- The transfer of $600M worth of ETH to ByBit occurred after the exchange liquidated $600M worth of Bitcoin and USDT thus indicating possible market readjustments.

- The current trading range for ETH sits between $2,360 and $2,520 while remaining close to the $2,451 value point but resists breaking above $2,500.

- Past ETH price surges saw increased long liquidations, suggesting overleveraged positions could impact future volatility.

In a significant development in the cryptocurrency market, Mirana Ventures has transferred $600 million in Ethereum (ETH) to ByBit over the past three days. The recent transfer of $600 million ETH to ByBit comes after the company liquidated Bitcoin ( BTC ) and Tether (USDT) worth $600 million indicating a purposeful reshaping of company assets. The massive asset movement has triggered market expert and trader interest which has led to predictions about future market transformations.

ETH Gains Amid Consolidation Below Resistance

The transfer has led to ETH experiencing price increase as of now, Ethereum’s (ETH) is trading at $2,451.36, reflecting a 1.1% increase. Additionally, the ETH-to-BTC price ratio is 0.02779 BTC, which has increased by 2.0%. The 24-hour trading range is between $2,363.71 and $2,523.96, indicating moderate volatility within the last day.

Source: Coingecko

Source: Coingecko

The overall trend suggests that ETH is maintaining stability around the mid-$2,400 level while experiencing fluctuations within the $2,360–$2,520 range. The price has failed to break past resistance zones exceeding $2,500 and subsequently continues to consolidate before potentially moving upwards.

ETH Liquidation Trends Signal Key Price Levels Ahead

Source: Coinglass

Source: Coinglass

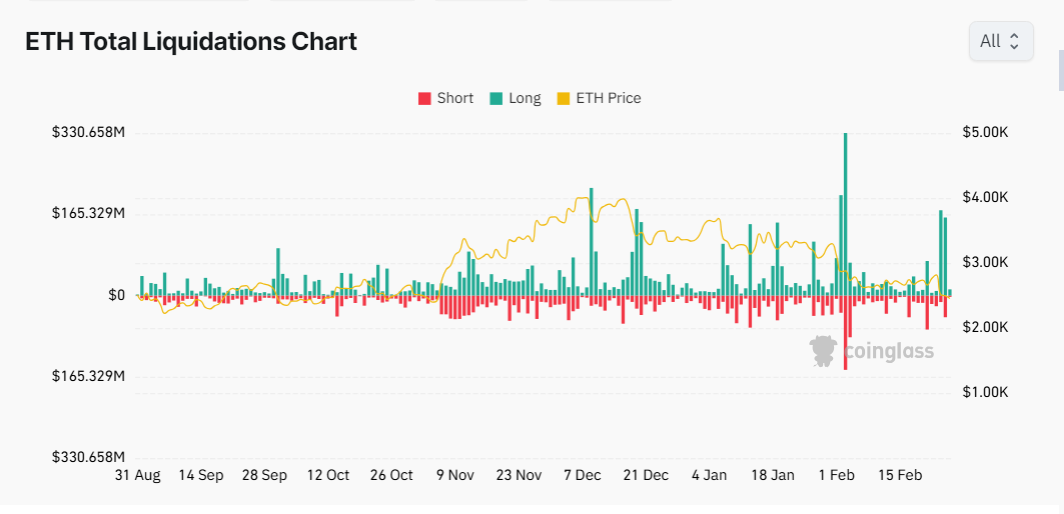

The ETH Total Liquidations Chart shows ETH prices maintained stable levels between late August and early November because there were low liquidation events within the $1500-$2000 price region. ETH prices strengthened significantly from mid-November until early December which caused them to surpass the $3,000 mark. The sharp price rise during this period correlated with traders taking excessive risks with their bullish position bets.

From mid-December to early February, ETH’s price exhibited volatility, reaching highs above $4,000 before facing pullbacks. Liquidation rates remained stable as ETH prices reached a stable midpoint at $3,000. ETH has the potential to resume its testing of $4,000 if it successfully maintains its position above $3,500. The market will face additional price drops if support at $2,800 fails to hold. ETH traders might expect prices to fluctuate between $3,200 and $3,800 during the next few months unless positive market momentum triggers a price rise to $4,500.

The crypto market has seen major institutional players adjusting their portfolios, and this move by Mirana Ventures adds to the evolving narrative. If similar transfers follow, it could indicate a broader trend of capital shifting toward Ethereum.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.