Analyst: The size of the Ethereum spot ETF market is expected to reach 75% of the Bitcoin spot ETF

On May 24, the U.S. Securities and Exchange Commission (SEC) officially approved the Form 19b-4 for eight Ethereum spot ETFs, with issuers including BlackRock, Fidelity, and Grayscale. Jeffery Ding, Chief Analyst at HashKeyGroup, believes that Ethereum is following in the successful footsteps of Bitcoin ETFs and has a broad future. More appealingly, it's expected that Ethereum spot ETFs will incorporate staking mechanisms to become interest-bearing assets. It is estimated that in the medium term, the market size of Ethereum spot ETFs could reach 75% of Bitcoin spot ETFs. Furthermore, Jeffery Ding thinks if The Financial Innovation Technology Act (FIT21) passes through Congress it would transfer digital currency regulation from SEC to Commodity Futures Trading Commission (CFTC). As CFTC has a more friendly attitude towards cryptocurrencies; other cryptocurrencies might also apply to become Spot ETFs in future leading cryptocurrency industry into mainstream.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Federal Reserve Governor Milan once again calls for a significant rate cut in December

International Business Settlement: Acquired approximately 247 bitcoins between October 17 and November 7

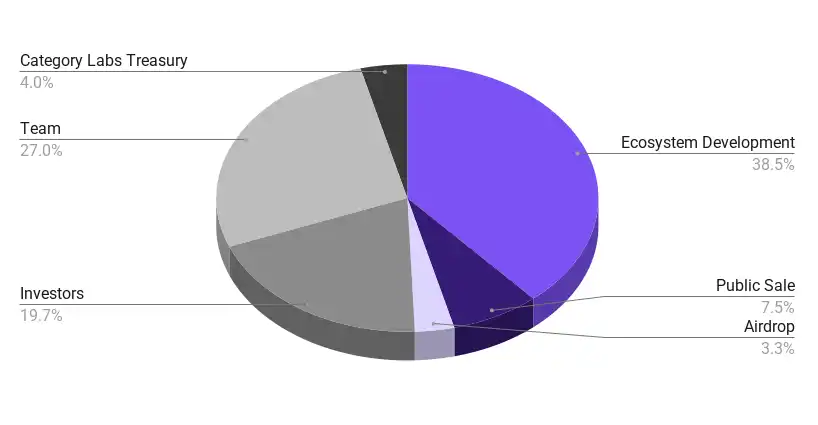

Monad announces tokenomics: total supply of 100 billions tokens, 3% to be distributed via airdrop

Trending news

MoreOverview of Monad Tokenomics: 49.4% of the total supply will be unlocked on the first day of mainnet launch, with 10.8% entering circulation through public sale and airdrop, and 38.5% managed by the Monad Foundation.

Federal Reserve Governor Milan once again calls for a significant rate cut in December