The US SEC submitted a final response to the Ripple case, saying that Ripple failed to guarantee that it would not violate regulations in the future

PANews May 8 news, according to Cointelegraph, Ripple Labs and the U.S. Securities and Exchange Commission (SEC) have made significant progress in the legal proceedings. The SEC has taken a step forward in the remedial measures stage of the lawsuit and submitted a final response. In a recent response to the outline of the remedial measures, the SEC questioned Ripple Labs' claim that the blockchain startup claimed that its behavior was not reckless and that there should not be "extensive uncertainty" about the legal status of XRP, although the court previously rejected this "fair notice" defense.

Although Ripple Labs has not violated any rules since the XRP lawsuit was filed in 2020, the SEC still maintains its position on whether Ripple Labs may take similar actions in the future. According to the remedial brief, Ripple Labs tried to downplay its responsibility while emphasizing its cooperation with the U.S. SEC since the initial public offering of XRP in 2013. However, the U.S. SEC emphasized that according to the law, even if Ripple Labs has not violated any regulations since 2020, it is expected that violations will be possible again.

The SEC believes that Ripple Labs' assurances about changing its behavior after the lawsuit are not enough to avoid the ban. According to the SEC, Ripple Labs’ claims of following legal guidance and restructuring future XRP sales in accordance with the Order are misleading. The SEC argues that Ripple Labs misinterpreted the Order and failed to accept its impact on compliance. The Remedial Action Response refutes Ripple Labs’ claims regarding sales to accredited investors outside the United States, as these defenses were abandoned at the summary judgment stage. In addition, Ripple’s claims regarding changes to the ODL sales contracts were rejected because those contracts already lacked certain restrictions that were found to be violations. Ultimately, the SEC believes that Ripple’s claims do not negate the need for an injunction to prevent future violations. In response to the SEC’s response in the Remedial Action Brief, Ripple Chief Legal Officer Stuart Alderoty commented that the SEC’s reputation continues to decline. He stressed that international financial regulators with a robust cryptocurrency licensing framework may be surprised that the SEC considers its efforts to be equivalent to issuing fishing licenses. Alderoty criticized the SEC for not applying the law consistently. He expressed optimism about resolving the XRP litigation case. While the cryptocurrency community eagerly awaits the final outcome of the case, analysts expect the final judgment to be made around September.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

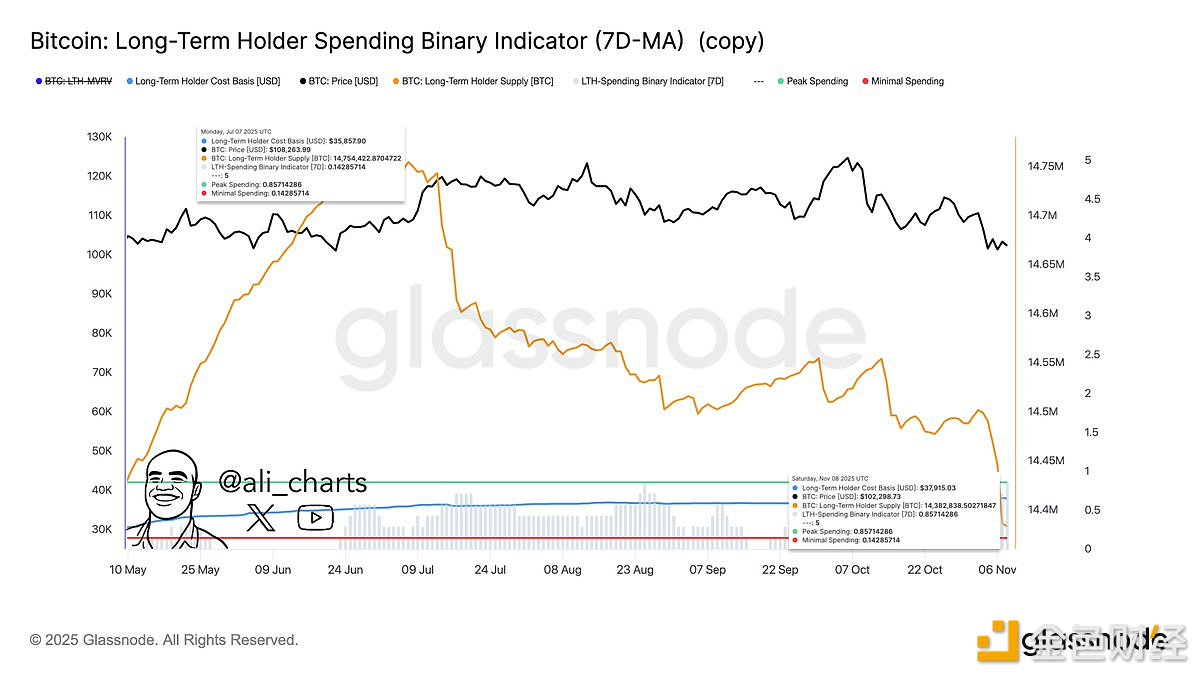

Data: Bitcoin long-term holders have sold 371,584 BTC since July

The U.S. Treasury provides a clear regulatory path for cryptocurrency ETP staking services