Dogecoin Drops 30% from Yearly Highs, Risks Falling Below $0.20

Dogecoin has plunged 30% from its yearly high, with bearish indicators like a "Death Cross" and Super Trend readings hinting at further losses.

Dogecoin (DOGE) price has dropped over 30% from its yearly high of $0.48 earlier this month. This decline is linked to multiple bearish signals, increasing the likelihood of further price decreases.

As the year draws to a close and bearish pressure mounts, technical indicators point to a further decline in DOGE’s price, possibly slipping below $0.20. Here is why.

Dogecoin’s Bearish Patterns Put It at Risk

A “Death Cross” pattern has been formed on the DOGE/USD one-day chart. This is a bearish pattern that is formed when an asset’s short-term moving average (often the 50-day moving average) crosses below its long-term moving average (commonly the 200-day moving average), suggesting a shift in market sentiment from positive to negative.

Dogecoin Death Cross. Source:

TradingView

Dogecoin Death Cross. Source:

TradingView

Readings from the DOGE/USD chart showed that DOGE’s 50-day MA crossed below its 200-day MA on December 18, and the meme coin’s price has since plummeted by 20%. This crossover is a bearish signal, suggesting a weakening trend, with recent price declines outweighing long-term price gains.

Moreover, the bearish readings from DOGE’s Super Trend Indicator confirm the possibility of further downsides. As of this writing, DOGE’s price rests below the red line of this indicator.

Dogecoin Super Trend. Source: TradingView

Dogecoin Super Trend. Source: TradingView

The Super Trend indicator tracks the overall direction and strength of a trend in asset prices. It appears as a line on the price chart that changes color to reflect the trend direction: red for a downtrend and green for an uptrend. When an asset’s price appears below the Super Trend line, it indicates a downward trend, suggesting bearish momentum is likely to persist.

DOGE Price Prediction: Meme Coin Eyes Sub $0.20

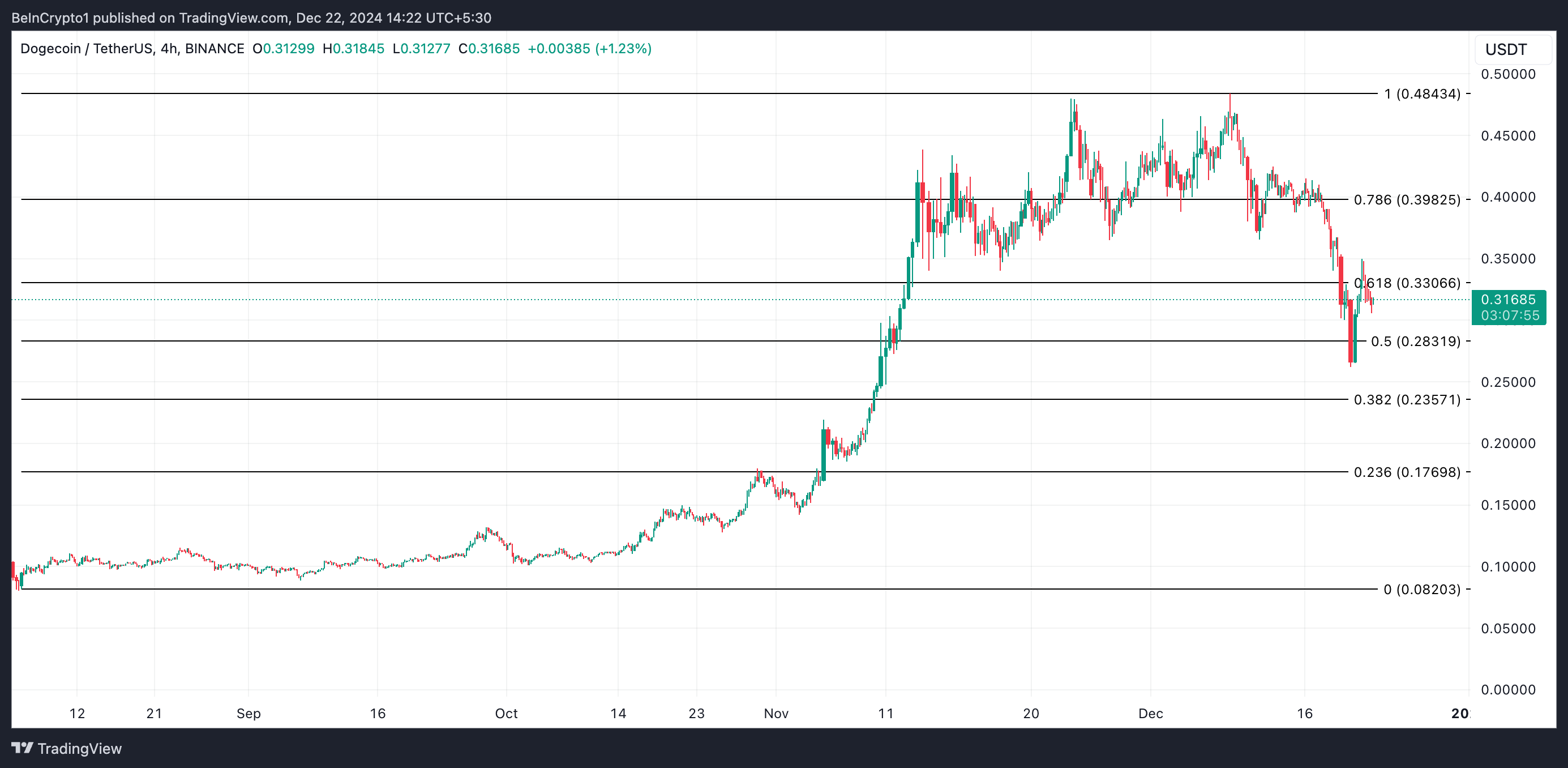

On the daily chart, DOGE is trading below the resistance at $0.33. Persistent spikes in selling pressure at this level could drive its price down to the support at $0.28.

Should this support fail, DOGE’s next key level lies at $0.23. If bulls cannot defend this level, the meme coin could slip below the $0.20 zone, potentially reaching $0.17.

Dogecoin Price Analysis. Source: TradingView

Dogecoin Price Analysis. Source: TradingView

On the other hand, a successful breach of the $0.33 resistance level could propel DOGE towards its yearly peak of $0.48.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Market value evaporates by 60 billions! Faith shaken, institutions on the sidelines—has bitcoin’s “post-halving crash” curse come true?

A major reason for the recent plunge is market concerns over a repeat of the "halving cycle"—that is, after a supply reduction triggers a boom, a deep correction inevitably follows. Panic selling by investors, combined with a stagnation of institutional funds and macroeconomic headwinds, have collectively led to a collapse in market confidence.

SharpLink and Upexi: Each Has Its Own Strengths and Weaknesses in DAT

For this model to be sustainable, one of the following two scenarios must occur: either staking truly becomes a corporate cash engine, continuously providing funds for digital asset purchases; or companies must incorporate the planned sale of digital assets into their digital asset strategies to achieve systematic profits.

80% is hype? Six major red lines reveal the true intentions of Stable

It appears to be an infrastructure upgrade, but in essence, it is an early, insider-friendly issuance.

Global assets are falling simultaneously—why have safe havens collectively failed?