3 Altcoins Crypto Whales Are Buying For The Last Week Of March

Crypto whales have been actively accumulating Litecoin (LTC), Uniswap (UNI), and Virtuals Protocol (VIRTUALS) heading into the final week of March.

These three altcoins have all seen a noticeable uptick in large-holder activity over the past few days. Whale accumulation often signals growing confidence and can drive stronger price movements. Here’s a closer look at the key levels and trends shaping each of these altcoins right now.

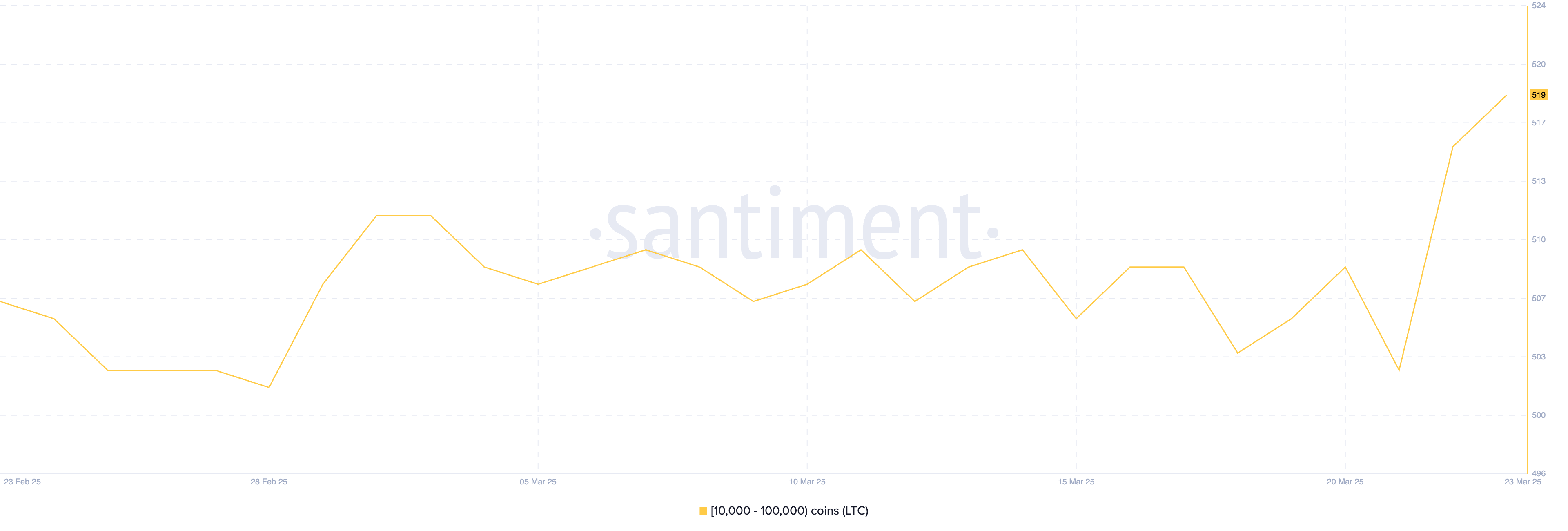

Litecoin (LTC)

The number of Litecoin whales has been climbing in recent days, showing renewed interest from large holders. Wallets holding between 10,000 and 100,000 LTC rose from 503 on March 21 to 519 by March 23, marking a clear uptick in accumulation.

This increase in whale activity could help fuel an uptrend in the coming days. If momentum builds, LTC could test resistance levels at $97.29 and $109. A breakout above these could open the door for a move toward $130 in the next few weeks.

Whale accumulation is often seen as a bullish indicator, as large investors can significantly influence price direction. The recent rise suggests growing confidence in Litecoin’s short-term potential.

However, if momentum fails to materialize, LTC could pull back to support at $87. A drop below this level could see the price fall further to $83, weakening the bullish case.

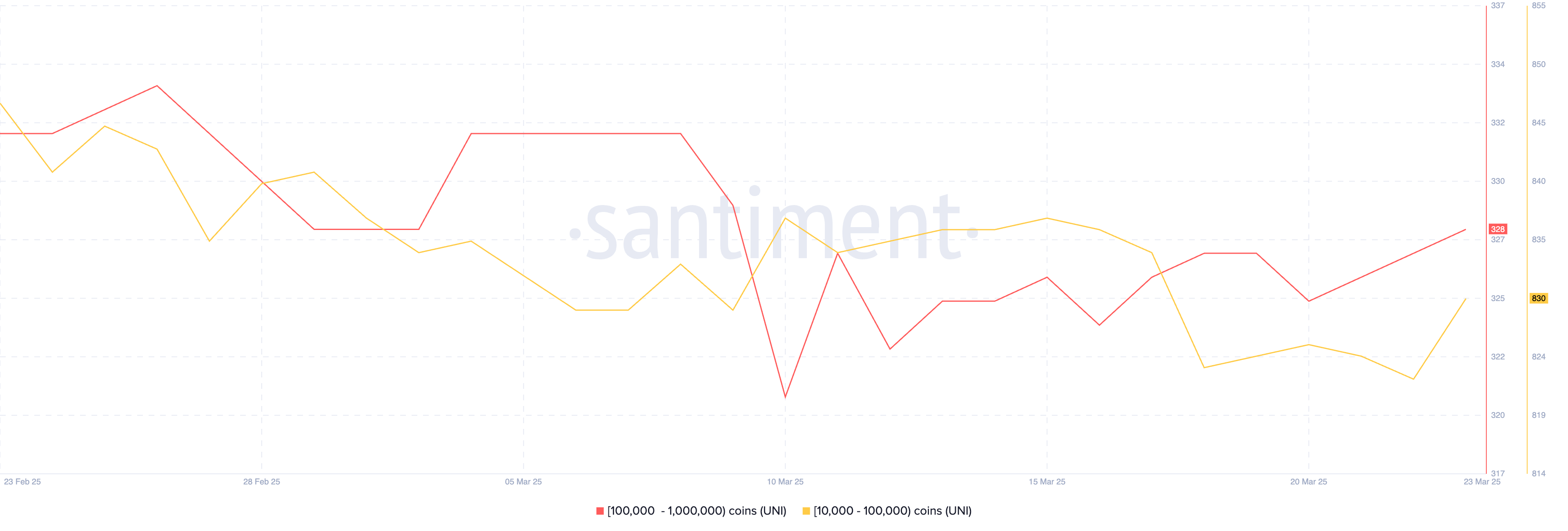

Uniswap (UNI)

Uniswap has recently faced mixed sentiment after backlash over its Unichain Layer 2 mainnet launch. However, sentiment has shifted following the community’s approval of a $165.5 million investment in its ecosystem.

In the past few days, crypto whales have been accumulating UNI. Between March 20 and March 23, the number of wallets holding between 10,000 and 1,000,000 UNI rose from 1,151 to 1,158, signaling renewed interest from large investors.

If bullish momentum continues, Uniswap price could test resistance levels at $7.69 and $8.33. A breakout above these could push the price further to $9.64.

On the downside, if momentum fades, UNI could retest the $6.82 support. Losing that level could open the door for declines toward $5.97 and even $5.50.

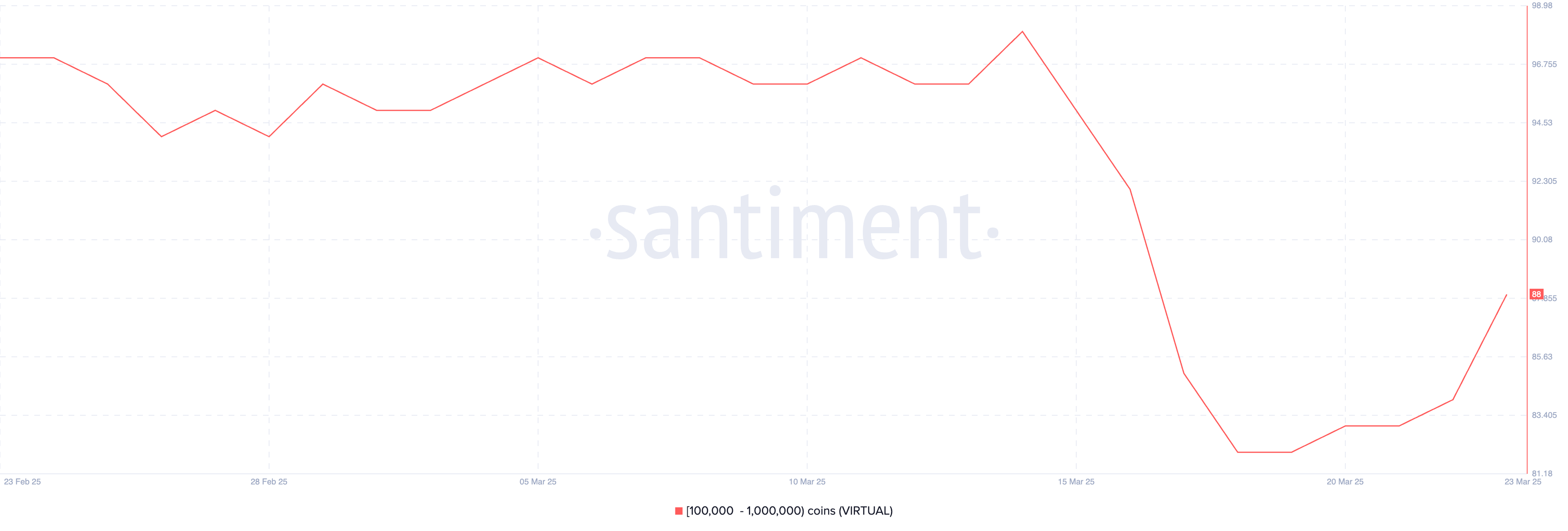

Virtuals Protocol (VIRTUALS)

VIRTUALS has seen a notable increase in whale activity after hitting its lowest levels in months. In the past few days, addresses holding between 100,000 and 1,000,000 VIRTUALS have grown from 82 to 88.

If the AI crypto sector rebounds, VIRTUALS could benefit strongly. The token could test resistance at $0.97, and if broken, rise above $1 to target $1.24 and $1.49.

Whale accumulation could help fuel this move if broader sentiment across crypto AI agents improves.

However, if the sector’s correction continues, VIRTUALS could retest support at $0.80. A deeper drop could push it down to $0.51, and falling below $0.50 would mark the lowest price since November 2024.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Vitalik's Long Article: The Exit Game of EVM Validiums and the Return of Plasma

Plasma allows us to completely bypass the data availability issue, significantly reducing transaction fees.

Market value evaporates by 60 billions! Faith shaken, institutions on the sidelines—has bitcoin’s “post-halving crash” curse come true?

A major reason for the recent plunge is market concerns over a repeat of the "halving cycle"—that is, after a supply reduction triggers a boom, a deep correction inevitably follows. Panic selling by investors, combined with a stagnation of institutional funds and macroeconomic headwinds, have collectively led to a collapse in market confidence.

SharpLink and Upexi: Each Has Its Own Strengths and Weaknesses in DAT

For this model to be sustainable, one of the following two scenarios must occur: either staking truly becomes a corporate cash engine, continuously providing funds for digital asset purchases; or companies must incorporate the planned sale of digital assets into their digital asset strategies to achieve systematic profits.

80% is hype? Six major red lines reveal the true intentions of Stable

It appears to be an infrastructure upgrade, but in essence, it is an early, insider-friendly issuance.