Bitcoin Bull Cycle Over? CryptoQuant CEO Warns of Possible Bearish Trend

- End of Bitcoin's bull cycle?

- Bearish trend for BTC.

- Market indicators point to a decline.

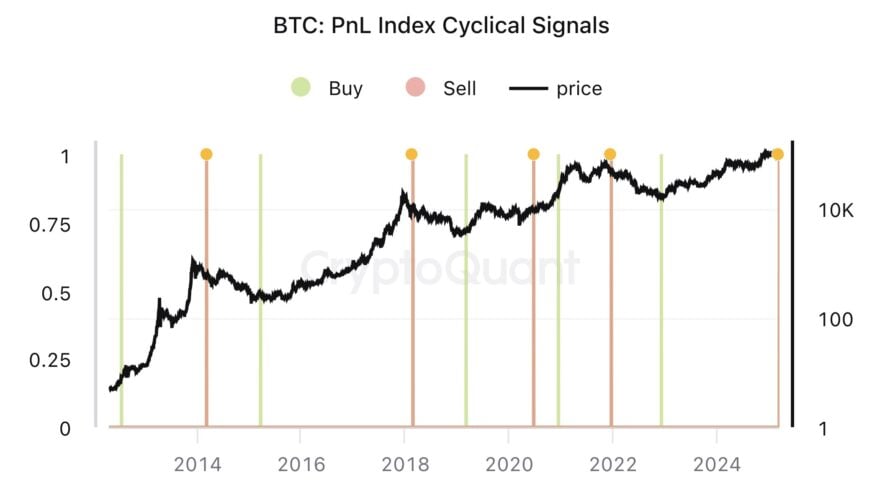

CryptoQuant CEO Ki Young Ju stated today, March 18, that the bull cycle of Bitcoin (BTC) is over. The forecast points to a possible downtrend or sideways trend in the next 6 to 12 months, marking a significant change in the landscape for Bitcoin investors and enthusiasts.

“Bitcoin’s bull cycle is over, with 6-12 months of bearish or sideways price action expected,” wrote in a shared analysis on the X platform.

Source: CryptoQuant/Ki Young Ju

Source: CryptoQuant/Ki Young Ju

The forecast comes after a period of strong growth for Bitcoin, which reached new all-time highs in January 2025 and attracted significant institutional interest. However, indicators such as the decline in inflows into Bitcoin exchange-traded funds (ETFs) as well as metrics based on realized capitalization are suggesting a reduction in market liquidity, signaling a possible reversal of the bullish trend for the largest cryptocurrency, as highlighted by the expert in his technical analysis.

“I’ve been predicting a bull market for the past two years, even when the metrics were borderline bearish. Sorry to change my mind, but it now seems pretty clear that we’re entering a bear market. Realized cap-based metrics show a lack of new liquidity. The massive volume around 100k failed to lift the price, and ETF inflows have been negative for three weeks in a row. I can’t keep sharing my hopes when the data keeps signaling bearish. I’m not going to sell BTC and still hold my position,” he added.

At the time of publication, the price of Bitcoin was quoted at US$81.691,54, down 1.6% in the last 24 hours.

Despite correction, Bitcoin leads global market after Trump election

Despite recent corrections in the cryptocurrency market, the largest crypto asset, Bitcoin (BTC), has demonstrated remarkable resilience, overcoming the performance of other major global assets such as stocks, U.S. Treasuries and precious metals, according to market data shared today.

This performance occurs even in a period of volatility, marked by a 23% correction in relation to its historical high recorded on January 20, the day of the inauguration of US President Donald Trump.

Thomas Fahrer, co-founder of Apollo Sats, shared data from Bloomberg that confirms Bitcoin’s superiority over other market segments, including real estate. “Even with the pullback, Bitcoin still outperforms all other assets post-election. Pure alpha,” Fahrer said in a post on X on March 18.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Weekly Crypto Market Watch (11.10-11.17): Extreme Market Panic, Privacy Sector Stands Out

Last week, both the open interest and trading volume of altcoin contracts on exchanges declined, reflecting a continued lack of liquidity following the sharp drop on October 11.

Multiple grand rewards are coming, TRON ecosystem Thanksgiving feast begins

Five major projects within the TRON ecosystem will jointly launch a Thanksgiving event, offering a feast of both rewards and experiences to the community through trading competitions, community support activities, and staking rewards.

Yala Faces Turmoil as Stability Falters Dramatically

In Brief Yala experienced a dramatic 52.9% decline, challenging its stability. Liquidity management emerged as a critical vulnerability in stablecoins. Investor skepticism deepened despite major fund support.