Solana Price Analysis Hints $300 Recovery Amid TVL Spike

This week, the cryptocurrency market recorded damped volatility as Bitcoin wavers between the $100k and $90k levels. This consolidation trend has stalled the prevailing correction sentiment in most major altcoins, including SOL. The Solana price holding above a confluence of major support signals a potential for a bullish recovery.

According to Coingecko, SOL price currently trades at $184.5, with an intraday loss of 2.5%. The asset market cap stands at $88.5 Billion, while 24-hour trading is at $3.6 Billion.

Key Highlights:

- A renewed uptrend in Solana’s TVL and open interest signals increased adoption and investor confidence if further rally.

- A downsloping trendline drives the current correction in Solana price.

- The $175 support is closely aligned with the 50% Fibonacci retracement level, and the 200-day Exponential moving average creates a high accumulation zone.

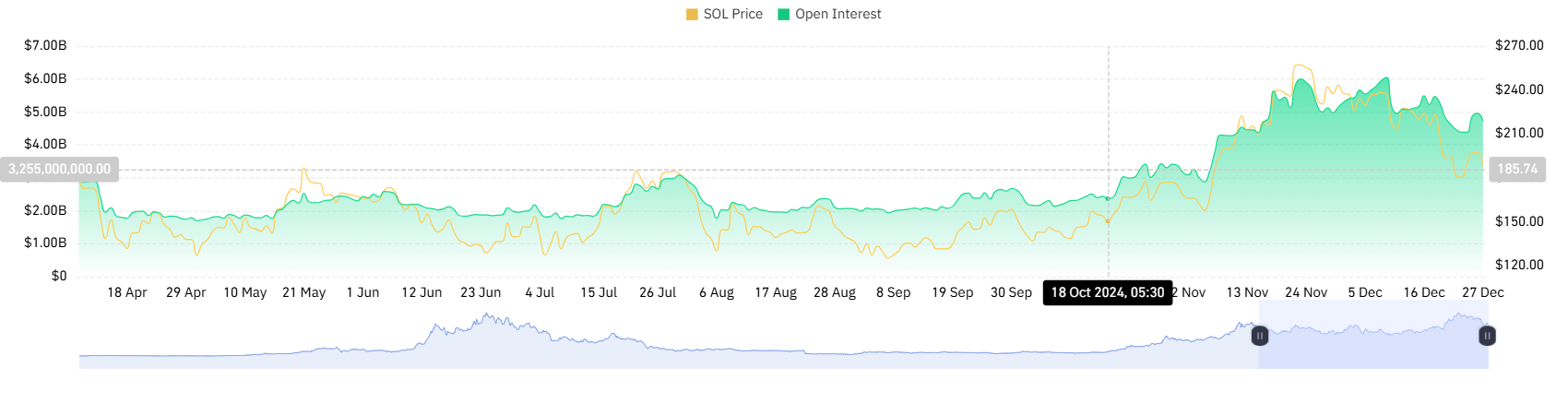

SOL Rebounds as Open Interest and TVL See Notable Increases

According to Coinglass data, the SOL futures open interest records a notable surge from $4.38 to $4.96— a 13% increase since last week. Open interest refers to the total number of outstanding derivative contracts that have not yet been settled.

A rise in open interest often suggests increased trader activity, signaling heightened interest and confidence in SOL’s price movements.

In the same period, Solana’s Total volume locked (TVL) records a jump from $8.06 to $8.67 Billion, registering a 7%. A growing TVL showcases increased trust in Solana’s DeFi platforms, suggesting that more users are staking, lending, or providing liquidity within its ecosystem.

Solana Price Correction Hits Key Support

For over a month, the Solana price has witnessed a major correction from $264 to $183, registering a 30% loss. The pullback is currently seeking support at $175, a horizontal coinciding with 50% FIB, 50-day EMA, and an emerging support trendline.

This creates a high area of interest for buyers to recuperate the bullish momentum and drive price reversal. An analysis of the daily chart shows the support trendline has acted as suitable pullback support for SOL since mid-September.

A potential reversal could drive the price 7.8% before a key breakout from the downsloping trendline. A successful breakout will further accelerate the bullying pressure to drive a rally past $300.

Also Read: Bitwise Files for Bitcoin Standard Corporations ETF with the SEC

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates: Digital Assets Shed $2B as Fed Uncertainty Grows, Large Investors Accumulate for 2026

- Digital asset ETPs lost $2B last week, marking the largest outflow since February and reducing AUM by 27% to $191B amid Fed policy uncertainty and whale selling. - Bitcoin and Ethereum products dominated the decline, with $1.38B and 4% of ETP market outflows respectively, while Germany attracted $13.2M as investors sought bargains. - Bitcoin whales accumulated 375,000 BTC over 30 days, doubling long-term holdings, signaling potential 2026 bullish momentum if institutional demand resumes. - Short-Bitcoin

Bitcoin Updates: Institutional Advancements and Clear Regulations Drive Crypto Toward Widespread Adoption

- Hyperscale Data buys 59.76 Bitcoin ($6M) amid volatility, reinforcing dollar-cost-averaging strategy and transparency. - SGX Derivatives launches Bitcoin/Ethereum perpetual futures (Nov 24), bridging traditional finance and crypto via regulated contracts. - GTBS Digital Ecosystem (Dec 25) integrates AI/Web3, featuring non-custodial wallet, exchange, and gaming hub with real-world utility. - Coincheck targets 2026 Nasdaq listing via SPAC, aiming to become second U.S.-listed crypto exchange after Coinbase

Shiba Inu Relies on Telecom Services to Withstand Bearish Market Trends

- Shiba Inu (SHIB) partners with Unity Nodes to integrate into telecom sector , offering real-world utility via node rewards and NFT licenses. - Meme coins face bearish pressure, with SHIB down 5-8% amid delayed Fed rate cut expectations and declining derivatives interest. - Unity Nodes’ decentralized network allows users to verify telecom infrastructure, earning SHIB rewards and boosting token visibility. - SHIB trades near critical support levels, with mixed technical indicators and uncertainty over Fed

Japan Approves a Colossal Stimulus Plan of 17 Trillion Yen