Mt. Gox moves 11,502 Bitcoin as price surges above $87,000

Key Takeaways

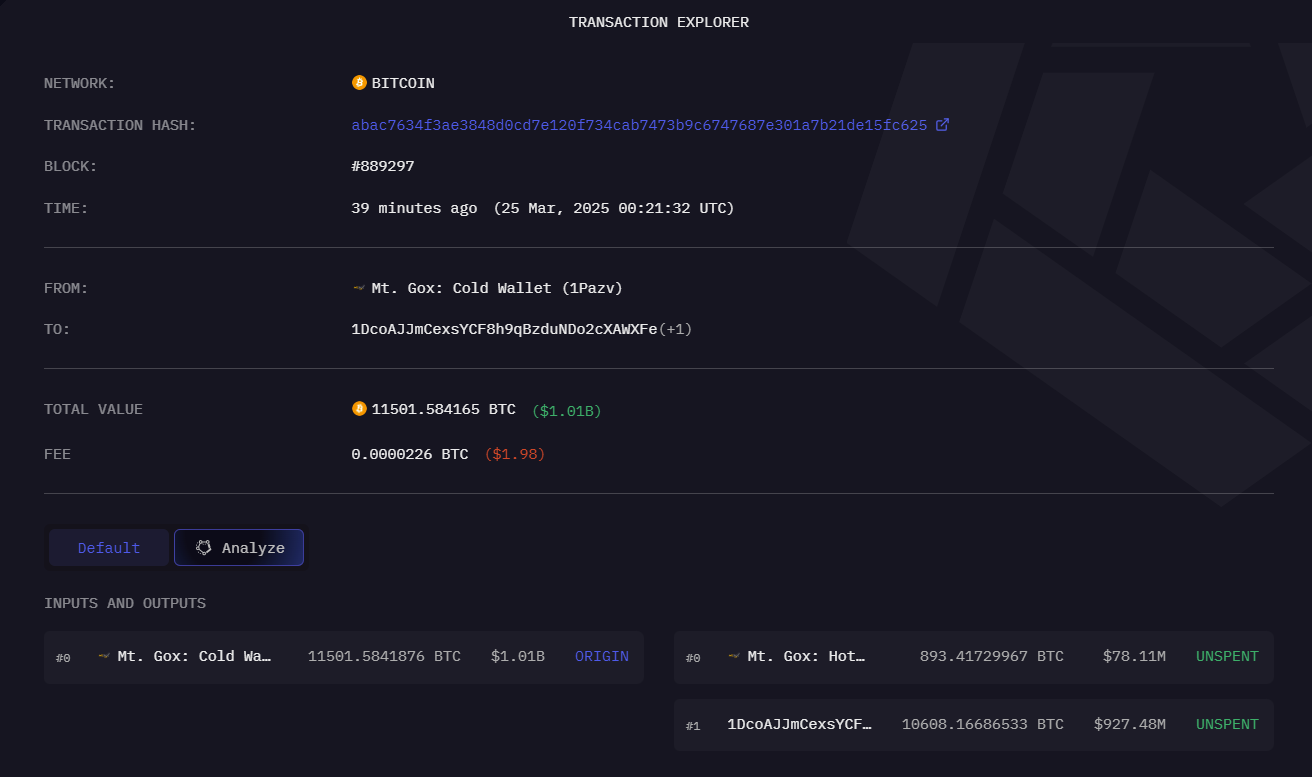

- Mt. Gox moved 11,502 Bitcoin on Monday, valued over $1 billion.

- Bitcoin price surged to $87,000 during the Mt. Gox transaction, although recent transfers have shown minimal market impact.

A Mt. Gox-labeled wallet just moved 11,502 Bitcoin, valued at over $1 billion, in the last hour, according to data from Arkham Intelligence. Of the 11,502 Bitcoin moved, a substantial $927 million was deposited into an unidentified wallet beginning with “1DcoAJ.”

These transfers occurred as Bitcoin’s price reached $87,000, CoinGecko data shows. Bitcoin has seen a 2% increase in value over the past 24 hours.

The defunct crypto exchange still maintains approximately 35,583 Bitcoin in its wallets, worth about $3 billion.

The transaction follows a smaller transfer on March 11, when Mt. Gox moved 332 Bitcoin, valued at approximately $26 million, to an unknown address. The new wallet activity continues to draw attention as the exchange has yet to fully resolve compensation claims from its former users.

Mt. Gox has extended its complete payout deadline from October 31, 2024, to October 31, 2025, citing ongoing verification and processing requirements for claimants.

While some creditors have confirmed receiving fiat currency payments as part of the reimbursement process, many users continue to await their full compensation in Bitcoin or Bitcoin Cash.

Past Bitcoin transfers from major holders like Mt. Gox often caused rapid price fluctuations. However, recent on-chain activity has shown a diminished correlation with market price changes.

The Bhutan government also transferred $63 million worth of Bitcoin to three separate wallets on Monday, as reported by Onchain Lens using Arkham Intelligence data. One of these wallets currently contains 600 BTC valued at approximately $53 million.

Since adopting Bitcoin mining in 2019 utilizing its abundant hydroelectric power, Bhutan’s total crypto holdings now constitute 30.7% of its GDP. While the nation primarily invests in Bitcoin, it also holds small amounts of Ether and other tokens.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Decoding VitaDAO: A Paradigm Revolution in Decentralized Science

Mars Morning News | ETH returns to $3,000, extreme fear sentiment has passed

The Federal Reserve's Beige Book shows little change in U.S. economic activity, with increasing divergence in the consumer market. JPMorgan predicts a Fed rate cut in December. Nasdaq has applied to increase the position limit for BlackRock's Bitcoin ETF options. ETH has returned to $3,000, signaling a recovery in market sentiment. Hyperliquid has sparked controversy due to a token symbol change. Binance faces a $1 billion terrorism-related lawsuit. Securitize has received EU approval to operate a tokenization trading system. The Tether CEO responded to S&P's credit rating downgrade. Large Bitcoin holders are increasing deposits to exchanges. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved by the Mars AI model.

The central bank sets a major tone on stablecoins for the first time—where will the market go next?

The People's Bank of China held a meeting to crack down on virtual currency trading and speculation, clearly defining stablecoins as a form of virtual currency with risks of illegal financial activities, and emphasized the continued prohibition of all virtual currency-related businesses.