial financial loss in their trading activities. The investor sold 743,947 $TRUMP tokens for $7.92 million at an average price of $10.66 per token, incurring a $3.3 million loss on the transaction. The investor now faces a total loss of $15.7 million after their latest trading setback, further adding to their unsuccessful trades. Despite this, the investor is not backing down and is preparing to purchase more tokens in an attempt to recover their losses.

The Investor’s Struggles in the Market

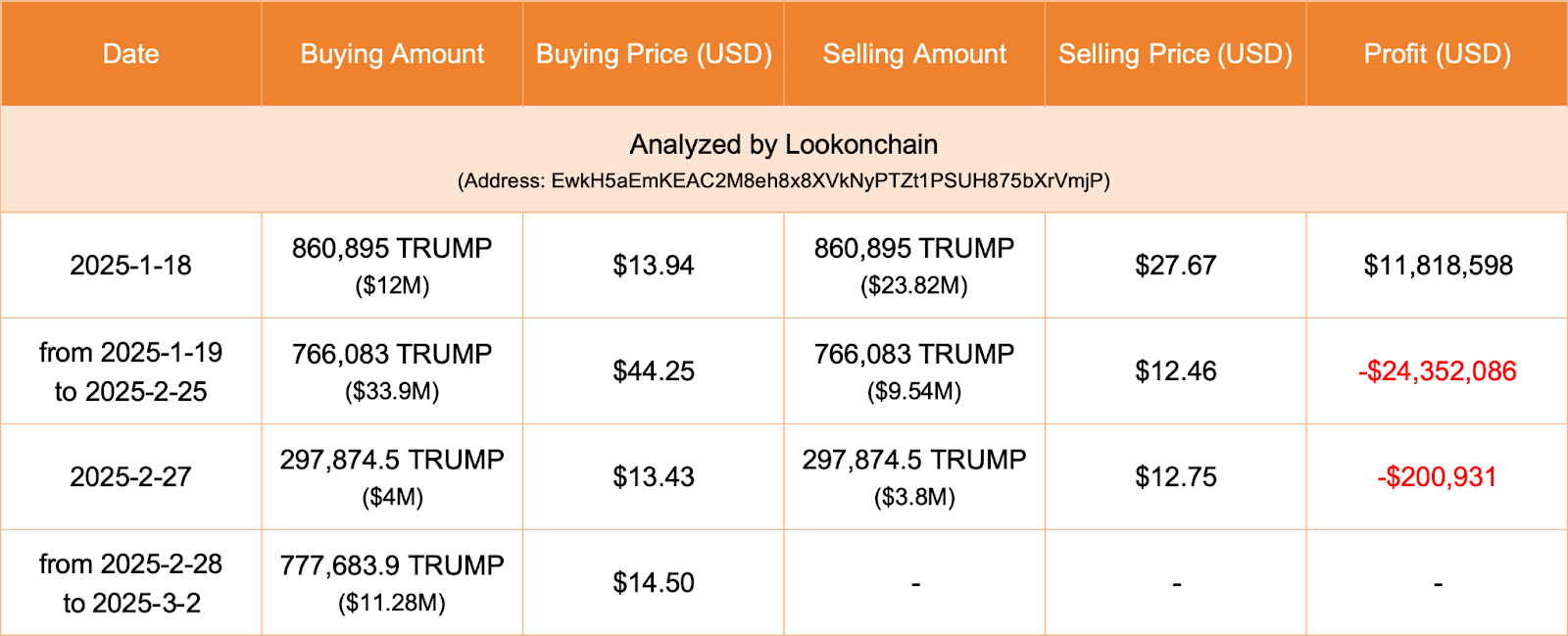

The investor initially made a profit of $11.8 million from their first $TRUMP trade by selling tokens at a favorable price. Subsequent trades turned out to be unsuccessful, causing multiple losses. During their second trade, the investors sustained major financial losses after selling tokens at falling prices. After making the second trade, the whale suffered a loss of $24.35 million and lost an additional $201K on the third transaction.

Despite facing losses, the investor continued trading activities in the market. This trading activity involved selling 743,947 $TRUMP tokens at $10.66, which resulted in a financial loss of $3.3 million.

Future Prospects and Strategy

In early March, the investor purchased 777,684 $TRUMP tokens for $11.28 million at $14.50 per token. While previous trades were unsuccessful, this position suggested they were betting on a price rebound.

Source:

Lookonchain

Source:

Lookonchain

Lookonchain tracks this investor’s strategic moves to determine whether their trading approach proves successful. The $TRUMP token’s high volatility has shown high-risk investment with substantial price swings recorded in its market activity. Future trades will depend on various market conditions and investor sentiment.

The investor’s ongoing strategy of buying $TRUMP highlights the extreme volatility of cryptocurrencies, which can experience sharp price swings. A sufficient market movement should enable the whale to recover some of their previous losses. Large investors, or ‘whales,’ can significantly impact market prices through their trading decisions, influencing smaller traders who often follow their moves.

Related: Trader’s $7M Bet on JELLYJELLY Leads to $1M Loss on Hyperliquid

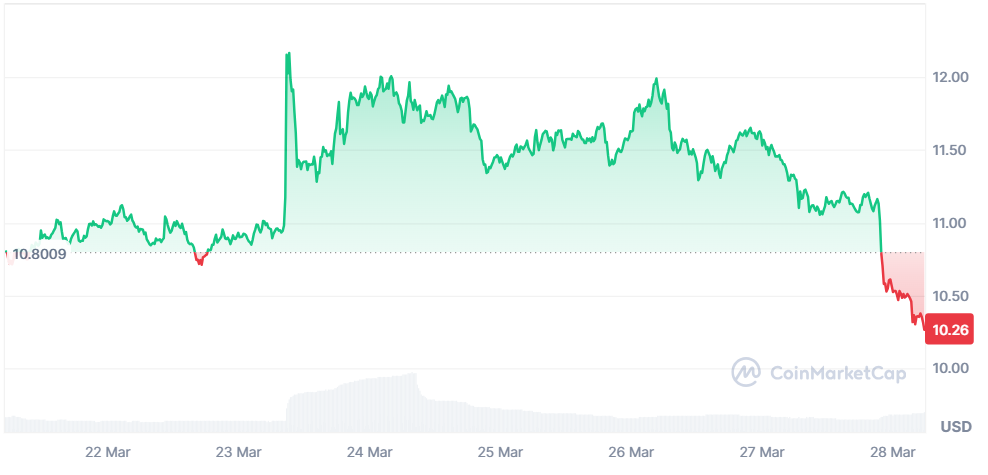

The $TRUMP token has been experiencing notable volatility recently. The daily price chart shows that the price saw a significant spike around March 23, 2025, reaching highs above $11, likely driven by increased trading volume. However, by March 27, the price began dropping to $10.26 at press time.

Source:

CoinMarketCap

Source:

CoinMarketCap

Despite the recent price drop, the token’s trading volume has surged, with a 30.2% increase in the last 24 hours, indicating heightened market activity. The market capitalization currently stands at $2.07 billion, with a circulating supply of 199.99 million $TRUMP tokens. The token’s future price direction will likely depend on whether the market can regain confidence after the recent pullback or if it will continue to face downward pressure.

The post $TRUMP Whale Takes $3.3M Loss, Total Loss Hits $15.7M appeared first on Cryptotale.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

KITEUSDT now launched for pre-market futures trading

Boost Your Liquidity & Earn BTC: Bitget Now Supports BGBTC as Collateral with 2.5% Reward!

Announcement on Suspension of LUNA Network Withdrawal Services

Announcement on Bitget listing NFLXUSDT, FUTUUSDT, JDUSDT, RDDTUSDT, QQQUSDT STOCK Index perpetual futures