Mt. Gox transfers $3.2 billion in Bitcoin with $150 million to Bitstamp

Key Takeaways

- Mt Gox moved around $3.2 billion in Bitcoin on Tuesday.

- The transfer is part of a $9 billion repayment plan to creditors.

A wallet linked to the now-defunct crypto exchange Mt. Gox transferred $3.2 billion worth of Bitcoin early Tuesday, including 42,587 Bitcoin (BTC), valued at $2.8 billion, to an unidentified address, and almost $150 million in Bitcoin to Bitstamp’s wallet, according to data from Arkham Intelligence.

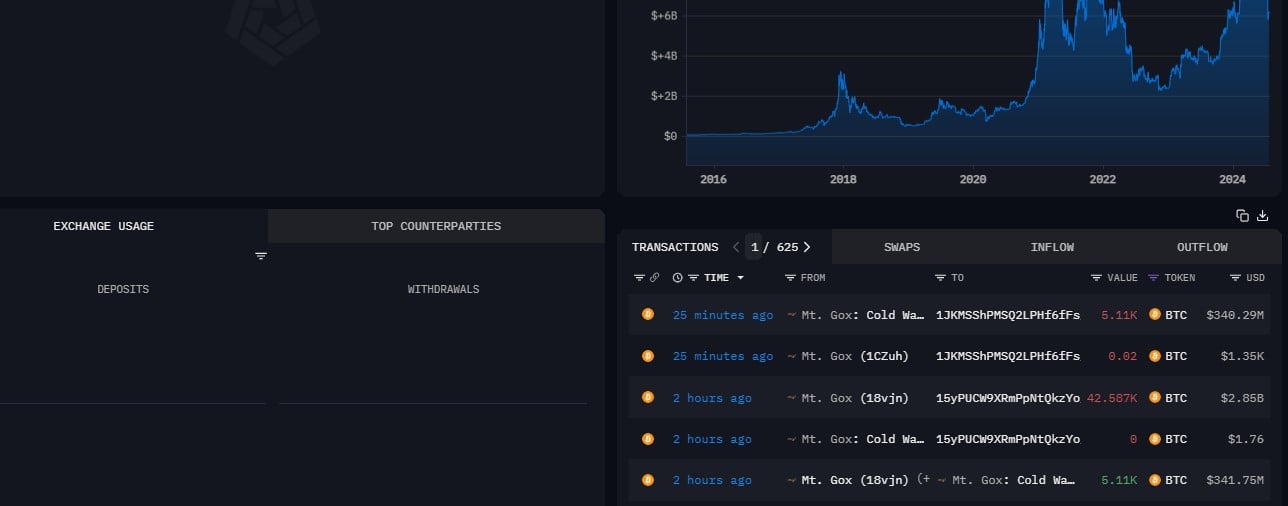

Mt. Gox’s recent wallet activities – Source: Arkham Intelligence

Mt. Gox’s recent wallet activities – Source: Arkham Intelligence

These transactions could be part of an ongoing process to repay $9 billion in Bitcoin to creditors, which was confirmed earlier this month. Mt. Gox’s latest wallet activities follow a number of small Bitcoin transfers made yesterday, including one linked to Bitstamp . Those were believed to be test transactions before major distributions.

Bitstamp is one of the designated exchanges to handle Mt. Gox’s repayments. Other exchanges like Kraken have also received their shares , with Bitbank and SBI VC Trade reportedly distributing the funds to creditors shortly after receipt.

At the time of reporting, Mt. Gox’s Bitcoin holdings are valued at over $6 billion.

The recent transfer led to a sudden drop in Bitcoin’s price, which fell below $66,500 after hitting a high of $68,200 earlier today, CoinGecko’s data shows.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto: The Fear Index Drops to 10, But Analysts See a Reversal

Uniswap Labs Faces Pushback as Aave Founder Highlights DAO Centralization Concerns

Ethereum Interop Roadmap: How to Unlock the “Last Mile” for Mass Adoption

From cross-chain to "interoperability," many of Ethereum's fundamental infrastructures are accelerating towards system integration for large-scale adoption.

A $170 million buyback and AI features still fail to hide the decline; Pump.fun is trapped in the Meme cycle

Facing a complex market environment and internal challenges, can this Meme flagship really make a comeback?