Layer-1 Project MultiversX Continues To Top the Crypto Gaming Sector in Terms of Development Activity: Santiment

The layer-1 blockchain MultiversX (EGLD) continues to lead the digital asset gaming sector in the realm of development activity, according to the crypto analytics firm Santiment.

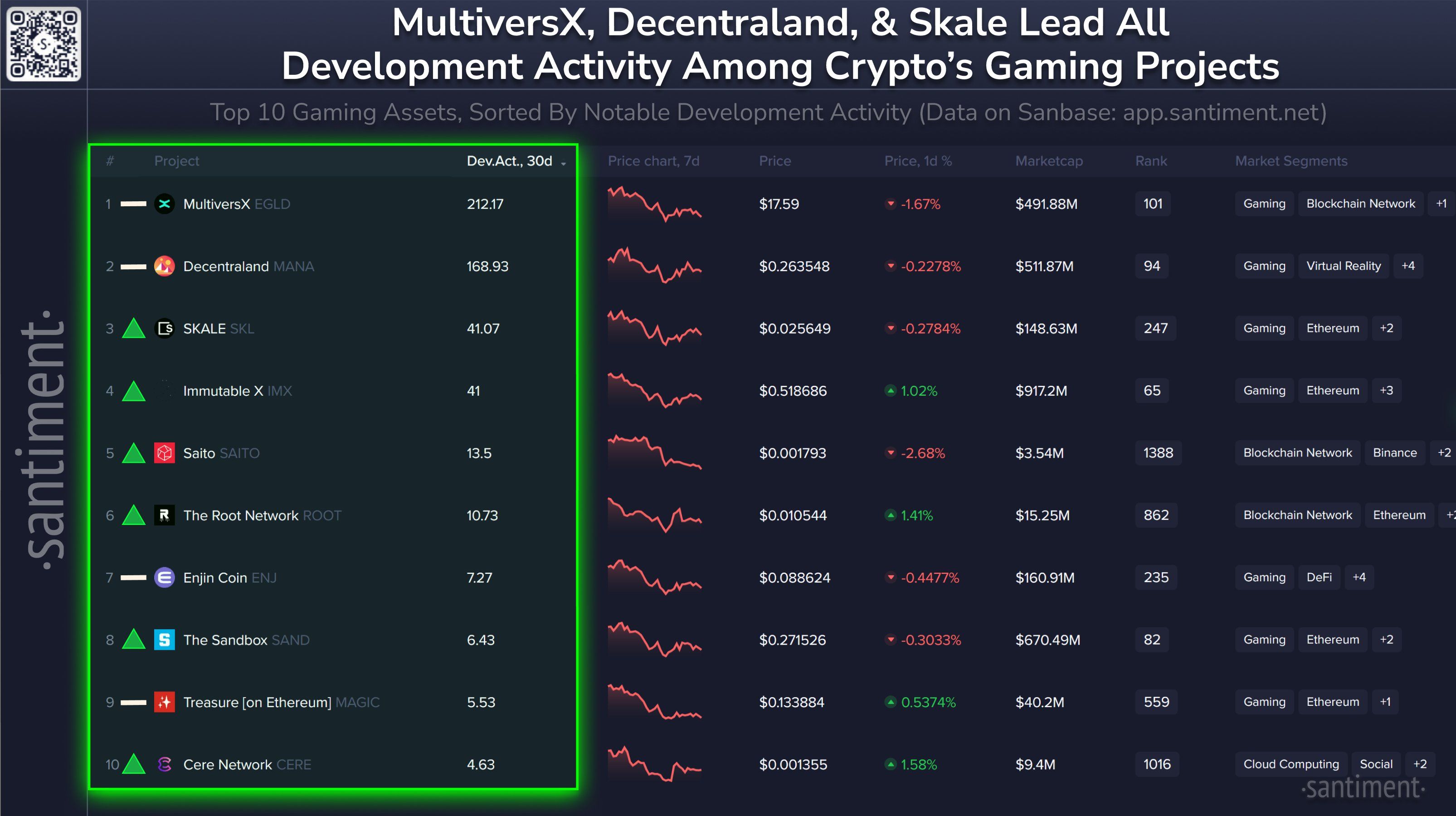

Santiment notes on the social media platform X that MultiversX, formerly known as Elrond, registered 212.17 notable GitHub events in the past 30 days.

The Ethereum (ETH)-based virtual reality platform Decentraland (MANA) ranks second, clocking 168.93 events, and the Ethereum layer-2 protocol Skale Network (SKL) is a distant third with 41.07.

MultiversX and Decentraland have occupied the number one and two spots in previous months as well, according to Santiment.

Santiment notes that it doesn’t count routine updates and uses a “better methodology” to collect data for GitHub events based on a “backtested process.”

The analytics firm has previously said that heavy development activity centered around a crypto project is a positive indication that could mean that the developers believe the protocol will be successful. It also indicates that the project is less likely to be an exit scam.

MultiversX is a distributed, proof-of-stake blockchain network that is decentralized via more than 3,500 nodes. The project aims to help developers build next-gen applications.

The project’s native token, EGLD, is trading at $18.10 at time of writing. The 139th-ranked crypto asset by market cap is up more than 3% in the past 24 hours.

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CandyBomb x RAVE: Trade futures to share 200,000 RAVE!

Bitget TradFi: Trade gold, forex, and more assets in one account

CandyBomb x US: Trade to share 5,400,000 US

[Initial Listing] Bitget to list Almanak (ALMANAK). Grab a share of 4,200,000 ALMANAK