Powell revealed a dovish tone: interest rates may have reached a peak, and the Fed is paying attention to the liquidity environment

According to Wu Talk, Powell revealed a strong dovish tone at the latest FMOC press conference. First of all, it said that interest rates may have reached a peak, and the Fed will decide when to adjust policy interest rates based on economic data and the need to balance risks; it firmly believes that financial conditions have been tightened enough, and it is expected to start to slow down QT soon. Selectively ignore the resurgence of inflation in January and February, as well as the significant rise in the prices of inflationary assets/risk assets such as crude oil/stocks, and reiterate that inflation is on the way to 2%. At this stage, the Fed is most concerned about the domestic liquidity environment: the risk of "insufficient" liquidity seems to be greater than "excess", especially in a critical election year.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin ‘Wave 3’ expansion targets $200K as sell-side pressure fades: Analyst

Market sentiment in the crypto space remains fragile; even the positive news of the "U.S. government shutdown" ending failed to trigger a meaningful rebound in bitcoin.

After last month's sharp drop, Bitcoin's rebound has been weak. Despite traditional risk assets rising due to the US government reopening, Bitcoin has failed to break through a key resistance level, and ETF inflows have nearly dried up, highlighting a lack of market momentum.

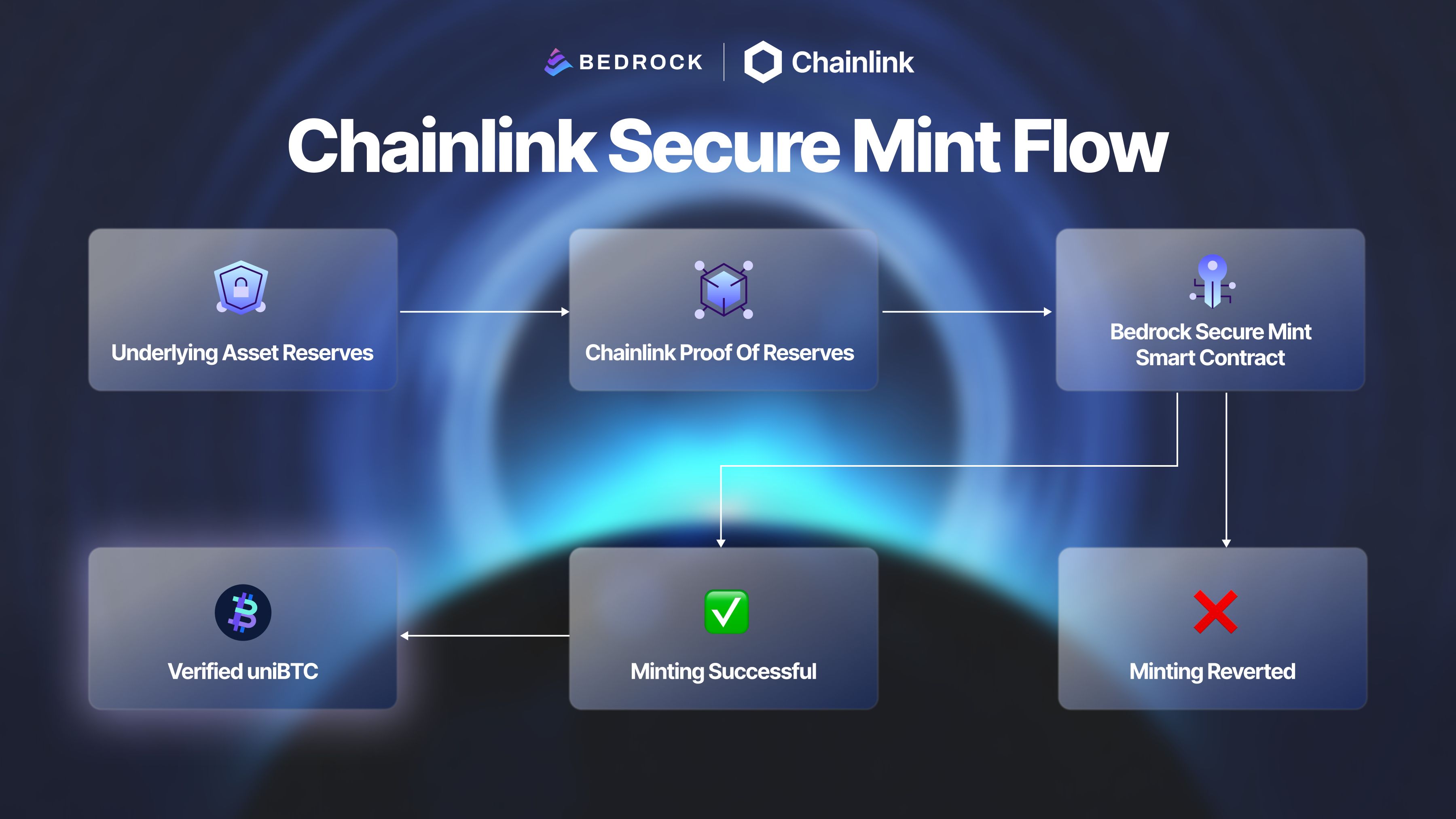

How Bedrock Strengthens BTCFi Security With Chainlink Proof of Reserve and Secure Mint