Bitcoin eyes all-time high with 4% gap as ETFs attract massive inflows

Bitcoin’s price soared to $71,200 on Tuesday, only 4% away from its all-time high of $73,700 established earlier in March, according to data from TradingView. The rally comes on the heels of massive inflows into US spot Bitcoin exchange-traded funds (ETFs).

Data from HODL15Capital shows that US Bitcoin funds collectively witnessed $887 million in net inflows, marking the second-highest such inflow ever recorded.

US Spot

Bitcoin ETF Inflows (June 4) – Source: HODL15Capital

US Spot

Bitcoin ETF Inflows (June 4) – Source: HODL15Capital

Leading the charge, the Fidelity Wise Origin Bitcoin Fund amassed an impressive $378 million, while BlackRock’s iShares Bitcoin Trust followed with $275 million, according to insights from Farside Investors and HODL15Capital. The ARK 21Shares Bitcoin ETF claimed the third spot with over $138 million in net inflows.

These inflows marked a significant milestone, being the most substantial since March 12, which saw a record-setting $1.04 billion influx. The following day, Bitcoin reached a peak of $73,700.

At press time, BTC is trading close to $71,000, up almost 3% in the last 24 hours. The recent surge signals a positive turn for Bitcoin after several weeks of moving sideways. Industry experts suggest that the crypto market is set for a “bright June” due to anticipated spot Ethereum ETF developments.

With Bitcoin ETFs scoring big on their 100th trading day, Nate Geraci, president of ETF Store, addressed the skepticism surrounding Bitcoin ETFs and their demand, particularly from critics who doubted their appeal to retail investors.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

1inch launches Aqua: the first shared liquidity protocol, now open to developers

The developer version of Aqua is now online, offering the Aqua SDK, libraries, and documentation, allowing developers to integrate the new strategy models ahead of time.

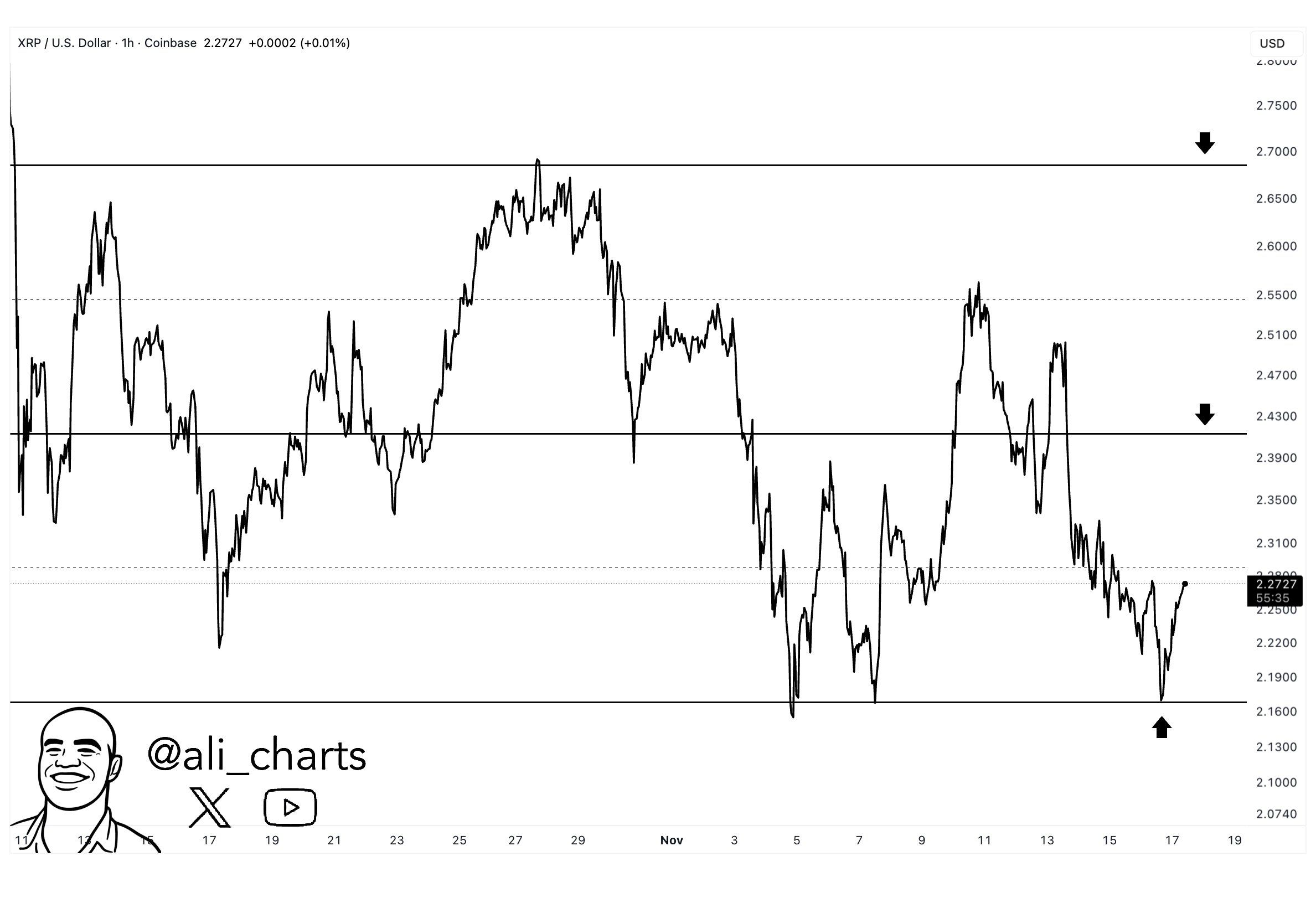

Franklin XRP ETF Debut Meets XRP’s $2.15 Line in the Sand

Weekly Crypto Market Watch (11.10-11.17): Extreme Market Panic, Privacy Sector Stands Out

Last week, both the open interest and trading volume of altcoin contracts on exchanges declined, reflecting a continued lack of liquidity following the sharp drop on October 11.