Crypto funds see $3.2 billion inflows in July amid bullish investor sentiment

Key Takeaways

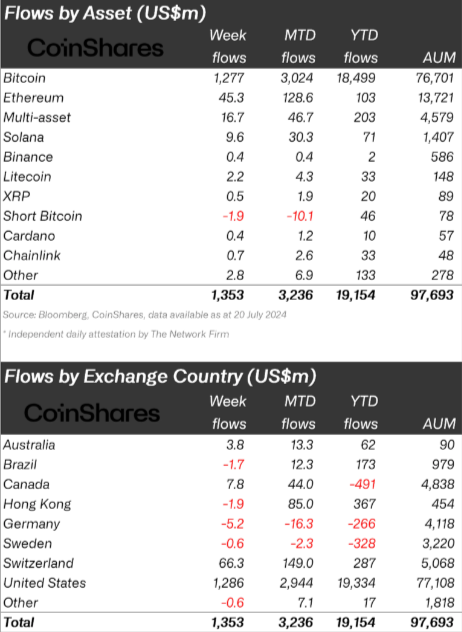

- Digital asset investment products saw $1.35bn inflows last week, totaling $3.2bn over three weeks.

- Ethereum surpassed Solana in year-to-date inflows, reaching $103m compared to Solana's $71m.

Crypto products saw inflows of $1.35 billion last week, bringing the total inflows over the last three weeks to $3.2 billion, according to asset management firm CoinShares.

Bitcoin dominated with $1.27 billion in inflows, while short Bitcoin products saw outflows of $1.9 million. Since March, short Bitcoin exchange-traded products (ETP) have experienced outflows totaling $44 million, representing 56% of assets under management.

Ethereum saw $45 million in inflows, surpassing Solana as the altcoin with the most inflows year-to-date at $103 million. Solana attracted $9.6 million in inflows last week, bringing its year-to-date total to $71 million. A noteworthy mention is Litecoin, which also saw inflows of $2.2 million.

Moreover, crypto funds indexed to digital assets’ baskets saw $16.7 million in weekly inflows, signaling an appetite for diversification from investors.

Image: CoinShares

Image: CoinShares

Regionally, the US and Switzerland led regional inflows with $1.3 billion and $66 million respectively, while Brazil and Hong Kong experienced minor outflows of $1.7 million and $1.9 million.

Notably, Brazil only saw two weeks of net outflows this year, making it the fourth-largest country on year-to-date assets under management.

ETP trading volumes increased by 45% week-on-week to $12.9 billion, representing 22% of the broader crypto market volumes. In contrast, blockchain equities experienced outflows of $8.5 million last week, despite most ETFs outperforming world equity indices.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto: The Fear Index Drops to 10, But Analysts See a Reversal

Uniswap Labs Faces Pushback as Aave Founder Highlights DAO Centralization Concerns

Ethereum Interop Roadmap: How to Unlock the “Last Mile” for Mass Adoption

From cross-chain to "interoperability," many of Ethereum's fundamental infrastructures are accelerating towards system integration for large-scale adoption.

A $170 million buyback and AI features still fail to hide the decline; Pump.fun is trapped in the Meme cycle

Facing a complex market environment and internal challenges, can this Meme flagship really make a comeback?