- Hong Kong is considered a pro-crypto jurisdiction.

- Spot Hong Kong Bitcoin ETFs greatly trail their U.S. counterparts.

- There are persistent calls and rumors of China ‘unbanning’ crypto.

Since their launch in January , U.S. spot Bitcoin ETFs have been a resounding success, attracting over $58 billion in capital. This significant influx has marked a key milestone for the cryptocurrency industry, underscoring Bitcoin’s growing acceptance in mainstream finance.

Hong Kong (HK) authorities approved their own Bitcoin ETF products in April, aiming to replicate the success seen in the U.S. market. However, the response in HK has been comparatively muted so far. Despite this, as BTC surged last week, HK spot Bitcoin ETFs saw their most significant inflows since mid-July.

Bitcoin Recovers, HK ETFs Show Life

Last week, Bitcoin surged to a 24-day high, surpassing $65,000, as optimism around potential U.S. rate cuts boosted market sentiment. This marked a strong recovery from early August, when concerns over the unwinding of the yen carry trade triggered a substantial sell-off.

Sponsored

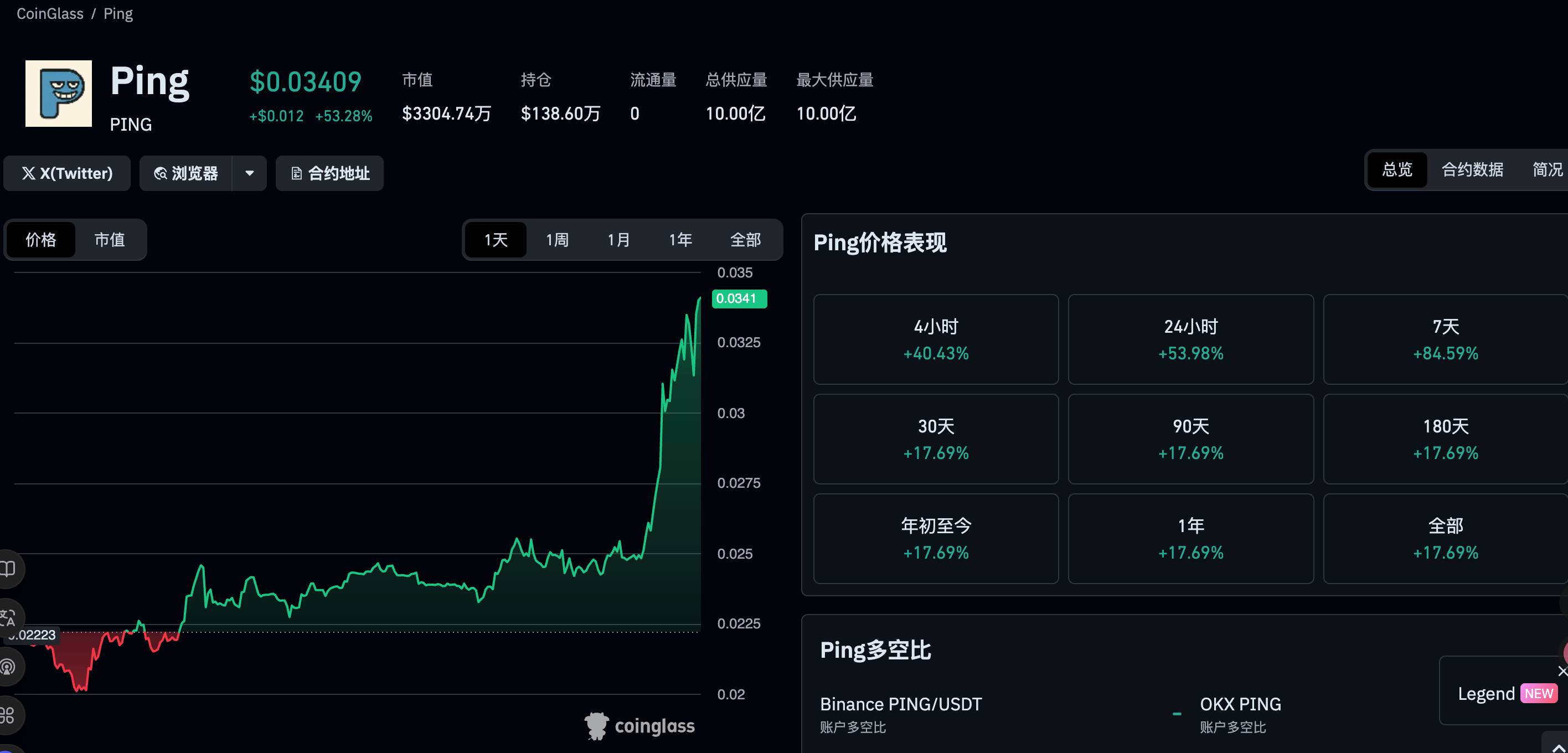

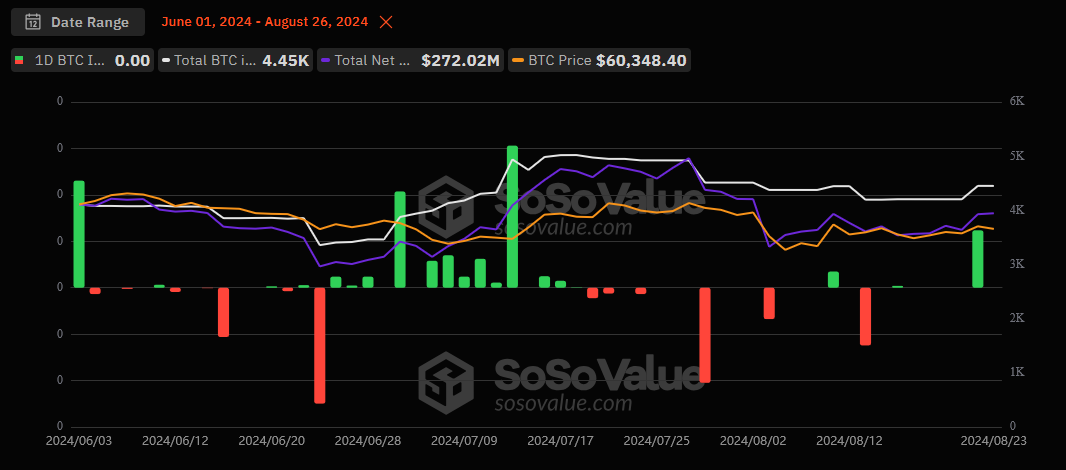

As Bitcoin strengthened, HK spot ETFs also showed renewed vigor, with buying activity driving the most significant inflows in over six weeks. HK spot ETFs recorded inflows of 247 BTC on August 22, bringing the total coins held to 4,450 BTC, valued at approximately $272 million.

HK Bitcoin spot ETF flows per SoSoValue

HK Bitcoin spot ETF flows per SoSoValue

Before this, the previous inflow peak occurred on July 12, when 612 BTC were added, pushing total holdings to 4,940 BTC.

Despite this recent uptick, HK’s ETFs continue to lag significantly behind their U.S. counterparts in terms of daily trading volume and assets under management.

Sponsored

This disparity in performance can be partly attributed to HK’s smaller market size, with a population of just 7 million.

Initially, there was speculation that entities from mainland China might participate in these ETF funds, but this has not materialized , limiting the potential investor base for HK ETF products.

Will China Flip Pro-Crypto?

Despite restrictions that prevent mainland Chinese entities from participating in HK crypto ETFs , speculation persists about potential changes to this policy.

ETF provider Harvest has reportedly been advocating for the inclusion of these investment products in Stock Connect, a channel that connects the Shanghai and Hong Kong stock exchanges.

Similarly, rumors persist that China might reverse its 2021 crypto restrictions. Tron founder Justin Sun is the latest industry figure to suggest a potential shift in China’s policy.

Sun has publicly urged Chinese authorities to reconsider the 2021 crypto restrictions, proposing the implementation of a regulatory framework instead. He argued that such a shift is crucial for China to maintain its competitive edge in the global financial landscape, particularly as the U.S.’s influence in the crypto sector grows.

On the Flipside

- Singapore overtook HK to become the top financial hub in Asia.

- Loh Boon Chye, CEO of the Singapore Exchange, recently stated that the Singaporean market is not ready for crypto ETF products.

- The disparity between U.S. and HK ETF performance highlights the importance of market size and liquidity.

Why This Matters

HK spot ETFs can only rival those in the U.S. if mainland Chinese entities are allowed to participate.

H.K. authorities take down crypto crime ring:

Hong Kong Police Nab $1.4M Cryptocurrency Fraud Syndicate

Bitcoin transaction fees spike as Runes show signs of coming back:

Bitcoin Fees Soar: Is Runes Revival Fueling the Surge?