The second quarter of 2024 marked a notable surge in the adoption of spot Bitcoin ETFs among institutional investors. According to 13F filings with the US SEC, 44% of asset managers increased their Bitcoin ETF holdings.

Around 22% maintained their positions and only about 21% cut back, and 13% exited.

In a post on X, Bitwise chief investment officer Matt Hougan noted that this positive trend highlights a broader institutional embrace of Bitcoin ETFs.

The SEC Form 13F is a quarterly report that all institutional investment managers have to fill if they manage over $100 million.

Spot Bitcoin ETFs simplify crypto investment for mainstream portfolios

The second quarter of 2024 was good for spot Bitcoin ETFs even though the value of Bitcoin went down by 14.5% in three months. Hougan noted institutional investors kept buying Bitcoin ETFs in the second quarter. He believes that the trend is here to stay.

On January 10, 2024, the big thumbs up from the Securities and Exchange Commission (SEC) for spot Bitcoin exchange-traded funds (ETFs) was a massive deal for crypto investing in the US.

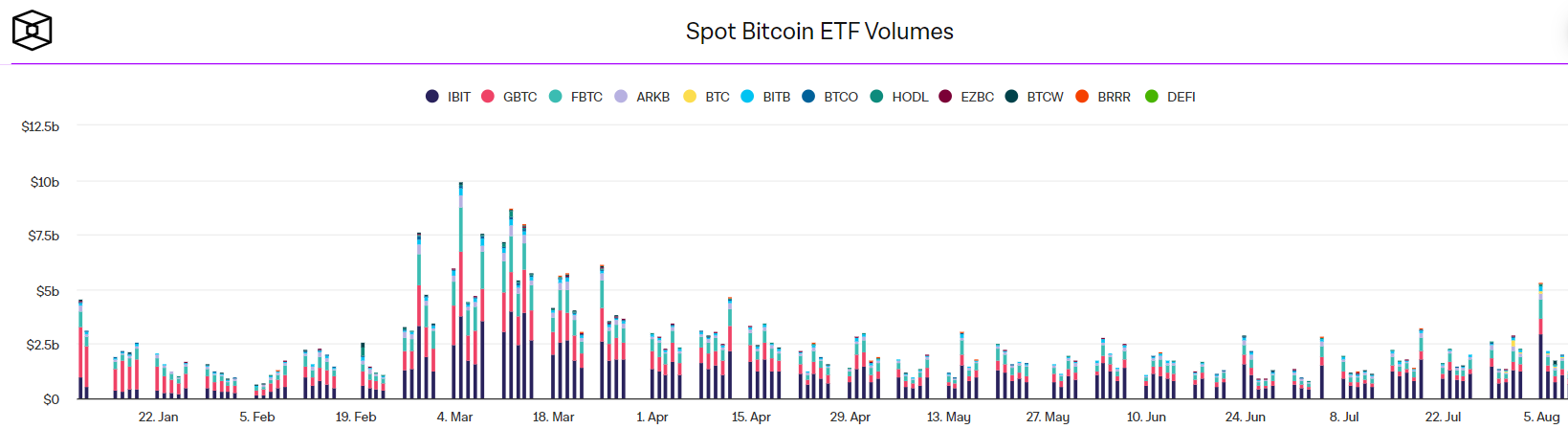

Spot Bitcoin ETF Flow Source: The Block

Spot Bitcoin ETF Flow Source: The Block

Bitcoin ETFs are like stepping stones connecting the world of traditional finance to crypto. Since the Bitcoin ETF got the green light and kicked off, the number of ETF trades has skyrocketed, hitting almost $10 billion a day in March and staying in the billions every day.

Institutional investors show steady confidence amid market volatility

Hougan pointed out that institutional investors were mainly steady and did not rush to sell like regular people did when things got shaky.

“If you thought institutional investors would panic at the first sign of volatility, the data suggest otherwise. They’re pretty steady.”

Hougan

He also mentioned that significant hedge funds like Millennium, Schonfeld, Boothbay, and Capula were leading the pack in holding Bitcoin ETFs. Still, there were also a lot of advisers, family offices, and select big investors doing quite well.

He wrapped up by saying ETFs are a big mix that attracts all sorts of investors. He noted that it’s cool to see Millennium’s name next to the State of Wisconsin in these reports. Over time, Hougan said he would like to see more wealth managers and pensions account for a growing share.

In a report from August 14, investment bank Morgan Stanley said they owned 5,500,626 shares of BlackRock’s iShares Bitcoin Trust, worth $188 million. That made Morgan Stanley one of the top five investors.

Investment giant Goldman Sachs also said they had over $238 million worth of shares in IBIT and other spot Bitcoin ETFs.