There’s a Good Chance the Bull Cycle’s Over if Bitcoin Plunges to This Level, Warns Analyst Benjamin Cowen

The widely followed cryptocurrency analyst Benjamin Cowen says Bitcoin’s ( BTC ) bull cycle would likely be over if it enters one key level.

In a new video, Cowen tells his 886,000 YouTube subscribers that Bitcoin may be repeating a similar pattern from 2017, when it tested the prior year high.

However, he warns that if Bitcoin drops below the 2024 low of about $71,000 and enters the $60,000 range, the bull cycle may be over.

“In 2017 Bitcoin had a drop in early 2017 where it tested the 2016 high. And it happened, by the way, fairly early on. I would argue that’s very much an outcome to consider for this cycle, testing the 2024 high, which is in the lower $70,000s…

If we get closes, and especially if there’s a wick in the low $60,000s, then there’s a good chance the cycle is over. If it stays above the 2024 high, then the party could easily go on.”

Source: Benjamin Cowen/YouTube

Source: Benjamin Cowen/YouTube

He also says that if Bitcoin maintains the $70,000 range, a bull cycle will probably remain intact, whereas anything lower may result in a bearish price pattern of lower highs later in the year on the weekly chart.

“If it holds support above $70,000, $73,000, [the] structure of the market is fine. If it goes into the $60,000s, then I would argue that the more likely outcome would be a macro lower high in Q2, Q3, potentially around like the August timeframe.”

Bitcoin is trading for $84,059 at time of writing, up 3.8% in the last 24 hours.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Morning Brief | The US Senate has passed a procedural vote on the "end government shutdown plan"; About 4.64 million bitcoins have been moved out of dormant wallets this year; Monad token public sale will start on November 17

Overview of major market events on November 10.

【Calm Order King】Trader achieves 20 consecutive wins: Who can stay calm after watching this?

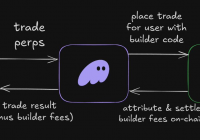

ERC-8021: Ethereum’s ‘copy Hyperliquid’ moment, a new way for developers to make a fortune?

Morgan Stanley: The End of Fed QT ≠ Restart of QE, Treasury's Issuance Strategy Is the Key

Morgan Stanley believes that the end of the Federal Reserve's quantitative tightening does not mean a restart of quantitative easing.

Trending news

MoreMorning Brief | The US Senate has passed a procedural vote on the "end government shutdown plan"; About 4.64 million bitcoins have been moved out of dormant wallets this year; Monad token public sale will start on November 17

【Calm Order King】Trader achieves 20 consecutive wins: Who can stay calm after watching this?