Daily Futures Market Update: Goldman Sachs will launch three tokenization projects by the end of the year

Goldman Sachs to Launch Three Tokenization Projects by Year's End

Futures Market Updates

BTC Futures Updates

Ether Futures Updates

Top 3 OI Surges

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

This year's 30% gains have been completely wiped out, and Bitcoin has fallen into a bear market.

The reversal from the historical highs in October is mainly attributed to fading optimism over US pro-crypto policies, a shift in the macro market toward risk aversion, and the quiet withdrawal of institutional buyers such as ETF investors.

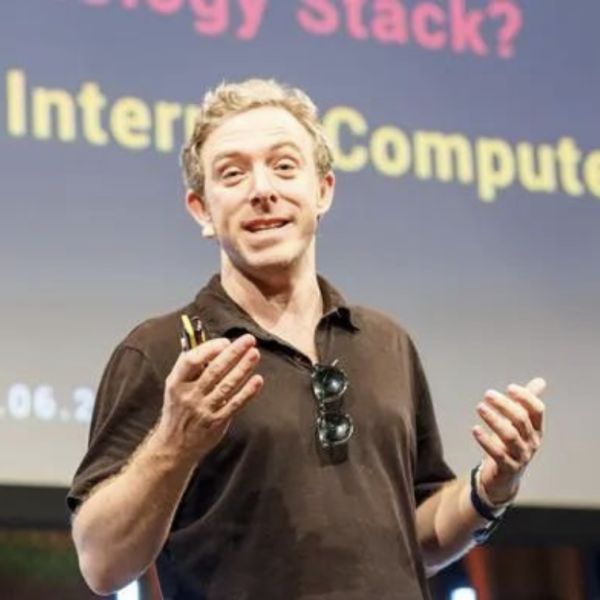

DFINITY founder Dominic: In the Web3 multi-chain era, where is Internet Computer headed?

On-chain, social media, gaming, and the metaverse will all be tokenized.

Explaining the concept of Preconfirmation with Taiko as an example: How to make Ethereum transactions more efficient?

By introducing the concept of preconfirmation, Taiko and many Based Rollup Layer2 projects are building a transaction confirmation system that enables users to confirm transactions more quickly and reliably.

Has SOL Bottomed Out? Multi-dimensional Data Reveals the True Picture of Solana

Despite the ongoing efforts of new chains such as Sui, Aptos, and Sei, they have not posed a substantial threat to Solana. Even though some user traffic has been diverted to application-specific chains, Solana still firmly holds its leading position among general-purpose chains.