Andre Cronje: L2 is the reason for Ethereum's re-inflation

Sonic Labs founder Andre Cronje recently criticized Ethereum's L2 solution for its handling of profits and potential inconsistency with Ethereum's decentralization principles on X. "I don't understand how Ethereum users convince themselves. L2 is the reason for Ethereum's inflation again."

The focus of this dispute is two competing visions for Ethereum expansion. Critics argue that L2 generates considerable revenue, but only returns a small portion to Ethereum in terms of data availability and security.

Decentralized expansion supporters, including Cronje, advocate using solutions like Sonic directly to enhance the base layer of Ethereum, reducing reliance on external L2 providers.

Julio Moreno, research director at CryptoQuant, pointed out that the supply of Ether has now exceeded pre-merger levels (September 2022), confirming that the network has resumed inflation. To address the inefficiency problem of Ethereum's L2 solution, Cronje proposed using Sonic technology to bypass centralized model restrictions.

Previously reported news showed members from Sonic Labs publicly questioning Base Sorter’s income flow direction implying Base team was dumping ETH; however this claim was refuted by members from Base team.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Federal Reserve Governor Milan once again calls for a significant rate cut in December

International Business Settlement: Acquired approximately 247 bitcoins between October 17 and November 7

Monad announces tokenomics: total supply of 100 billions tokens, 3% to be distributed via airdrop

Trending news

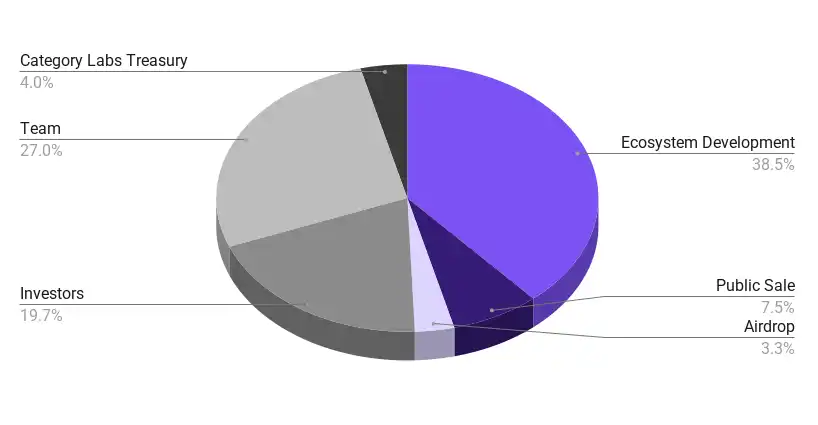

MoreOverview of Monad Tokenomics: 49.4% of the total supply will be unlocked on the first day of mainnet launch, with 10.8% entering circulation through public sale and airdrop, and 38.5% managed by the Monad Foundation.

Federal Reserve Governor Milan once again calls for a significant rate cut in December