RESEARCH: BTC Options Market Sees Massive Block Trades, Cumulative Block Call Options Traded Over $120 Million Throughout the Day

According to Adam, a macro researcher at Greeks.live, the Bitcoin options market has seen a massive volume of large trades, with more than 6,000 BTC worth of Bitcoin traded since 21:00 p.m., and more than $120 million in cumulative call options traded over the course of the day. Nearly 5,000 BTC of these trades have been for $92,000 to $100,000 in active buying of December 27 calls, and the buying continues. In addition to the high number of purchase orders, the premium for this wave of purchases is significantly higher than usual, roughly sweeping at more than double the cost of the premium. Analysis suggests that the giant whale is on the move.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Japanese bond yields rise as market focuses on this week's economic data

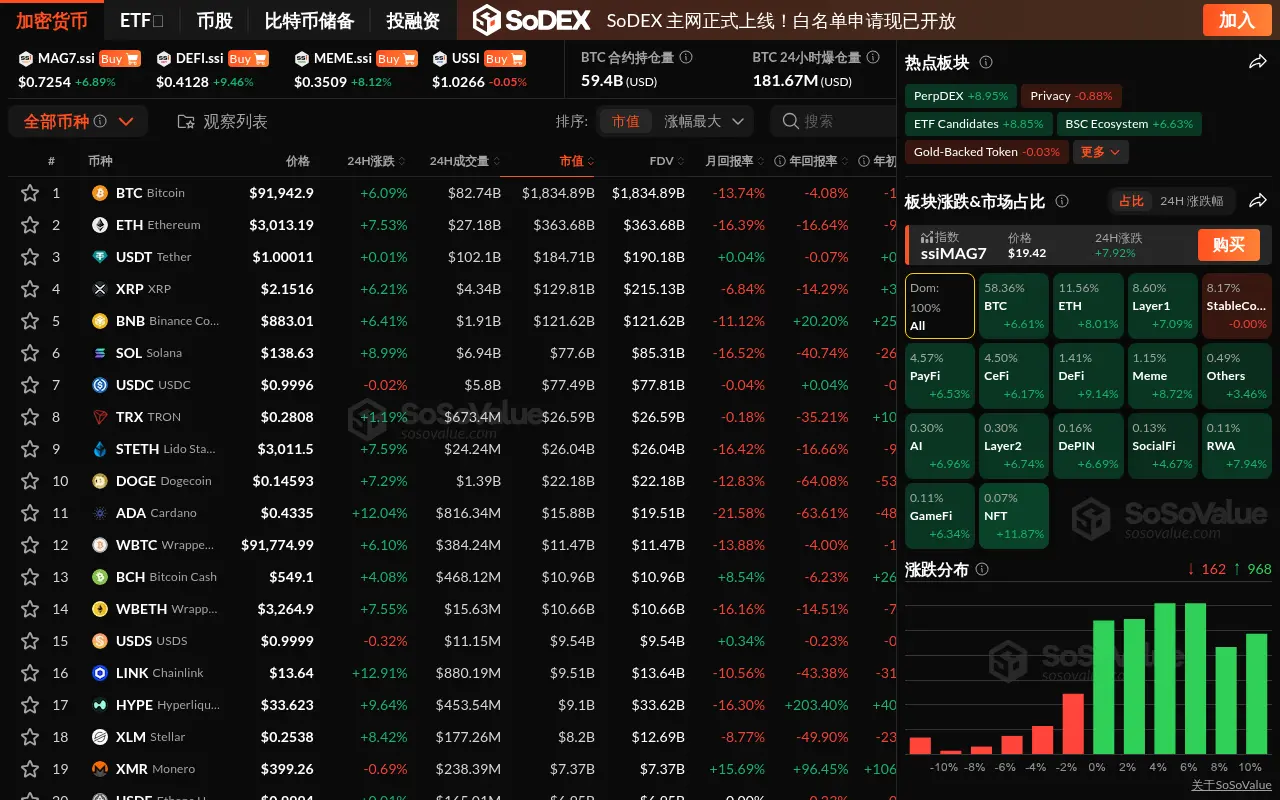

Data: The crypto market rebounds across the board, NFT sector leads with nearly 12% gain, BTC surpasses $91,000

Kalshi co-founder Lopes Lara becomes the world’s youngest self-made female billionaire

Renowned analyst: Whether Ethereum can break through $3,700 will determine if the bull market is over