Bitcoin’s recent price struggles have sparked a divide among crypto experts. While some predict a shift toward bearish sentiment and anticipate months of decline or stagnation, others remain confident the rally still has room to grow.

Metrics Signal Bearish Outlook

CryptoQuant CEO Ki Young Ju declares Bitcoin’s bull cycle dead, forecasting up to 12 months of decline.

In a recent post on X, Ki warns all on-chain metrics point to a bear market as liquidity dries up and whales sell Bitcoin at lower prices.

Sponsored

“The data keeps signaling bearish,” he says.

Weak Demand and Fading Accumulation

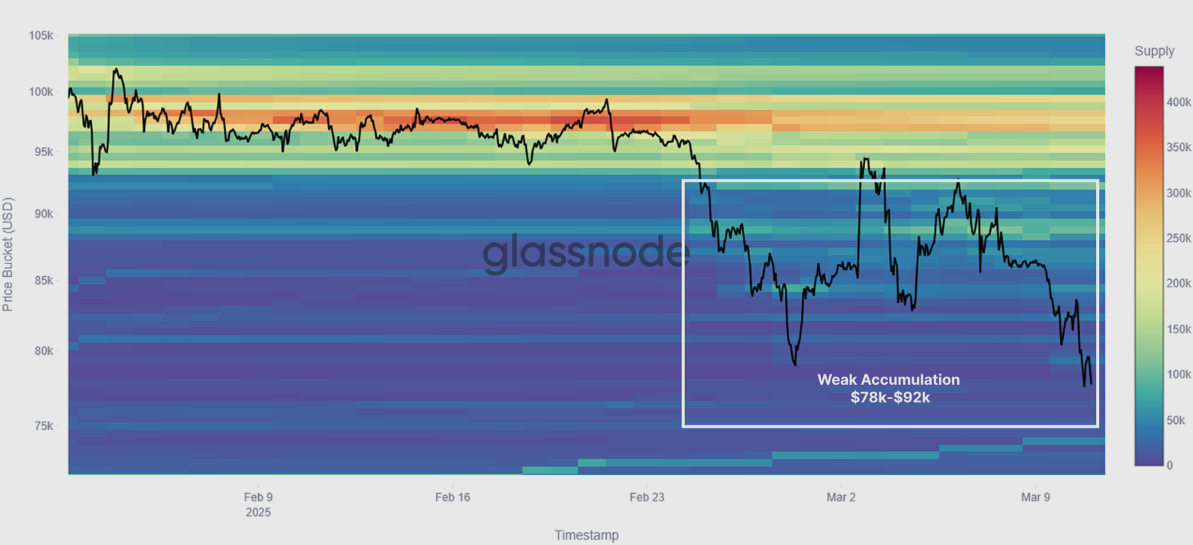

On-chain analytics firm Glassnode reports weakening Bitcoin fundamentals in its March report . Since Bitcoin’s second attempt to break above $105,000 in late January, demand has been weak, and accumulation has diminished.

The failed rally triggered market contraction and consolidation, prolonging Bitcoin’s slump.

But unlike the earlier phase, there was no significant dip-buying response this time, indicating a shift in sentiment toward risk aversion and capital preservation, according to Glassnode.

“The lack of dip-buying at lower levels suggests that capital rotation is underway, potentially leading to a more prolonged consolidation or corrective phase before the market finds a firm support base.”

CBD heatmap confirms that as macro uncertainty increased and accumulation demand weakened. Source: Glassnode

CBD heatmap confirms that as macro uncertainty increased and accumulation demand weakened. Source: Glassnode

Despite high trading volumes near $100,000, Bitcoin’s price remained stagnant, and ETF inflows have been negative for three consecutive weeks, reflecting waning institutional interest.

Bitcoin futures funding rates are also near 0%, reflecting weak demand for both long and short positions and growing trader uncertainty.

Broader macroeconomic concerns and trade tensions push investors away from risky assets like Bitcoin, Glassnode analysts say.

Bitcoin Holds Steady Ahead of FOMC Meeting

Bitcoin has held steady around the $82,000 support level for a week, showing a minor 1.3% change and no signs of volatility ahead of the Federal Open Market Committee (FOMC) meeting on Wednesday.

The FOMC meeting is crucial for the financial markets, as decisions on interest rates and monetary policy directly impact investor sentiment and market liquidity.

Market expectations are high that the Federal Reserve will keep interest rates unchanged between 4.25% and 4.50%.

The CME FedWatch tool, which tracks market expectations for future Federal Reserve interest rate decisions, shows a 99% probability that no rate cuts will be announced.

With no rate cut expected, Bitcoin’s price is likely to continue its current sideways trajectory.

Bitcoin Bottom Confirmed, Says Trader

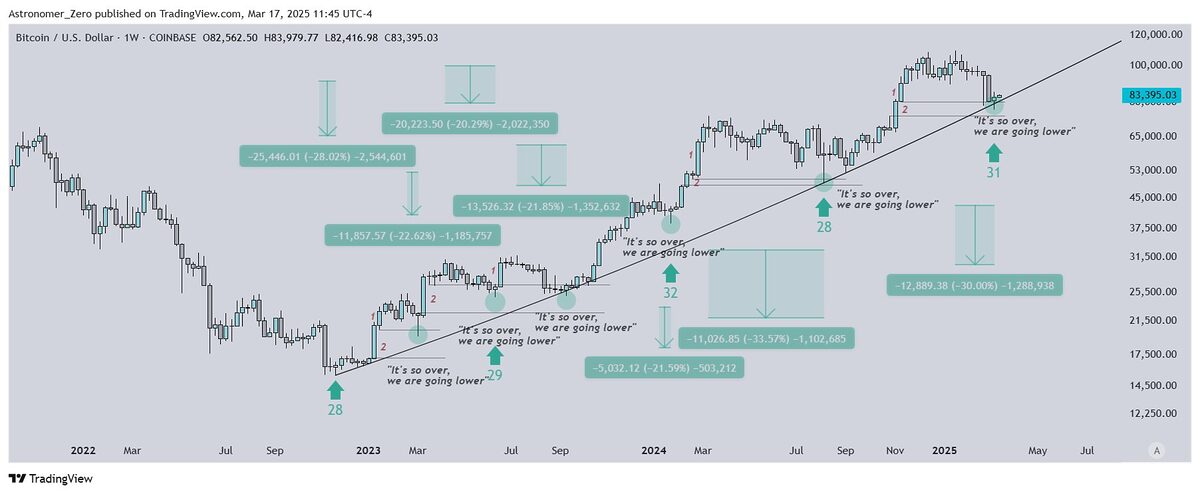

However, not all crypto market participants are bearish. Crypto trader Astronomer stated in a series of posts on X that Bitcoin’s bottom is confirmed, expressing surprise that many reputable traders expected lower prices after Bitcoin briefly dipped below the $80,000 institutional level.

According to Astronomer, Bitcoin has bottomed and reached its higher timeframe support of nearly $80,000.

Bitcoin bottom is in, says crypto trader Astronomer. Source: X

Bitcoin bottom is in, says crypto trader Astronomer. Source: X

Despite recent declines, the trader remains bullish , predicting Bitcoin will reach $160K–$200K by the end of this cycle.

Astronomer believes Bitcoin’s current price action mirrors the parabolic advance seen in 2017, reinforcing his optimistic outlook.

Why This Matters

Bitcoin struggles to climb as demand weakens and uncertainty grows, signaling a cautious market ahead.

Check out DailyCoin’s popular crypto news:

FalconX Completes CME’s First Major Solana Futures Trade

Stablecoin Bill Moves Forward: A Key Step in U.S. Stablecoin Regulation