-

Cardano (ADA) has experienced a remarkable rebound, reaching $1.15, a notable increase fueled by reduced sell-offs and significant whale activity.

-

After a dramatic 217% price increase last month, the movement of dormant tokens suggests a shift in network dynamics, with long-term holders beginning to accumulate.

-

Recently, large investors have purchased $276 million worth of ADA in a week, indicating strong market confidence and positive future price expectations.

Cardano’s price surge to $1.15 signals increased investor confidence as whales accumulate ADA. A closer look at market dynamics reveals promising trends.

Cardano’s Rapid Rise: A Collaborative Effort Between Holders and Whales

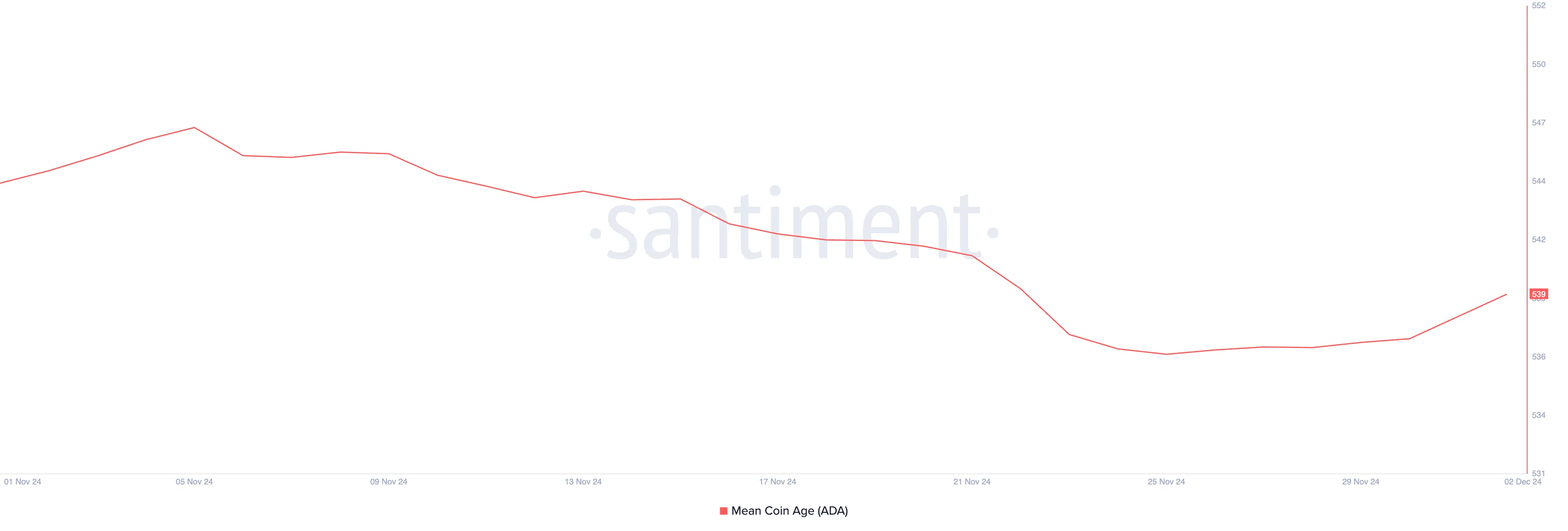

The recent uplift in Cardano’s performance can be attributed to long-term holders and large investors working in tandem. After a 217% price hike in November, previously stagnant tokens were activated, reflected in a dip in Mean Coin Age metrics. This decline suggests a fresh wave of on-chain activity, as more coins are being moved out of dormancy.

However, the trend has changed positively over the past week. Data from Santiment indicates an upward trend in ADA’s Mean Coin Age, showcasing that long-term holders have reduced their sell-offs, contributing to a remarkable 10% price rise in this period.

Cardano Mean Coin Age. Source: Santiment

In addition, significant acquisitions by ADA whales have been observed. Recent on-chain analytics reveal that addresses holding between 100 million and 1 billion ADA have collectively acquired $276 million worth over the past week. This substantial buying activity indicates an increased belief in the asset’s future value.

Cardano Supply Distribution. Source: Santiment

Future of ADA: Price Predictions Show Promise

The recent analysis on Cardano’s daily performance reveals a bullish sentiment, evidenced by an Elder-Ray Index value of 0.31. This indicator helps assess market trends by comparing buying and selling pressures. A positive reading signifies that buying interest currently outweighs selling, pointing to a sustained bullish atmosphere.

Should this positive momentum persist, projections suggest ADA could potentially reach $1.30, a level last witnessed in January 2022. However, market dynamics may also lead to fluctuations; a shift towards increased coin distribution could trigger a decline to $1.09.

Cardano Price Analysis. Source: TradingView

In the event that bullish momentum falters, a failure to maintain support levels could see the price retract below $1, targeting a potential range of $0.92.

Conclusion

In summary, Cardano’s recent price movements reflect a strong combination of support from long-term holders and proactive whale accumulation. With promising metrics and analysis suggesting further potential for price increases, ADA remains a focal point for market participants looking for opportunities in a dynamic landscape. Ongoing monitoring of market trends and investor behavior will be key in the forthcoming days.